Get the free sample letter to beneficiaries distribution of funds

Show details

TRUST DISTRIBUTION AGREEMENT NORMAN L. MAYER REVOCABLE TRUST ORIGINALLY ESTABLISHED JANUARY 22, 1985, AS AMENDED, 2013 by LOIS D. JOHNSON and This agreement is made as of EFFIE LOUISE CREW, Cotrustees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final trust distribution letter to beneficiaries from trustee form

Edit your trust distribution letter to beneficiaries template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample letter to beneficiaries distribution of funds pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust fund distribution letter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit trust distribution letter form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust distribution letter sample form

01

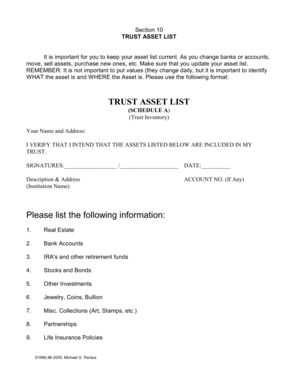

To fill out a trust distribution agreement sample, gather all necessary information such as the names and contact details of the parties involved, the date of the agreement, and the specific details of the trust.

02

Begin by identifying the trust in question and providing its legal name and date of establishment.

03

Clearly state the purpose of the trust distribution agreement, whether it is to distribute assets, income, or any other specific aspects of the trust.

04

Specify the beneficiaries who will be receiving distributions from the trust and include their full names, addresses, and any other pertinent information.

05

Outline the distribution terms, including the frequency and manner in which distributions will be made. Specify if the distributions will be in cash, property, or other assets.

06

Include any conditions or restrictions for the distributions, such as age requirements, specific purposes for the funds, or any other relevant provisions.

07

If there are any trustees or administrators involved in the distribution process, clearly identify them and their roles and responsibilities.

08

Include a section for signatures, where all parties involved in the distribution agreement should sign and date the document.

09

Finally, make sure to review the completed trust distribution agreement for accuracy and seek legal advice if needed before finalizing it.

Who needs trust distribution agreement sample?

01

Individuals who have established a trust and need to distribute its assets or income to the beneficiaries.

02

Estate planners or attorneys who are drafting trust distribution agreements for their clients.

03

Beneficiaries of a trust who want to understand their rights and obligations as recipients of trust distributions.

Fill

trustee letter to beneficiaries sample

: Try Risk Free

People Also Ask about beneficiaries trust distribution letter sample

How is money distributed from a trust?

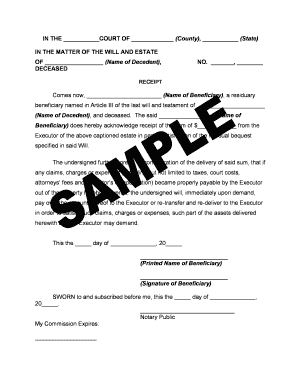

The trust can pay out a lump sum or percentage of the funds, make incremental payments throughout the years, or even make distributions based on the trustee's assessments. Whatever the grantor decides, their distribution method must be included in the trust agreement drawn up when they first set up the trust.

What is a specific distribution in a trust?

A trust distribution is a payment or other distribution of trust assets made by a trustee to one or more trust beneficiary. Under California Probate Code §16000, trustees have a duty to administer the trust ing to the trust instrument, which includes following the asset distributions outlined in the document.

What is a distribution agreement trust?

The Trust Distribution Agreement It is another form of communication identifying who is the trustee (if it's a single trustee) or identifying who is doing what (co-trustees). The agreement outlines the assets, the provisions of the trust, where assets are going, and asks for consent from the beneficiary.

How do you write a distribution agreement?

Parts of a Distribution Agreement Names and addresses of both parties. Sale terms and conditions. Contract effective dates. Marketing and intellectual property rights. Defects and returns provisions. Severance terms. Returned goods credits and costs. Exclusivity from competing products.

What is the average age trust distribution?

The most widely-used provisions distribute one-third at age 25, one-half of the balance at age 30 and the balance at age 35. The philosophy of doing this is that the beneficiary has three chances to make mistakes. The so-called “three strikes and you're out” rule.

How is trust income distributed?

After the money is placed into the trust, the interest it accumulates is taxable as income, either to the beneficiary or the trust itself. The amount distributed to the beneficiary is considered to be from the current-year income first, then from the accumulated principal.

What does distribution mean in a trust?

Trust Distribution means any cash distribution of income and/or capital by the Trust. Sample 1Sample 2. Trust Distribution means an Exchange Offer Distribution, an Accelerated Trust Distribution, a Mandatory Distribution or a Merger Event Distribution, as the case may be.

How do you allocate trust income to beneficiaries?

Trusts: allocating income to beneficiaries but taxed to trust. The basic rules are as follows: If any of the trust's income is payable in a taxation year to a beneficiary, that amount is deductible in computing the trust's income for year. The amount payable is then included in the beneficiary's income.

What is a typical distribution on a trust?

Age-based distribution provisions are fairly common in trust funds. For example, a trust could specify that a beneficiary should receive one-third of the trust at 25, one-half at 30 and the rest at 35.

What are required distributions from a trust?

What Are Mandatory Trust Distributions? Some trusts require trustees to make mandatory distributions. These distributions might take place every month or every year. Often, a trust requires distribution of a percentage of the interest earned on trust assets during the year.

How do you distribute trust income to beneficiaries?

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the letter to beneficiaries distribution of funds template in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your trust distribution agreement in seconds.

Can I edit trust distribution examples on an Android device?

You can make any changes to PDF files, like clearly state the purpose of specific aspects of the trust text specify the beneficiaries who will, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out trust distribution letter template on an Android device?

On an Android device, use the pdfFiller mobile app to finish your trust distribution letter to beneficiaries. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is trust distribution agreement sample?

A trust distribution agreement sample is a template document that outlines how the assets of a trust are to be distributed among its beneficiaries. It serves as a guideline for trustees to follow when making distributions.

Who is required to file trust distribution agreement sample?

The trustee or the fiduciary responsible for managing the trust is typically required to file the trust distribution agreement sample, especially when distributions are made to beneficiaries.

How to fill out trust distribution agreement sample?

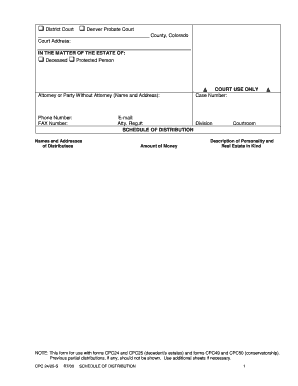

To fill out a trust distribution agreement sample, you need to include details such as the name of the trust, the trustee's information, beneficiaries' names, the specific assets to be distributed, and the terms of distribution.

What is the purpose of trust distribution agreement sample?

The purpose of a trust distribution agreement sample is to provide a clear outline of how and when trust assets will be distributed to beneficiaries, ensuring transparency and reducing potential disputes.

What information must be reported on trust distribution agreement sample?

The information that must be reported on a trust distribution agreement sample includes the trust's name, trustee details, beneficiary names, the nature of the assets being distributed, and any conditions or timelines for distribution.

Fill out your sample letter to beneficiaries online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Trust Distribution Letter is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill out trust and any other pertinent information

Related to on an android device use of trust distribution agreement sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.