CA Superior Court Petition for Final Distribution - Santa Clara County 2011-2026 free printable template

Show details

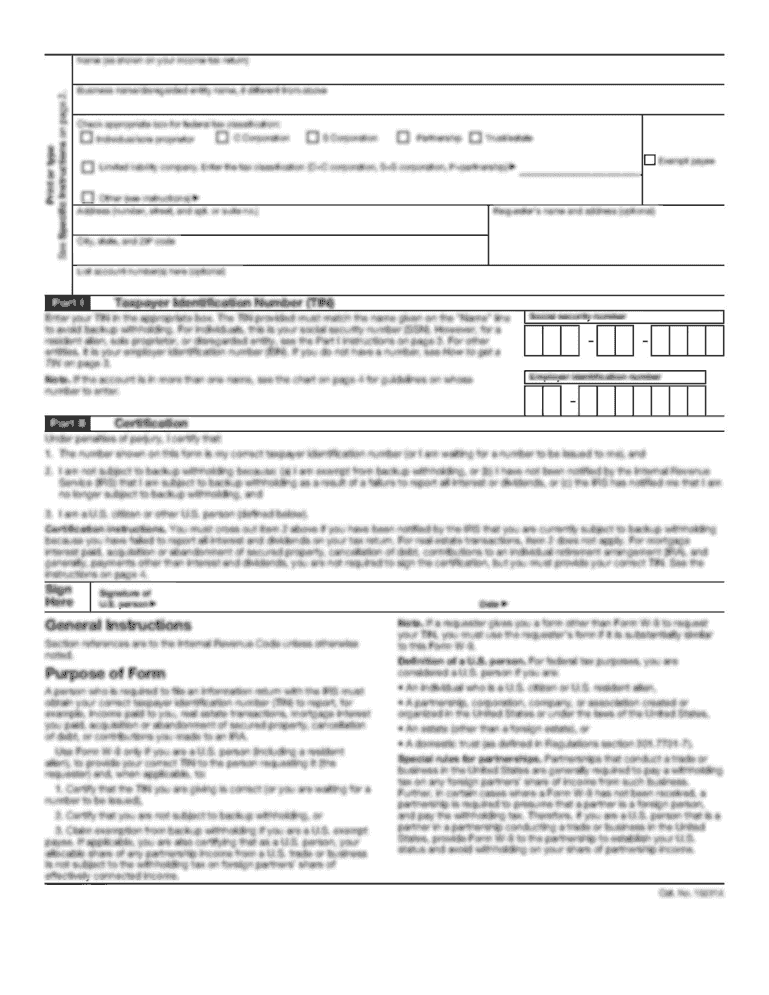

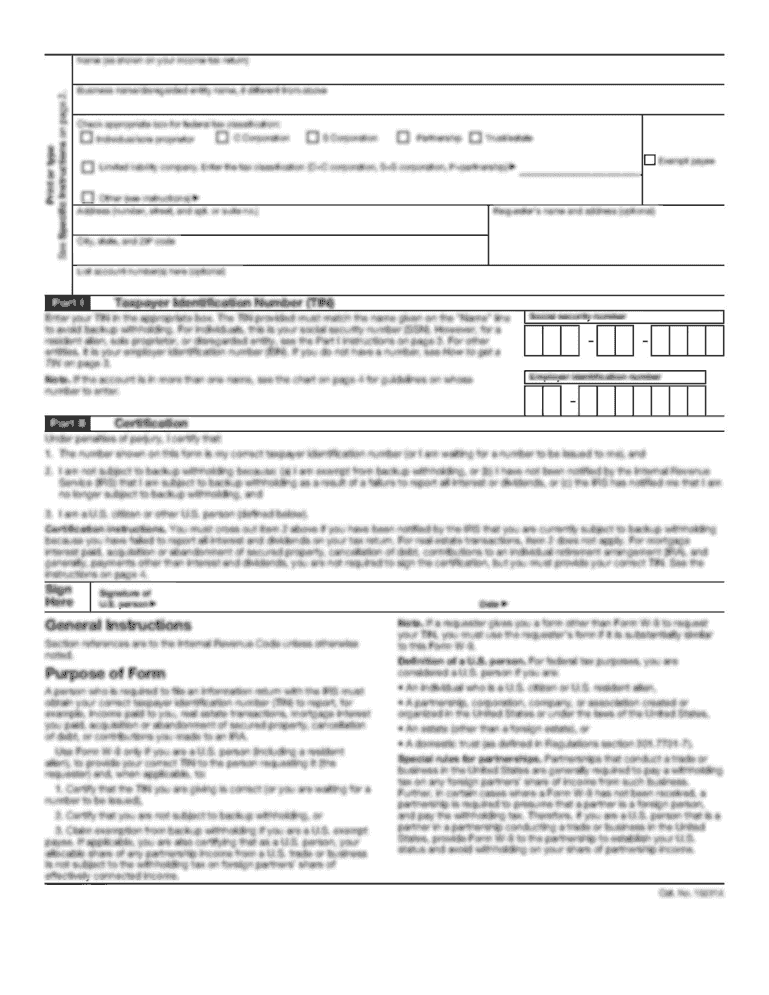

SAMPLE DOCUMENT FOR INFORMATION ONLY 1 Name, Address and Telephone Number of Person Without Attorney: 2 3 4 5 In Pro Per 6 7 8 SUPERIOR COURT OF THE STATE OF CALIFORNIA 9 COUNTY OF SANTA CLARA 10

