Paychex OP0053 2014-2025 free printable template

Show details

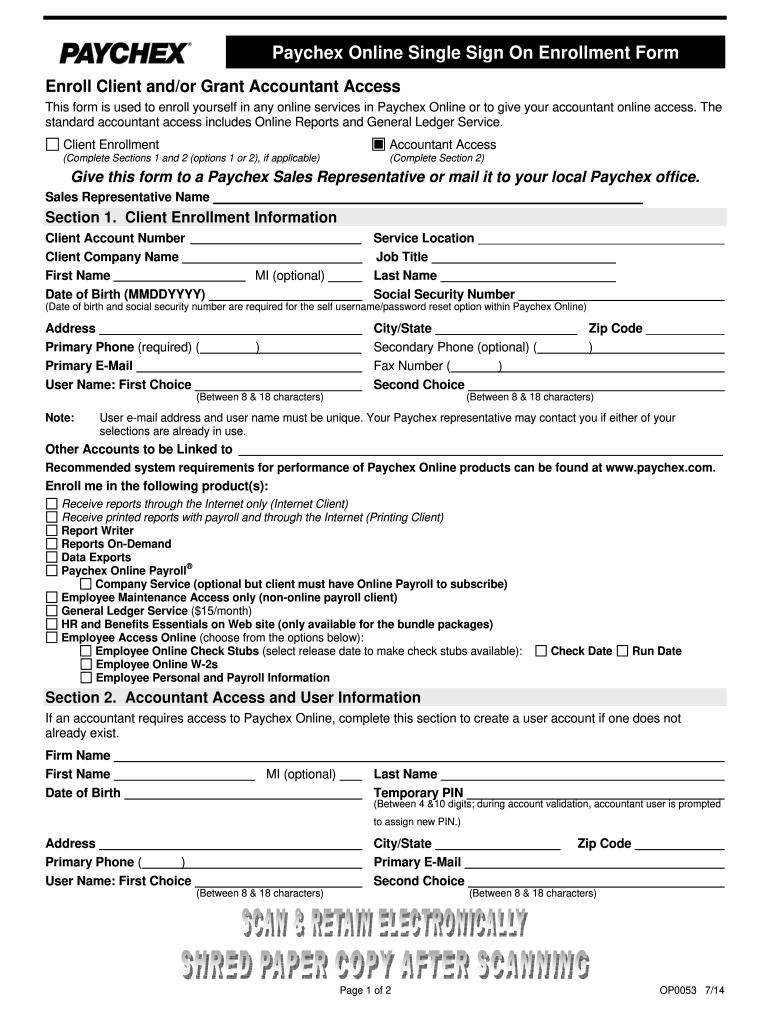

Patches Online Single Sign On Enrollment Form

Enroll Client and/or Grant Accountant Access

This form is used to enroll yourself in any online services in Patches Online or to give your accountant

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign paychex single sign fillable form

Edit your Paychex OP0053 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Paychex OP0053 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

