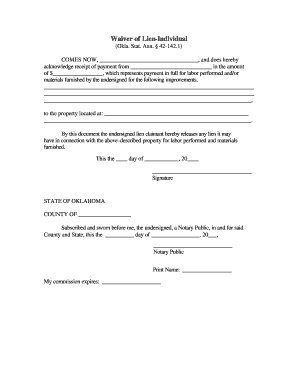

Oklahoma law permits a property owner to issue a written demand to a contractor in which the property owner requests a waiver from all persons providing labor and/or materials.

Get the free pdffiller

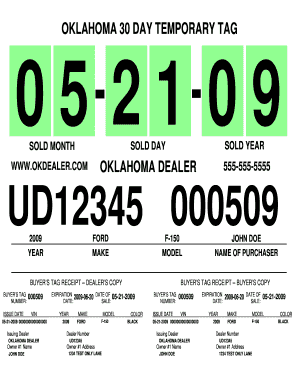

Get, Create, Make and Sign vehicle owners if you have paid off need a lien release form in oklahoma

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out lien release form Oklahoma?

Who needs lien release form Oklahoma?

Video instructions and help with filling out and completing pdffiller

Instructions and Help about pdffiller form

Your IRS weapon with Travis Watkins is on the air Travis is the president of the Law Offices of Travis W Watkins PC headquartered in Oklahoma City and Tulsa if you find out more about Travis Watkins and his unique law practice log on to our secure website tax help ok calm while you're there order a free copy of his book the ultimate Survival Guide to IRS problems and check out Travis's videos on how to solve your IRS problems today now here is the host of your IRS weapon Travis Watkins this is your IRS weapon on Oklahoma tax lawyer Travis Watkins I am joined today by Joe Goldstein and Zack Gregory who are attorneys in my office we have offices in Oklahoma City and Tulsa we've got a full bag here of questions that have come in to us the number here at the station is one triple eight nine tax help give us a call today here in the studio if you have a question first question that we have is how can I make sure that an IRS lien withdrawal is communicated to the credit bureaus so that I'm not adversely affected the best way and really though the only way you're going to do this is when you finish the payoff whatever it is installment agreement paying a lump sum finisher offering compromise is to request or have your attorney request the lien release sort of certificate and as we discussed in our previous program about them having 30 days to issue that that can be expedited the IRS is they're lazy, but they will go out to the credit bureaus they'll send letters to the credit bureaus, but they will go out and put liens on your property and to do that properly they have to go to the County Assessor's Office and get it put it on books and when you get that lien release they are not they figure they're out of the picture, and it's your job to go get those liens release, so they will send you that certificate you will have to take that down if you're selling property you help from a title company on this, but you will have to take that down to the where it's registered in that County, and they'll make a copy, and they stamp it, and then you need to make copies of that and send it with a cover letter to each of the credit bureaus and asking them to release the liens on your credit report, and you are going to have to also include a copy of the lien release, and it's going to take them about 30 days to get that off of there they don't work fast either, but basically it's going to be up to you to actually get this done the IRS will just tell you that it's going to be released by operational law but the credit bureaus and everybody else does not they want written proof, and you're going to get that you need to keep that lien release certificate forever keep it in a safe deposit box or whatever in case this would come up and just keep that as proof that that lien was released I think it's important to make a distinction here — between a lien release and a lien withdrawal a lien withdrawal from the IRS is kind of the holy grail that's what you want when you've...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdffiller form directly from Gmail?

How do I complete pdffiller form online?

How can I edit pdffiller form on a smartphone?

What is oklahoma lien release form?

Who is required to file oklahoma lien release form?

How to fill out oklahoma lien release form?

What is the purpose of oklahoma lien release form?

What information must be reported on oklahoma lien release form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.