CT OP-236 Package 2017-2026 free printable template

Show details

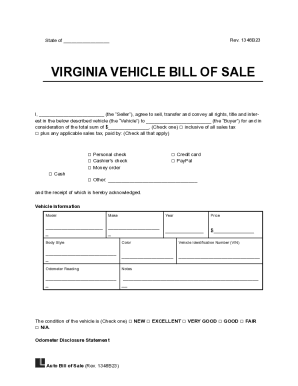

Print Form Reset Form Department of Revenue Services State of Connecticut PO Box 5035 Hartford CT 06102-5035 OP236 0417W 01 9999 OP-236 Connecticut Real Estate Conveyance Tax Return Rev. 04/17 For Town Town Code Clerk Use Only Complete Form OP-236 in blue or black ink only. 1. Town Land Record Vol* Pg* 2. Location of property conveyed number and street Amended return Yes If Yes attach OP-236 Schedule A - Grantors Supplemental Information for Real Estate Conveyance Tax Return* 3. Are there...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign op 236 form

Edit your op236 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your op 236 ct form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing op 236 pdf online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit op 236 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct conveyance tax form

How to fill out CT OP-236 Package

01

Obtain the CT OP-236 Package from the official website or your local office.

02

Fill out the personal information section, including your name, address, and contact information.

03

Provide details regarding the specific operation or procedure related to the CT OP-236.

04

Attach any required documentation or supporting materials as specified in the instructions.

05

Review the completed form for accuracy and completeness.

06

Submit the form as directed, whether online or in person.

Who needs CT OP-236 Package?

01

Individuals or organizations looking to initiate a specific operation or request.

02

Contractors or vendors that require approval for certain procedures.

03

Departmental or regulatory agencies involved in the process outlined by the CT OP-236.

Fill

ct op236 online

: Try Risk Free

People Also Ask about op236 form

How much is the transfer tax in CT?

Connecticut allows taxpayers who pay conveyance tax at the 2.25% rate to claim a property tax credit against their state income tax liability. This credit is based on the amount they paid in conveyance tax at 2.25% rate.

Who pays the transfer tax in CT?

This tax, typically paid by the seller at closing, is based on a percentage of the total sales price of a home. Sellers in some states pay multiple conveyance taxes, one to the state and another to the town and/or county. In Connecticut, sellers pay a state conveyance tax along with a municipal tax.

Who pays transfer taxes at closing in CT?

These are taxes paid to the Town and State on the sale of real estate. They are generally paid by the seller from the closing and given to the town clerk when the transaction is recorded. State Conveyance Taxes are paid to the State of Connecticut Commissioner of Revenue Services.

What is the local conveyance tax?

The California Revenue and Taxation Code states that all the counties in California have to pay the same rate. The current tax rate is $1.10 per $1,000 or $0.55 per $500. So, if your home sells for $600,000, the property transfer tax is $660.

How is CT conveyance tax calculated?

1. The State Conveyance Tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. 2. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a rate of 1.25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ct op236 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your op 236 form ct and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the op236 online in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your form op 236 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out op236 form ct on an Android device?

Complete ct form op 236 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CT OP-236 Package?

CT OP-236 Package is a form used by certain businesses in Connecticut to report their operational and financial information to the state for tax purposes.

Who is required to file CT OP-236 Package?

Entities such as corporations, partnerships, and limited liability companies conducting business in Connecticut may be required to file the CT OP-236 Package.

How to fill out CT OP-236 Package?

The CT OP-236 Package should be filled out with accurate financial information, including details about revenues, expenses, and other relevant data as specified in the form instructions.

What is the purpose of CT OP-236 Package?

The purpose of the CT OP-236 Package is to provide the Connecticut Department of Revenue Services with essential information needed for tax assessment and compliance purposes.

What information must be reported on CT OP-236 Package?

Information that must be reported on the CT OP-236 Package includes gross receipts, deductions, exemptions, and any other financial details required by the state tax authorities.

Fill out your CT OP-236 Package online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Connecticut Conveyance Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to drs op236 form

Related to ct op 236 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.