Get the free SSA-1696-U4

Show details

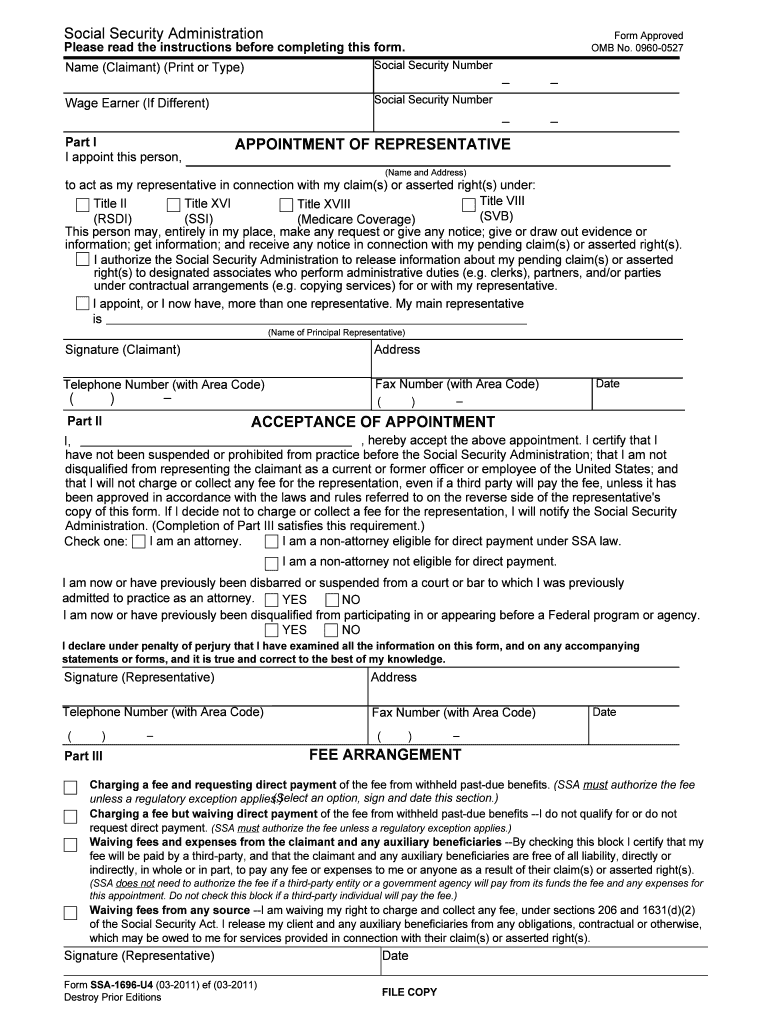

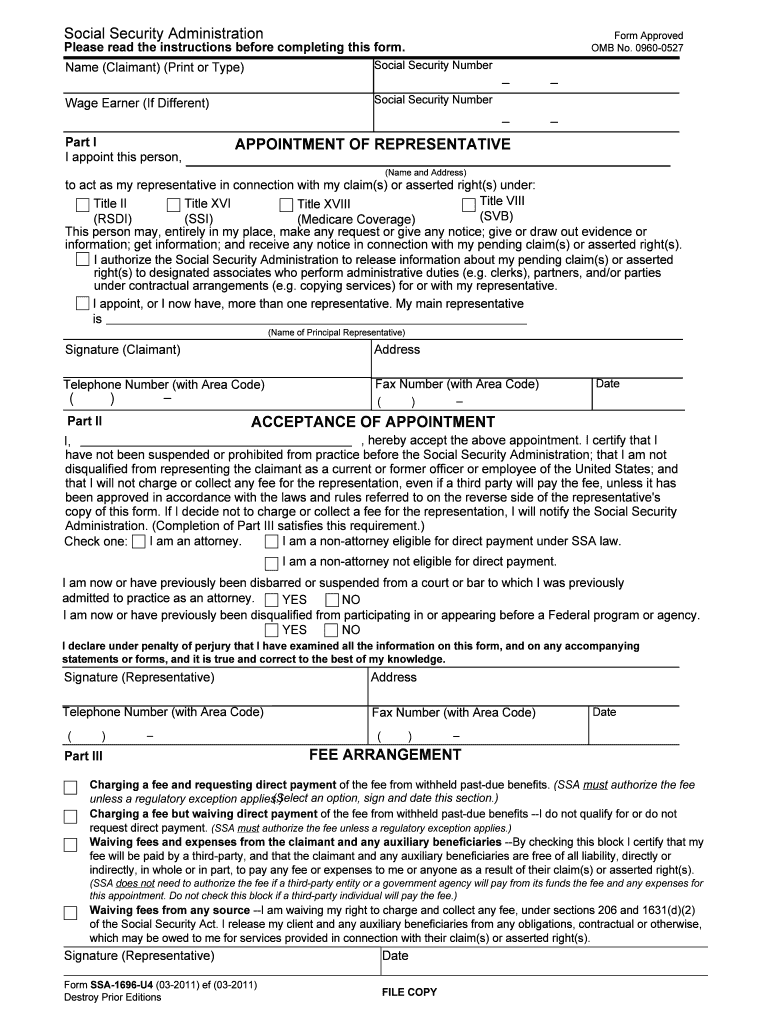

This form is used to appoint an individual as your representative in matters concerning Social Security. It details the responsibilities of the representative and the privacy information associated

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ssa-1696-u4

Edit your ssa-1696-u4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssa-1696-u4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ssa-1696-u4 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ssa-1696-u4. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ssa-1696-u4

How to fill out SSA-1696-U4

01

Obtain the SSA-1696-U4 form from the Social Security Administration's website or an SSA office.

02

Read the instructions provided with the form carefully to understand each section.

03

Fill out your personal information in the top section, including your name, Social Security number, and address.

04

Indicate whether you are applying for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

05

Provide information about your work history, including the names of employers, job titles, and dates of employment.

06

Answer questions regarding your medical condition and how it affects your ability to work.

07

Include additional information that may support your claim, such as medical records or professional evaluations.

08

Review the completed form for accuracy and ensure all sections are filled out.

09

Sign and date the form at the bottom before submitting it.

Who needs SSA-1696-U4?

01

Individuals applying for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits.

02

Those who have a medical condition that significantly impairs their ability to work.

Fill

form

: Try Risk Free

People Also Ask about

What is form SSA 1694 used for?

All entities that want to receive direct payment will need to register or update their registration with necessary payment and Point of Contact (POC) information. This information will be collected on a revised SSA-1694, Entity Registration and Taxpayer Information.

What is form SSA-1696 used for?

All entities that want to receive direct payment will need to register or update their registration with necessary payment and Point of Contact (POC) information. This information will be collected on a revised SSA-1694, Entity Registration and Taxpayer Information.

What is the CMS form 1696 used for?

The Social Security Administration (SSA) administers two programs that provide benefits based on disability: the Social Security disability insurance program (title II of the Social Security Act (Act)) and the Supplemental Security Income (SSI) program (title XVI of the Act).