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign petition for final distribution form

Edit your petition for final distribution california form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your order for final distribution california form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing the ca superior court petition for final distribution is a and taxes have been settled online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sample petition for final distribution california form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petition for distribution form

How to fill out CA Superior Court Petition for Final Distribution

01

Obtain the CA Superior Court Petition for Final Distribution form from the court's website or office.

02

Fill out the case caption at the top of the form, including the court name, case number, and title of the petition.

03

Provide details about the decedent, including their name, date of death, and any estate information.

04

List all beneficiaries and their respective shares of the estate, ensuring to include names, addresses, and relationship to the decedent.

05

Attach a complete inventory of the estate's assets and their estimated values.

06

Include any debts or claims against the estate and how they will be handled.

07

Specify any required notices that have been sent to creditors and beneficiaries as per legal requirements.

08

Sign and date the petition, affirming that all information provided is accurate to the best of your knowledge.

09

Make copies of the completed petition and all supporting documents for your records and to serve to interested parties.

10

File the petition with the CA Superior Court in the appropriate jurisdiction, paying any required filing fees.

Who needs CA Superior Court Petition for Final Distribution?

01

Individuals who are the personal representatives or executors of an estate in California need the CA Superior Court Petition for Final Distribution to finalize the distribution of the deceased's assets.

02

Beneficiaries of an estate may also need the petition if they seek formal distribution of their inheritances.

Fill

petition for final distribution sample

: Try Risk Free

People Also Ask about petition for final distribution california probate

What is final distribution of estate assets in California?

This is when courts transfer the ownership of assets to beneficiaries or heirs. The final distribution only occurs when the estate is settled, meaning all creditors and taxes have been paid, all disputes have been resolved, and the judge gives final approval.

How long does it take a bank to pay out after probate?

Once this document has been obtained from the Probate Registry, an official copy will need to be sent to all of the banks and financial institutions that have asked to see it. Generally, collecting straightforward estate assets like bank account money will take between 3 to 6 weeks.

How long does an executor have to distribute funds in California?

In California, state law gives executors or administrators of estates a time limit to complete probate: one year from the date they are appointed to their position. However, extensions can be requested when delays in the process occur—which is why it generally takes 12 to 18 months.

How long after probate do you receive money?

If you need to close a bank account of someone who has died, and probate is required to do so, then the bank won't release the money until they have the grant of probate. Once the bank has all the necessary documents, typically, they will release the funds within two weeks.

How long does a probate payout take in CA?

How long does probate take? California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

What is a probate order for final distribution in California?

An order for final distribution in California probate is conclusive to the rights of heirs and devisees in a decedent's estate. The order also releases the personal representative from claims by heirs and devisees, unless, of course, there is fraud or misrepresentation present.

What is a CA petition for final distribution?

A final account and petition for distribution can be filed by the Personal Representative when there are sufficient funds available to pay all debts and taxes, the time for filing creditors' claims has expired, and the estate is in a condition to be closed.

How long after probate can funds be distributed in California?

When Does The Executor Petition for Final Distribution in California? The administrator has to wait at least four months from the date the court issued letters of administration to submit a petition for final distribution of the decedent's remaining estate assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my pdffiller in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your order for final distribution form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the how to fill out ca 01 form on my smartphone?

Use the pdfFiller mobile app to complete and sign order for final distribution on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete final decree of distribution california on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your final distribution from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is CA Superior Court Petition for Final Distribution?

The CA Superior Court Petition for Final Distribution is a legal document filed in California courts to request the final distribution of a deceased person's estate to beneficiaries after all debts and taxes have been settled.

Who is required to file CA Superior Court Petition for Final Distribution?

The executor or administrator of the deceased person's estate is required to file the CA Superior Court Petition for Final Distribution.

How to fill out CA Superior Court Petition for Final Distribution?

To fill out the CA Superior Court Petition for Final Distribution, the filer should provide information about the deceased, details of the estate assets, the proposed distribution plan, and signatures from interested parties. It is advisable to consult a legal professional or follow court instructions for accurate completion.

What is the purpose of CA Superior Court Petition for Final Distribution?

The purpose of the CA Superior Court Petition for Final Distribution is to formally request the court's approval to distribute the remaining assets of an estate to beneficiaries, ensuring that all legal requirements are met.

What information must be reported on CA Superior Court Petition for Final Distribution?

The information that must be reported includes the decedent's details, a summary of the estate assets, a list of debts paid, the names and addresses of beneficiaries, and the proposed distribution to each beneficiary.

Fill out your CA Superior Court Petition for Final Distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Superior Court Petition For Final Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.