UK IHT205() 2004 free printable template

Show details

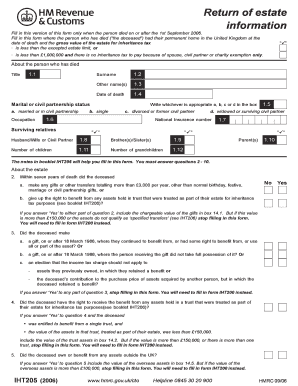

Return of estate information Capital Taxes Probate and inheritance tax Helpline 0845 30 20 900 Fill in this form where the person who has died (the deceased) had their permanent home in the United

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK IHT205

Edit your UK IHT205 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK IHT205 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK IHT205 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK IHT205. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK IHT205(2011) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK IHT205

How to fill out UK IHT205()

01

Obtain the UK IHT205 form from the official government website or via relevant solicitors.

02

Fill in the deceased's details, including full name, date of birth, and date of death.

03

Provide information about the deceased's estate, including property, bank accounts, investments, and personal belongings.

04

List any funeral expenses and outstanding debts of the deceased.

05

Calculate the total value of the estate, ensuring to include joint accounts and properties where applicable.

06

Declare the exemptions that apply to the estate, such as the spouse exemption.

07

Review the form for completeness and accuracy.

08

Sign and date the declaration to certify the information provided is true.

09

Submit the completed form to HM Revenue and Customs (HMRC) along with any additional required documentation.

Who needs UK IHT205()?

01

Executors of a deceased person's estate.

02

Personal representatives managing estates where the value exceeds the inheritance tax threshold.

03

Individuals who are responsible for settling the deceased's affairs.

04

Families and beneficiaries who are involved in estate administration.

Fill

form

: Try Risk Free

People Also Ask about

How long does IHT400 take?

Fill out and send form IHT400 and form IHT421 to HMRC and wait 20 working days before applying for probate. You normally have to pay at least some of the tax before you'll get probate. You can claim the tax back from the estate, if you pay it out of your own bank account.

What does a IHT400 do?

If Inheritance Tax is due or full details are needed. You must report the value of the estate to HM Revenue and Customs ( HMRC ) by completing form IHT400. You must submit the form within 12 months of the person dying. You may have to pay a penalty if you miss the deadline.

Do I need to fill in inheritance tax form UK?

You must report the value of the estate to HM Revenue and Customs ( HMRC ) by completing form IHT400. You must submit the form within 12 months of the person dying. You may have to pay a penalty if you miss the deadline.

Do I need to complete IHT400?

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'.

What is an IHT form?

The value and complexity of the estate will have a bearing on which type of form is submitted to HM Revenue & Customs ("HMRC") for Inheritance Tax ("IHT") purposes. Ultimately the value of the estate will determine if any IHT is due on the estate and if so, how much.

What is IHT404 form?

Use the IHT404 with form IHT400 to give details of all UK assets the deceased owned jointly with another person.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK IHT205 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your UK IHT205 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit UK IHT205 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing UK IHT205 right away.

How do I fill out UK IHT205 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign UK IHT205 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is UK IHT205()?

UK IHT205 is a form used to report inheritance tax for estates that do not need to pay inheritance tax, also known as the 'Property and Financial Affairs' form.

Who is required to file UK IHT205()?

The personal representatives of a deceased person's estate are required to file UK IHT205 if the estate's value is within certain thresholds and qualifies as a non-taxable estate.

How to fill out UK IHT205()?

To fill out UK IHT205, personal representatives must provide details about the deceased's assets, liabilities, and any exemptions or reliefs applicable, ensuring all information is accurate and complete.

What is the purpose of UK IHT205()?

The purpose of UK IHT205 is to enable HM Revenue and Customs to assess the value of an estate and determine if inheritance tax is payable, facilitating the administration of the estate.

What information must be reported on UK IHT205()?

UK IHT205 requires reporting of the deceased's personal details, asset values, liabilities, any gifts made in the seven years before death, and any exemptions or reliefs claimed.

Fill out your UK IHT205 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK iht205 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.