MCPS Form W4-MW-507 2011-2025 free printable template

Show details

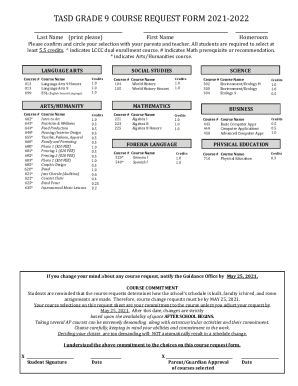

MCPS Form W4-MW-507 Revised December 2011 Employee s Withholding Allowance Certificate Montgomery County Public Schools 1. Type or print your full name 2. Your Employee Identification Number Home

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign MCPS Form W4-MW-507

Edit your MCPS Form W4-MW-507 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MCPS Form W4-MW-507 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MCPS Form W4-MW-507 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MCPS Form W4-MW-507. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MCPS Form W4-MW-507

How to fill out MCPS Form W4-MW-507

01

Obtain a copy of MCPS Form W4-MW-507 from the official MCPS website or your employer.

02

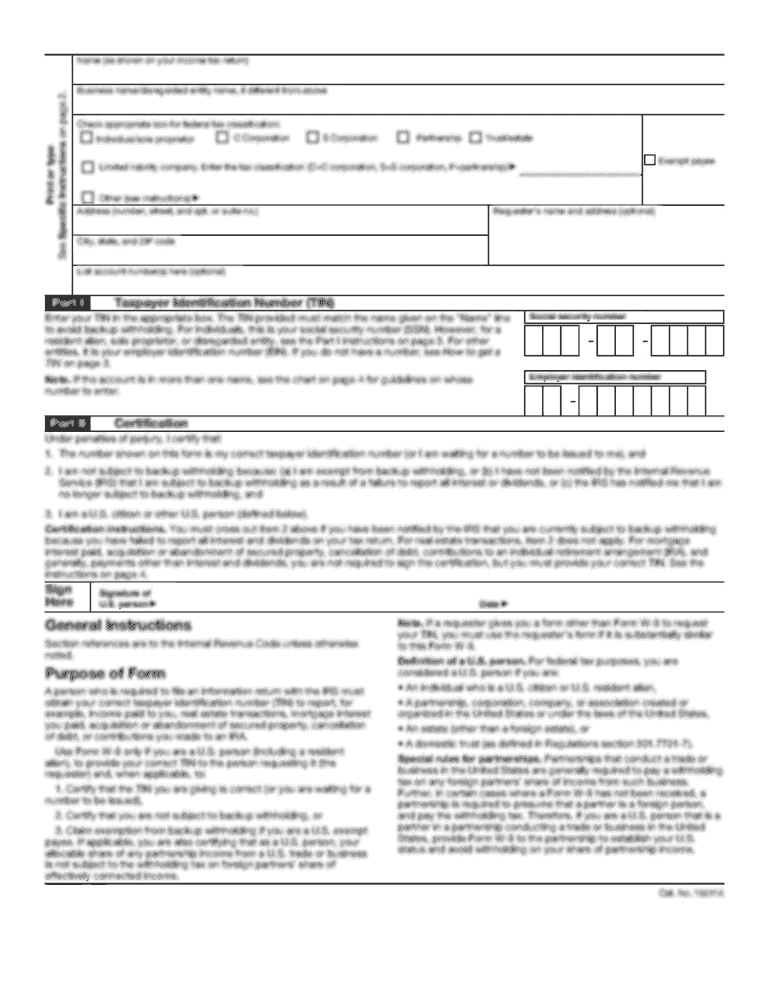

Fill in your personal information, such as your name, address, and Social Security Number.

03

Indicate your filing status (single, married, etc.) in the appropriate section.

04

Complete the number of allowances you are claiming based on your personal situation.

05

If applicable, add any additional withholding amounts you wish to specify.

06

Review your completed form for accuracy.

07

Submit the form to your employer's payroll department as instructed.

Who needs MCPS Form W4-MW-507?

01

Employees of Montgomery County Public Schools (MCPS) who need to adjust their tax withholdings.

02

New hires at MCPS who need to complete their payroll documentation.

03

Current employees who wish to change their tax withholding status or allowances.

Fill

form

: Try Risk Free

People Also Ask about

What does the U.S. Department of Treasury do?

The Department of the Treasury operates and maintains systems that are critical to the nation's financial infrastructure, such as the production of coin and currency, the disbursement of payments to the American public, revenue collection, and the borrowing of funds necessary to run the federal government.

How do I know if I owe the Department of Treasury?

The TOP Interactive Voice Response (IVR) system at 800-304-3107 can provide an automated message on who to call for your specific debt.

How do I find out why the U.S. Treasury sent me a check?

If you received a check or EFT (Electronic Funds Transfer) payment from Treasury and don't know why it was sent to you, the Bureau of the Fiscal Call Center can help. The Bureau of the Fiscal Service Call Center can be reached by calling 1-855-868-0151, Option 2.

Is Department of Treasury the same as IRS?

The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. In fiscal year 2020, the IRS collected almost $3.5 trillion in revenue and processed more than 240 million tax returns.

Is the U.S. Department of Treasury sending out checks?

U.S. Department of the Treasury Treasury will continue to send out checks as extensions or late-filed returns are processed.

Is the Treasury Dept sending out checks?

Over the past eleven weeks, Treasury has sent out nearly 83 million checks for more than $35 billion in tax relief. Treasury will continue to send out checks as extensions or late-filed returns are processed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MCPS Form W4-MW-507?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific MCPS Form W4-MW-507 and other forms. Find the template you need and change it using powerful tools.

How do I make changes in MCPS Form W4-MW-507?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your MCPS Form W4-MW-507 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit MCPS Form W4-MW-507 on an iOS device?

Create, modify, and share MCPS Form W4-MW-507 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is MCPS Form W4-MW-507?

MCPS Form W4-MW-507 is a form used by employees of Montgomery County Public Schools (MCPS) to determine the amount of Maryland income tax withholding from their paychecks.

Who is required to file MCPS Form W4-MW-507?

Employees of Montgomery County Public Schools who wish to specify their Maryland income tax withholding amounts are required to file MCPS Form W4-MW-507.

How to fill out MCPS Form W4-MW-507?

To fill out MCPS Form W4-MW-507, employees need to provide their personal information, including name, address, Social Security number, and the number of allowances they wish to claim, based on their personal tax situation.

What is the purpose of MCPS Form W4-MW-507?

The purpose of MCPS Form W4-MW-507 is to allow employees to adjust their state income tax withholding to better match their tax liability and to avoid underpayment or overpayment of taxes.

What information must be reported on MCPS Form W4-MW-507?

The information that must be reported on MCPS Form W4-MW-507 includes the employee's full name, address, Social Security number, the number of exemptions claimed, and any additional amount to withhold.

Fill out your MCPS Form W4-MW-507 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MCPS Form w4-MW-507 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.