Business Income Schedule C free printable template

Show details

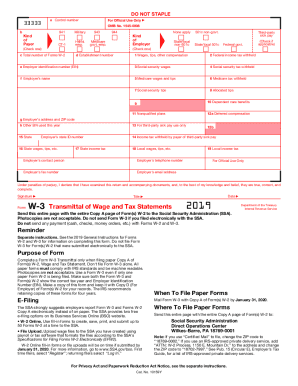

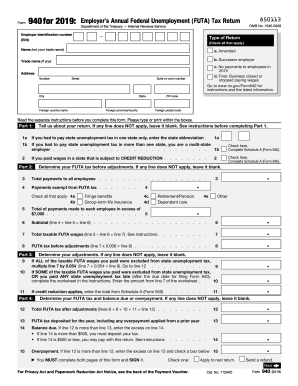

Page 1 ORGANIZER US Business Income Schedule C No. Please enter all pertinent amounts. GENERAL INFORMATION Principal business/profession. Business name if different from Form 1040. Business address if different from Form 1040. City state ZIP code if different from Form 1040. Page 1 ORGANIZER US Business Income Schedule C No* Please enter all pertinent amounts. GENERAL INFORMATION Principal business/profession. Business name if different from Form 1040. Business address if different from Form...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign follow these steps 1 form

Edit your schedule c worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule c organizer form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing printable schedule c tax form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule c template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule c expenses worksheet form

How to fill out Business Income Schedule C

01

Begin by gathering all necessary financial documents, including income statements, receipts, and previous tax returns.

02

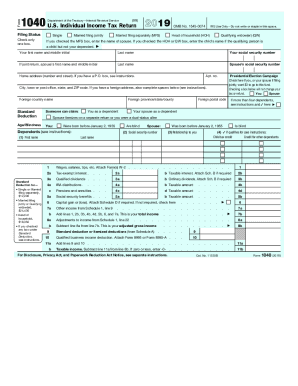

Start filling out the top section of Schedule C, entering your name and the name of your business.

03

Indicate your business address and provide the type of business organization.

04

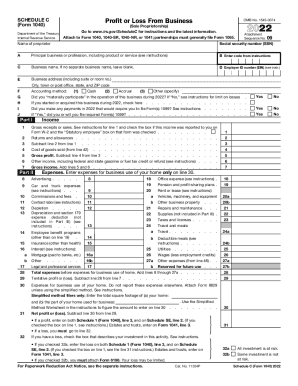

For Part I, report your gross receipts or sales from your business activities.

05

Subtract any returns and allowances from your gross receipts to find your net receipts.

06

Move to Part II to list your business expenses, categorizing them appropriately (e.g., advertising, car and truck expenses, supplies).

07

Sum all your expenses to find the total expenses for your business.

08

Calculate your net profit or loss by subtracting total expenses from gross income in Part III.

09

Complete any additional sections as necessary, including inventory and cost of goods sold if applicable.

10

Review your entries for accuracy before filing with your tax return.

Who needs Business Income Schedule C?

01

Any self-employed individuals or sole proprietors who report business income from their operations.

02

Freelancers, consultants, and independent contractors who earn income from their services.

03

Small business owners operating under a sole proprietorship or single-member LLC.

04

Individuals who have income from rental properties or hobby activities that qualify as businesses.

Fill

printable schedule c expenses worksheet

: Try Risk Free

People Also Ask about schedule c expenses worksheet pdf

What is a Schedule C worksheet?

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Do sole proprietors have balance sheets?

A balance sheet for a sole proprietorship is similar to a balance sheet for any other kind of business in that it shows how much the business entity owns and owes.

How do I calculate my income if I am self employed?

You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income you derived from your trade or business. You can be liable for paying self-employment tax even if you currently receive social security benefits.

How do you calculate Schedule C gross income?

Schedule C spells out the gross income calculation: Add your gross receipts from the sale of goods or services. Add up any refunds you gave for returned merchandise. Subtract the cost of goods sold, which you work out in Section III of Schedule C.

How do I fill out a Schedule C worksheet?

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

What are Schedule C items?

Schedule C information includes profits and losses earned by you as a sole proprietor or single-member LLC. If you only work as an employee and earn money reported on a W-2, you'll typically not complete a Schedule C for your tax return.

How do I calculate my Schedule C?

Calculating Schedule C Income The formula is relatively simple – you start with the net profit (or less) and then add-back a few items and subtract meals and entertainment.

Is a balance sheet included in a tax return?

The balance sheet and tax reporting. For federal income tax purposes, only C corporations are required to complete a balance sheet as part of their annual return. This balance sheet compares items at the beginning of the year with items at the end of the year.

What is the accounting method for Schedule C?

The Cash Method of accounting is the most commonly used. Using the Cash Method of accounting, you report all items received as gross income at the time you receive them.

Can I fill out my own Schedule C?

Schedule C is the tax form filed by most sole proprietors. As you can tell from its title, "Profit or Loss From Business," it´s used to report both income and losses. Many times, Schedule C filers are self-employed taxpayers who are just getting their businesses started.

How do I calculate taxes owed self employed?

As noted, the self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Self-employment tax is not the same as income tax. For the 2022 tax year, the first $147,000 of earnings is subject to the Social Security portion.

What is a balance sheet for self employed?

A balance sheet is a financial "snapshot" of your business at a given date in time. It includes your assets and liabilities and tells you your business's net worth.

Do you need a P&L for Schedule C?

The IRS requires sole proprietors to use Profit or Loss From Business (Sole Proprietorship) (Schedule C (Form 1040)), to report either income or loss from their businesses.

Is there a balance sheet for Schedule C?

What Information Do I Need to Complete Schedule C? You will need the following information to complete your Schedule C: A profit and loss statement, sometimes called an income statement, for the tax year. A balance sheet for the tax year.

What is Schedule C worksheet?

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my schedule c fillable form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your blank schedule c as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in schedule c tax form pdf?

With pdfFiller, the editing process is straightforward. Open your schedule c for business in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out filing schedule c on an Android device?

Complete business income worksheet and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is Business Income Schedule C?

Business Income Schedule C is a form used by sole proprietors to report income or loss from their business to the IRS. It helps in calculating the net profit or loss that is then reported on the individual's tax return.

Who is required to file Business Income Schedule C?

Individuals who operate a sole proprietorship and earn income from self-employment are required to file Business Income Schedule C. This includes freelancers, independent contractors, and small business owners.

How to fill out Business Income Schedule C?

To fill out Business Income Schedule C, you need to provide information about your business income and expenses, including gross receipts, cost of goods sold, and any profit or loss calculation. Detailed instructions are provided in the IRS guidelines, which should be followed.

What is the purpose of Business Income Schedule C?

The purpose of Business Income Schedule C is to report the income and expenses of a sole proprietorship. This form allows the IRS to assess the tax obligations of self-employed individuals based on their actual business performance.

What information must be reported on Business Income Schedule C?

Business Income Schedule C requires reporting of business name, address, and type, gross receipts, expenses related to the business (such as rent, supplies, and salaries), and total net profit or loss.

Fill out your Business Income Schedule C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule C Income is not the form you're looking for?Search for another form here.

Keywords relevant to schedule c worksheet for self employed

Related to schedule c tax form 2024 printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.