Get the free Interest on such loans will be 2% above the

Show details

For Individuals/ Trusts & InstitutionsCredit Rating 'A A A 'QUICK LOAN FACILITYPayment of interest will be made only through ECS where this facility is available. Loan against deposit is available

We are not affiliated with any brand or entity on this form

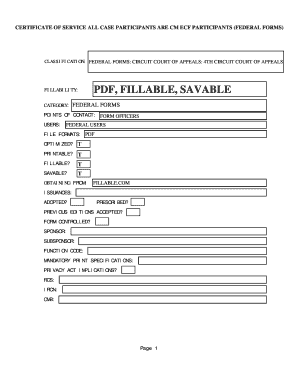

Get, Create, Make and Sign interest on such loans

Edit your interest on such loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interest on such loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing interest on such loans online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit interest on such loans. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

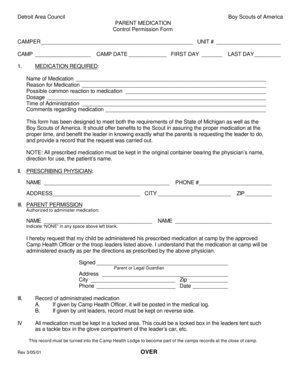

How to fill out interest on such loans

How to fill out interest on such loans

01

Start by gathering all the necessary information about the loan, including the loan amount, interest rate, and repayment terms.

02

Understand the loan agreement and read through it carefully. Pay attention to the specific sections regarding interest calculation and payment.

03

Calculate the interest amount for each period using the agreed-upon method. This can be done manually or by using online loan calculators.

04

Ensure you have a clear understanding of when and how the interest payments are due. It is important to make timely payments to avoid any penalties or additional charges.

05

Keep track of the interest payments made and maintain proper documentation for future reference.

06

Consider consulting with a financial advisor or loan specialist if you have any doubts or concerns regarding the interest calculation or repayment process.

07

Regularly review your loan statement to ensure that the interest is being accurately calculated and applied.

08

If you encounter any issues or discrepancies with the interest calculation or payments, contact the loan provider immediately to seek clarification and resolution.

Who needs interest on such loans?

01

Individuals or businesses seeking financial assistance through loans may need to consider interest on such loans.

02

Borrowers who require funds for various purposes, such as education, home purchase, starting a business, or debt consolidation, may avail of loans with interest.

03

Entrepreneurs or companies looking for capital to fund their operations, invest in projects, or expand their business may opt for loans with interest.

04

Individuals or businesses looking to build credit history or improve their credit score may choose to take loans with interest and repay them responsibly.

05

People in emergency situations or facing unexpected expenses may seek short-term loans with interest to cover their immediate financial needs.

06

Investors or individuals seeking to grow their wealth may lend money to others at an interest rate, thereby earning interest on such loans.

07

Individuals or businesses aiming to bridge the gap between income and expenses may rely on loans with interest to manage their cash flow.

08

Governments or financial institutions may offer loans with interest to stimulate economic growth, provide financial aid, or support infrastructure development.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my interest on such loans in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign interest on such loans and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in interest on such loans?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your interest on such loans to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit interest on such loans on an Android device?

With the pdfFiller Android app, you can edit, sign, and share interest on such loans on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is interest on such loans?

Interest on loans is the amount of money charged by a lender to a borrower for the use of assets.

Who is required to file interest on such loans?

Anyone who has earned interest on loans should file this information when filing their taxes.

How to fill out interest on such loans?

To fill out interest on loans, you will need to report the amount of interest earned on your tax return.

What is the purpose of interest on such loans?

The purpose of interest on loans is to compensate the lender for the risk of lending money.

What information must be reported on interest on such loans?

You must report the amount of interest earned, the name of the borrower, and any other relevant details.

Fill out your interest on such loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interest On Such Loans is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.