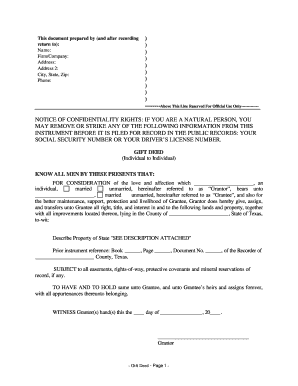

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Gift, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USAF control no. GA-8215

Get the free deed of gift

Show details

This document serves as a legal instrument for the transfer of property from the Grantor to the Grantee under an irrevocable trust agreement, detailing the land and associated rights being gifted.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of gift

Edit your deed of gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deed of gift online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deed of gift. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of gift

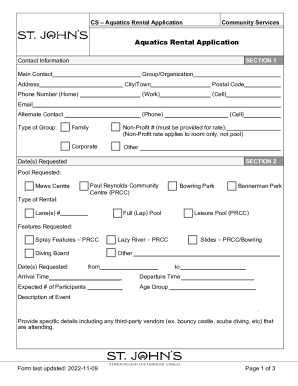

How to fill out a deed of gift Georgia:

01

Obtain the necessary template or form for a deed of gift in Georgia. This can usually be found online or at your local county clerk's office.

02

Begin by entering the relevant information about the donor, including their full name, address, and contact information.

03

Next, provide the recipient's details, such as their full name, address, and contact information.

04

Clearly state the gift being transferred, including a detailed description of the property or item being gifted.

05

Include any conditions or terms that may apply to the gift, such as restrictions on its use or transferability.

06

Sign and date the deed of gift in the presence of a notary public or other authorized official. Make sure all parties involved also sign and date the document.

07

Submit the completed deed of gift to the appropriate government agency or office for recording and documentation.

Who needs a deed of gift Georgia:

01

Individuals who wish to transfer ownership of a property or item as a gift to another person.

02

Those who want to ensure that the transfer of the gift is legally documented and recorded in Georgia.

03

Organizations or institutions that may be receiving a gift and require a deed of gift to establish ownership.

Fill

form

: Try Risk Free

People Also Ask about

What type of deed is commonly used for transfers within a family?

Quitclaim deeds, therefore, are commonly used to transfer property within a family, such as from a parent to an adult child, between siblings, or when a property owner gets married and wants to add their spouse to the title.

What is the difference between a grant deed and a gift deed?

Gift Deed – A gift deed is a special type of grant deed that “gifts” ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

What was the purpose of the deed of gift?

The Deed of Gift is a formal and legal agreement between you, the donor, and Special Collections that transfers ownership of and legal rights to the donated materials.

What are the terms of a deed of gift?

The Elements of a Deed of Gift The typical deed of gift identifies the donor, describes the materials, transfers legal ownership of the materials to the repository, establishes provisions for use, specifies ownership of intellectual property rights, and indicates disposition of unwanted materials.

How do I add someone to my deed in GA?

If youve recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorders office.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit deed of gift online?

The editing procedure is simple with pdfFiller. Open your deed of gift in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the deed of gift in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your deed of gift.

Can I edit deed of gift on an Android device?

You can make any changes to PDF files, like deed of gift, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is deed of gift georgia?

A deed of gift in Georgia is a legal document that formally transfers ownership of property or assets from one individual to another without any exchange of money. It is typically used for gifts of real estate or personal property.

Who is required to file deed of gift georgia?

The donor, or person giving the gift, is typically required to file the deed of gift in Georgia. Additionally, the recipient may also be involved in ensuring the document is recorded appropriately.

How to fill out deed of gift georgia?

To fill out a deed of gift in Georgia, include the names and addresses of both the donor and the recipient, a legal description of the property being gifted, and any applicable terms or conditions of the gift. It should be signed before a notary public.

What is the purpose of deed of gift georgia?

The purpose of a deed of gift in Georgia is to provide a clear and legally binding record of the transfer of property from one individual to another, ensuring that the recipient legally owns the gifted property without future disputes.

What information must be reported on deed of gift georgia?

The information that must be reported on a deed of gift in Georgia includes the names and addresses of the donor and recipient, a detailed legal description of the property, the date of the gift, and any conditions or restrictions regarding the gift.

Fill out your deed of gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.