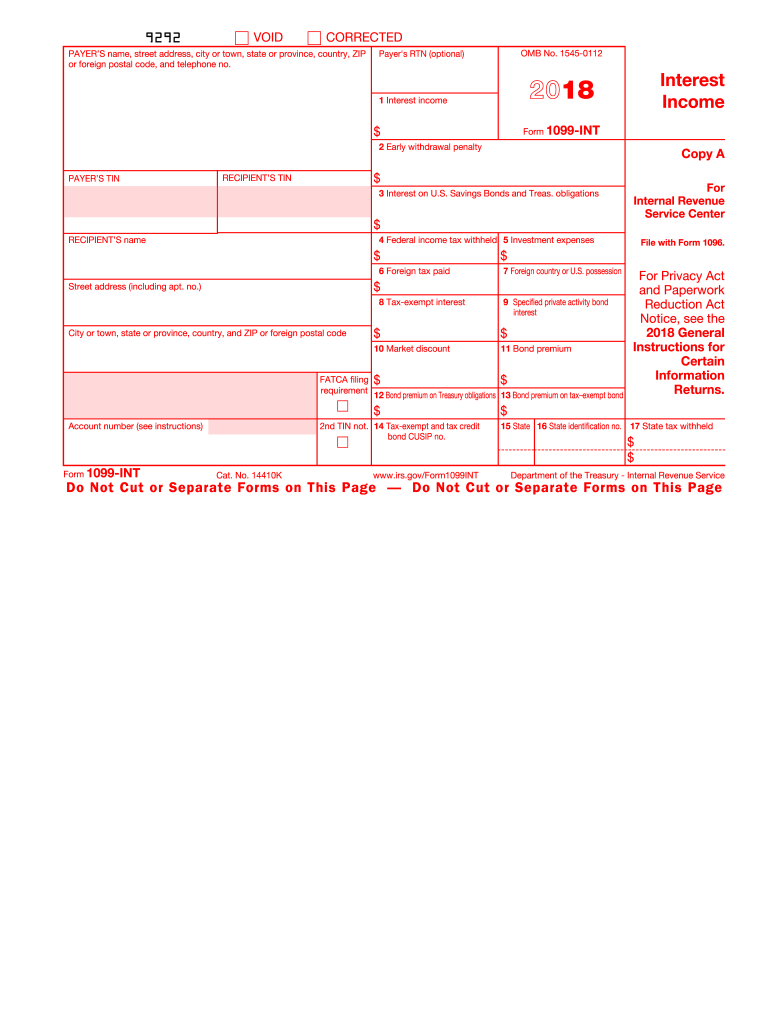

What is form IRS 1099 INT?

Form 1099-INT is used to report interest income from banks and other financial institutions. Interest reported on the IRS 1099 INT includes the interest paid on saving accounts and US saving bonds. This form reports both the interest earned and the penalties on the investments incurred by the investor during the tax year.

When is 1099-INT issued?

Form 1099 INT is issued to account holders of accounts for which interest of more than $10 was paid during the financial year. It includes interest paid on:

• Saving accounts

• Certificate of deposit

• Money market accounts

• Treasury bonds

• Interest-yielding accounts

What is the benefit of IRS 1099-INT?

With the 1099-INT, you will not have to pay any income tax on the interest reported in the form, but you will need to report it in your return.

When is form 1099-INT due?

The recipient needs copy B of this form by January, 31st, 2017. Copy A must be filed with IRS by February, 28th, 2017, or by March, 31st, if filed electronically.

How do I fill out IRS 1099-INT?

In the form, you need to provide payer’s information, business’s tax identification number, recipient’s identification number and basic information. Fill the numbered boxes after reading the instruction carefully.

For more information on filling out IRS 1099 INT, check out the following video: