Get the free irs 2848 instructions

Get, Create, Make and Sign form 2848 instructions

How to edit irs 2848 instructions form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs 2848 instructions form

How to fill out form 2848 instructions:

Gather all necessary information:

Complete the taxpayer information section:

Specify the representative details:

Define the tax matters:

Sign and date the form:

Who needs form 2848 instructions:

Video instructions and help with filling out and completing irs 2848 instructions

Instructions and Help about irs 2848 instructions form

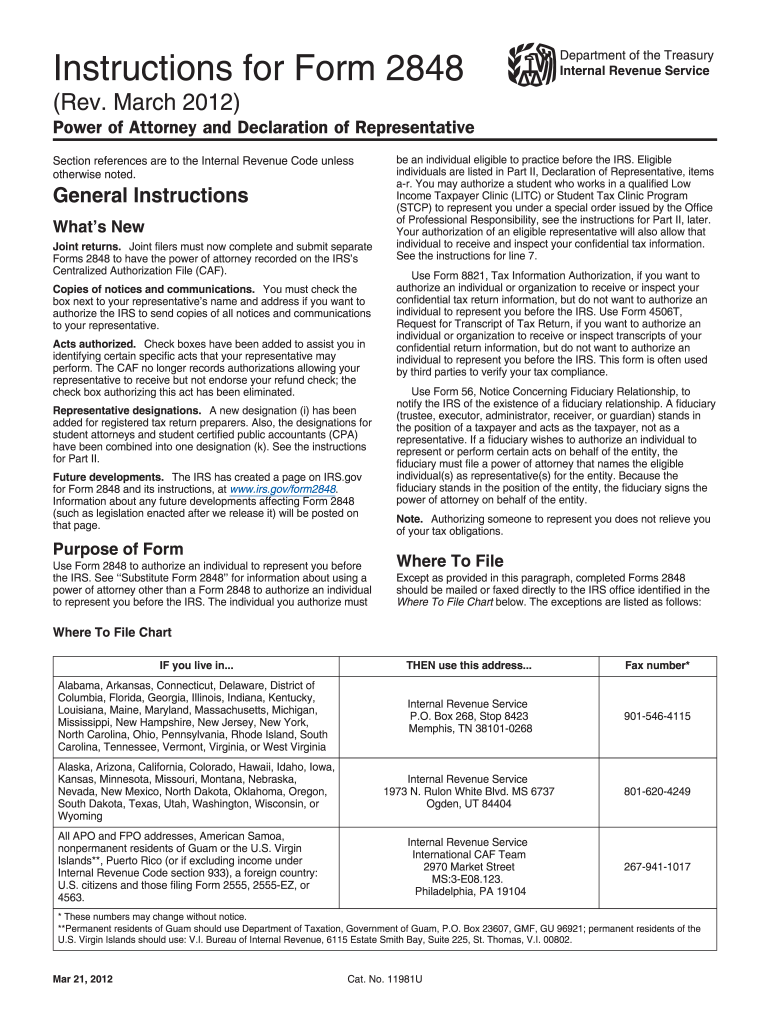

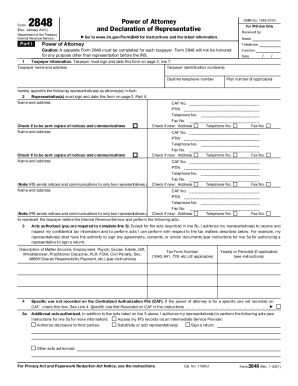

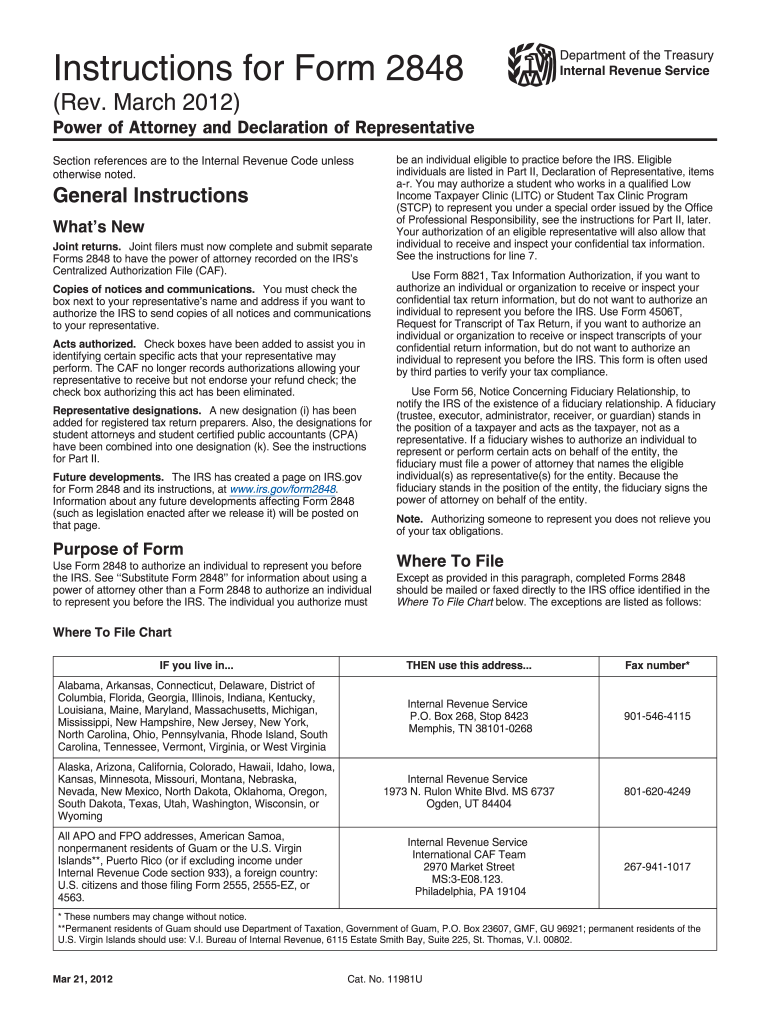

Laws calm legal forms guide form 2848 as the United States Internal Revenue Service tax form used for listing a power of attorney for a taxpayer the power of attorney allows a representative to file taxes and appear on behalf of another in IRS proceedings the form 2848 can be obtained through the IRS s website or by obtaining the documents through a local tax office the tax form is to be filed by the representative who is applying for power of attorney in box one the taxpayer who is giving power of attorney must provide their name address social security number employer identification number if a corporation daytime phone number and plan number in box to the party assuming the power of attorney must provide their information if multiple parties are to be granted power of attorney each must provide their information provide the name and address followed by the CAF number telephone number and fax number the form 2848 allows the taxpayer to elect the scope of the power of attorney granted in box three provide the tax matters tax form issues and specific dates in which the power of attorney is granted for box 5 the form 28 48 states the standard definition of power of attorney and allows space for additions or deletions from the standard to allow the taxpayer to define the scope of the power of attorney if the standard form is acceptable leave box 5 blank box 6 is important as it states whether the taxpayer will allow the representing party to receive tax refund checks but not to cash them sign this box if this is what you want boxes 7 camp; 8 cover the communications aloud to your power of attorney and allows you to keep any previous power of attorney filings in effect most likely you will not want previous powers of attorney to remain in effect but if you do, you must attach those documents with the form the taxpayer must certify the form 2848 in box 9 providing a signature and tax pin if the power of attorney is given for a joint tax return both parties must sign off on the power of attorney in order for the form 2848 to be effective the representative must declare their status in part 2 and sir to fight the declaration with their signature once completed the form is ready to be submitted to the IRS to watch more videos please make sure to visit laws calm

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs 2848 instructions form directly from Gmail?

Can I sign the irs 2848 instructions form electronically in Chrome?

Can I edit irs 2848 instructions form on an Android device?

What is form 2848 instructions?

Who is required to file form 2848 instructions?

How to fill out form 2848 instructions?

What is the purpose of form 2848 instructions?

What information must be reported on form 2848 instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.