Get the free sars itr12 form.pdf

Show details

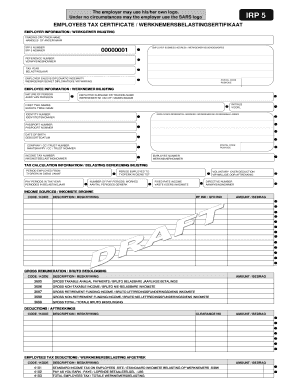

A comprehensive guide to the ITR12 return, detailing how individuals can complete their income tax return for submission to the South African Revenue Service (SARS).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign itr12 blank form

Edit your itr12 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your itr12 form download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sars itr12 form pdf download online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irt12 form download. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out itr12 download form

How to fill out sars itr12 form.pdf

01

Gather all necessary documents such as income statements, medical aid certificates, and any other relevant tax documents.

02

Download the SARS ITR12 form from the official SARS website and open the PDF.

03

Begin with your personal information: fill in your name, surname, ID number, and contact details.

04

Provide details of your income: include salaries, interest, rental income, and any other sources of income.

05

Declare any deductions you are eligible for, such as retirement contributions and medical expenses.

06

Fill out any additional information required, such as foreign income or capital gains.

07

Review all sections for completeness and accuracy.

08

Save your completed form and print it if necessary for submission.

09

Submit your ITR12 form through the SARS eFiling system or by delivering it to the nearest SARS branch.

Who needs sars itr12 form.pdf?

01

Individuals who earn income from employment, self-employment, or other sources in South Africa are required to fill out the SARS ITR12 form.

02

Tax residents who need to declare their income and claim deductions to the South African Revenue Service (SARS).

03

Individuals who are required to submit their annual tax returns as per the South African tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between ITA34 and ITR12?

An ITA34 is a form SARS issues after you submit your annual individual income tax return (ITR12). It shows the income you declared on the return and the expenses you incurred during the tax year while you were generating your self employed income. 43 An ITA34 is a summary of your assessment for the tax year.

How to download sars efiling online?

0:24 1:33 Systems or the Huawei app gallery. Using iOS powered device open the App Store by tapping the AppMoreSystems or the Huawei app gallery. Using iOS powered device open the App Store by tapping the App Store icon displayed on your device. Using an Android powered.

How to download ITR12 online?

Follow the steps below to request an Income Tax return: Log in to eFiling. Click on “Returns Issued” Click on “Personal Income Tax (ITR12)” On the right-hand side of the screen select the tax year for the return you would like to request and then click on “Request Return”

What if my ITR12 is not issued?

If your ITR12 return has not been issued, this means that your registration information could not be verified against SARS's systems. Please call the SARS Contact Centre on 0800 00 SARS (7277) to resolve the problem.

How to download form 26AS?

Go to the 'e-File' tab on the home page, click 'Income Tax Returns' from the drop-down, and select 'View Form 26AS'. Read the disclaimer and click on 'Confirm', and you will be redirected to the TRACES portal. Agree to the acceptance and usage of Form 16/16A generated from TRACES, and click on the 'Proceed' button.

What is the ITR12 income tax return for individuals?

An Income Tax Return (ITR12) is a form that SARS requires all individuals (including provisional taxpayers) to complete and submit to SARS once every year. The form is used to declare your income, deductions and tax credits to SARS, so that SARS can calculate how much tax you need to pay, or the refund due to you.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sars itr12 form.pdf?

The SARS ITR12 form is a tax return document used by individuals in South Africa to report their income and calculate their tax obligations for the relevant tax year.

Who is required to file sars itr12 form.pdf?

Individuals who are taxpayers in South Africa and have received income in a tax year are required to file the SARS ITR12 form, especially if they earn above a certain threshold.

How to fill out sars itr12 form.pdf?

To fill out the SARS ITR12 form, individuals must gather their income details, tax certificates, and other relevant financial information, and then complete the form either online through the SARS eFiling system or by manually filling out the PDF.

What is the purpose of sars itr12 form.pdf?

The purpose of the SARS ITR12 form is to enable individuals to declare their income, calculate their tax liabilities, and report any allowable deductions or credits for tax purposes.

What information must be reported on sars itr12 form.pdf?

The information to be reported on the SARS ITR12 form includes personal details, income from various sources, allowable deductions, tax credits, and any other relevant financial information for the assessment of tax liability.

Fill out your sars itr12 form.pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

itr12 Form Pdf Download is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.