KS K-BEN 990 2017 free printable template

Show details

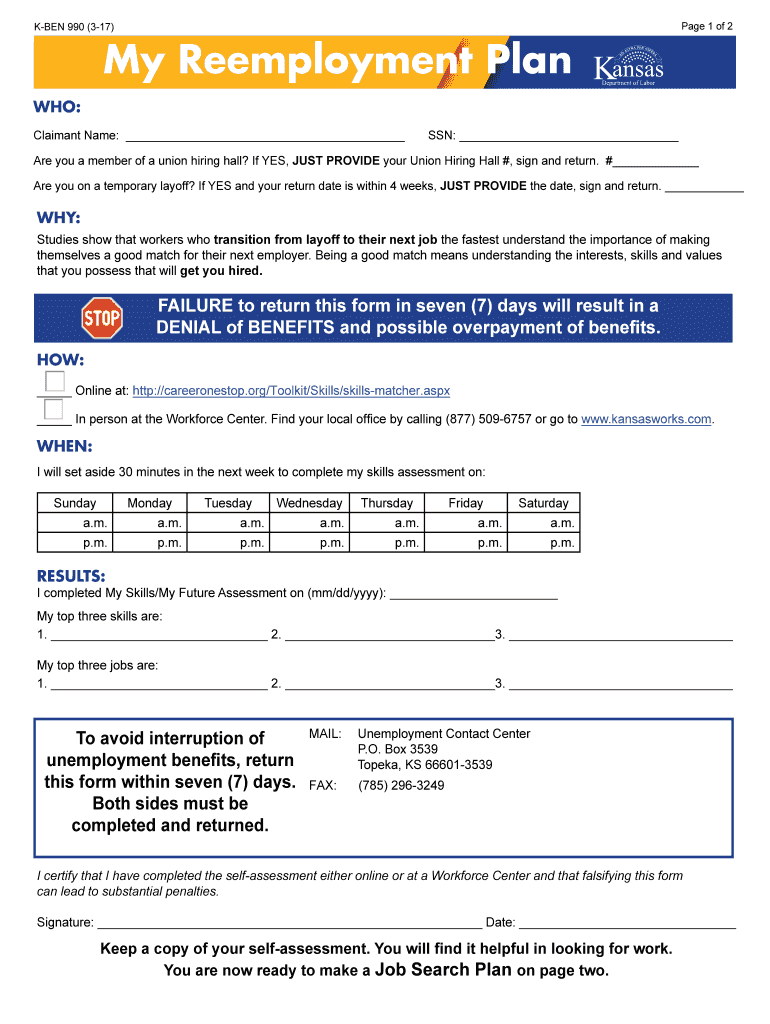

Page 1 of 2 K-BEN 990 3-17 My Reemployment Plan WHO Claimant Name SSN Are you a member of a union hiring hall If YES JUST PROVIDE your Union Hiring Hall sign and return. Are you on a temporary layoff If YES and your return date is within 4 weeks JUST PROVIDE the date sign and return. WHY Studies show that workers who transition from layoff to their next job the fastest understand the importance of making themselves a good match for their next employer. Being a good match means understanding...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS K-BEN 990

Edit your KS K-BEN 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS K-BEN 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS K-BEN 990 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KS K-BEN 990. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS K-BEN 990 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS K-BEN 990

How to fill out KS K-BEN 990

01

Begin by downloading the KS K-BEN 990 form from the official website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information such as name, address, and contact details in the designated sections.

04

Provide information regarding your income and any deductions you wish to claim.

05

Review your entries to ensure accuracy and completeness.

06

Sign and date the form at the bottom where indicated.

07

Submit the completed form to the appropriate tax authority by the deadline.

Who needs KS K-BEN 990?

01

Individuals or businesses that need to report their income and deductions for tax purposes.

02

Taxpayers seeking to apply for tax benefits or specialized tax credits associated with KS K-BEN 990.

Fill

form

: Try Risk Free

People Also Ask about

What information do I need to file for unemployment in Kansas?

If filing online - your user name, password and PIN. If filing by phone - your Social Security number and PIN. The amount of your gross wages earned (money earned before deductions, not received) during the week you are making a claim for unemployment insurance.

What qualifies me for unemployment Kansas?

To qualify for benefits you must have been paid wages from insured employment in at least two quarters with the total of your wages being at least 30 times your WBA. Insured work is work performed for employers who are required to pay unemployment insurance tax on your wages.

How much unemployment will I get in Kansas?

Unemployment FAQs For claims filed on or after July 1, 2021, weekly benefit amounts will be between $140 and $560 per week.

What are the requirements to file for unemployment in Kansas?

You must be totally or partially unemployed through no fault of your own, and you must have earned sufficient wages in your base period (the first 4 of the last 5 completed calendar quarters before the start date of your claim). Also, you must be able and available for full-time work.

What is the Kansas unemployment tax form?

In the case of unemployment, the 1099-G documents the total benefits paid to the claimant during the previous calendar year. The same information is provided to the Internal Revenue Service.

What disqualifies you from unemployment in Kansas?

If you return to work full time or have gross earnings (wages before deductions) that equal or exceed your weekly benefit amount, you should stop filing weekly claims, and your claim will become inactive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KS K-BEN 990 for eSignature?

Once your KS K-BEN 990 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get KS K-BEN 990?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the KS K-BEN 990. Open it immediately and start altering it with sophisticated capabilities.

How do I edit KS K-BEN 990 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing KS K-BEN 990 right away.

What is KS K-BEN 990?

KS K-BEN 990 is a tax form used in the state of Kansas for reporting certain types of income and expenses by non-profit organizations and other entities subject to Kansas tax laws.

Who is required to file KS K-BEN 990?

Entities that are engaged in activities or operations within Kansas that generate taxable income, including non-profits, must file the KS K-BEN 990 if their income exceeds the threshold set by the Kansas Department of Revenue.

How to fill out KS K-BEN 990?

To fill out the KS K-BEN 990, organizations must provide accurate financial information, including revenue, expenses, and any applicable deductions. It is advisable to refer to the instructions provided by the Kansas Department of Revenue for detailed guidelines.

What is the purpose of KS K-BEN 990?

The purpose of KS K-BEN 990 is to ensure transparency and accountability for non-profit organizations and other entities in Kansas by requiring them to report their financial activities to the state.

What information must be reported on KS K-BEN 990?

The KS K-BEN 990 requires reporting of various financial details including total revenue, total expenses, net assets, contributions, program service revenue, and other specific income and expense categories as outlined in the form guidelines.

Fill out your KS K-BEN 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS K-BEN 990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.