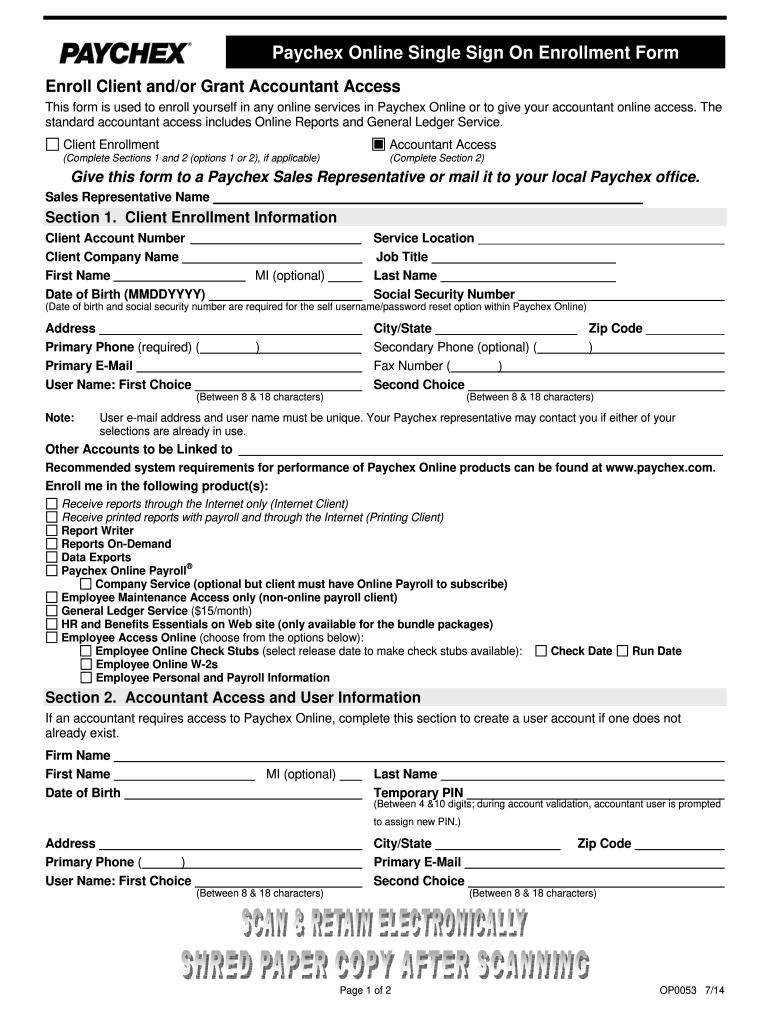

Editing Paychex OP0053 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Paychex OP0053. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Paychex OP0053

How to fill out Paychex OP0053

01

Gather required employee information such as name, address, and Social Security number.

02

Provide the employer's details including business name, address, and federal employer identification number (EIN).

03

Fill out the payroll period information,包括开始和结束日期.

04

Enter the total hours worked for each employee, along with their respective pay rates.

05

Calculate gross pay by multiplying hours by pay rates.

06

Deduct any applicable taxes and contributions (e.g., federal taxes, state taxes, retirement plans).

07

Determine the net pay for each employee after deductions.

08

Review all entered data for accuracy.

09

Submit the completed form for processing.

Who needs Paychex OP0053?

01

Employers seeking to manage payroll for their employees.

02

Businesses that require accurate payroll documentation for tax reporting.

03

HR departments that handle employee compensation and benefits.

04

Accountants responsible for financial record-keeping related to payroll.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my w2 from Paychex?

How can I have my W-2 sent to me? Your W-2 is available on the Paychex Oasis portal. You may also contact our W-2 hotline (866-641-8699) to request a copy.

What is the employee ID for Paychex?

Employee ID's can be found by clicking on the Time & Attendance tab, and selecting Employees. The Paychex Client ID can be found by selecting Company from the menu. If you're not sure where to find your Paychex Codes, reach out to a Paychex representative or your payroll provider to assist you.

How to use Paychex online?

0:19 2:01 How it works: Paychex Flex Demo - YouTube YouTube Start of suggested clip End of suggested clip Track training and manage performance reviews on any schedule. Simplify open enrollment and compileMoreTrack training and manage performance reviews on any schedule. Simplify open enrollment and compile key data for health care regulations in Benefits Administration.

How can I access my pay stubs online?

Through your employee website Find out where you can search for your pay stubs online. Ask your manager or the human resources department where you can locate them electronically. Typically, companies who house them electronically have them on a payroll service website which requires an employee login and password.

How do I get my money from Paychex?

Employees can transfer the money to their bank account, prepaid or debit card, or pick as cash at any Walmart Money Center. The accessed money is deducted from the next paycheck.

How do I change my employee access on Paychex Flex?

Employee Group Access Click company setup | Security | System Access. Click Create New User or select the name of the user for whom you want to grant access to an Employee Group for. Click Employee Group Access. Check the checkboxes for each option in which you want the employee to have access. Click Save.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Paychex OP0053 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including Paychex OP0053, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the Paychex OP0053 in Gmail?

Create your eSignature using pdfFiller and then eSign your Paychex OP0053 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit Paychex OP0053 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Paychex OP0053 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

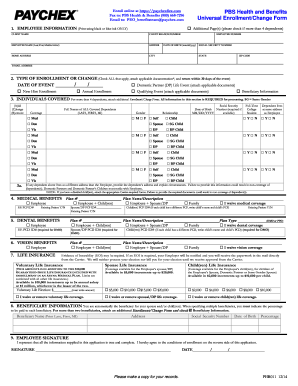

What is Paychex OP0053?

Paychex OP0053 is a specific form used by businesses to report employee information and compensation details to Paychex for payroll processing.

Who is required to file Paychex OP0053?

Employers who use Paychex payroll services and need to report employee wages and tax withholdings are required to file Paychex OP0053.

How to fill out Paychex OP0053?

To fill out Paychex OP0053, employers should enter the required information regarding employee names, social security numbers, wages, and any applicable deductions as outlined in the form instructions.

What is the purpose of Paychex OP0053?

The purpose of Paychex OP0053 is to ensure accurate payroll processing and tax reporting by providing a standardized format for reporting employee compensation and tax information to Paychex.

What information must be reported on Paychex OP0053?

Paychex OP0053 must report employee names, social security numbers, gross wages, tax withholdings, and any other relevant payroll data as specified in the form.

Fill out your Paychex OP0053 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paychex op0053 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.