Does SSA still use 1695?

SSA-1695 – obsolete since 2020, this form previously associated the individual representative with the firm – this is now accomplished via section 5 of SSA-1696.

What is a SSA-1696 u4?

Form SSA-1696 | Claimant's Appointment of a Representative If you have a case before us and need assistance, you can appoint a representative to help you. Your representative can be an attorney or a non-attorney, but must be qualified and comply with our published rules of conduct.

What is form SSA 1694 used for?

You may use Medicare's Form for Appointment of a Representative (CMS1696) . You may also use an equivalent notice which satisfies the requirements in Form CMS-1696. Unless otherwise stated, your appointed representative will have all the rights and responsibilities of you.

Can SSA-1696 be signed electronically?

The claimant may sign the Form SSA-1696 using any agency-approved signature method (e.g., pen and ink or electronically as part of the e1696 process). SSA will also accept a photocopy or facsimile of a wet-signed Form SSA-1696.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SSA-1696-U4?

SSA-1696-U4 is a form used by individuals applying for Social Security Disability Insurance (SSDI) benefits to provide information about their work history and the impact of their disability on their ability to work.

Who is required to file SSA-1696-U4?

Individuals who are applying for Social Security Disability Insurance (SSDI) benefits and need to provide information about their past work and current disability status are required to file SSA-1696-U4.

How to fill out SSA-1696-U4?

To fill out SSA-1696-U4, applicants must provide personal information, detailed work history, and information about their medical condition and how it affects their ability to perform work activities. It is important to follow the instructions provided with the form carefully.

What is the purpose of SSA-1696-U4?

The purpose of SSA-1696-U4 is to gather essential information from applicants seeking SSDI benefits, which helps the Social Security Administration evaluate their eligibility based on work history and disability.

What information must be reported on SSA-1696-U4?

The information that must be reported on SSA-1696-U4 includes the applicant's identifying information, work experience over the last 15 years, the nature of their disability, and how their condition affects their ability to work.

Fill out your ssa-1696-u4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ssa-1696-u4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.