Get the free duty exemption and drawback office

Show details

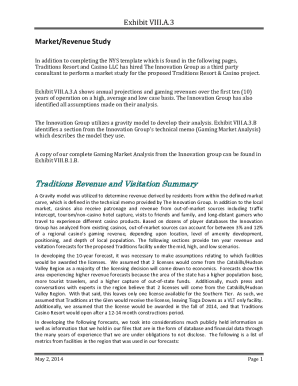

Mushak22 Duty Drawback Application Form (under the provision of SubRule (1) of Rule 30 of The Value Added Tax Rules, 1991) To Director General Duty Exemption & Drawback Office Attogram Haiti Shaman

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign duty exemption and drawback

Edit your duty exemption and drawback form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your duty exemption and drawback form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing duty exemption and drawback online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit duty exemption and drawback. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out duty exemption and drawback

How to fill out duty exemption and drawback

01

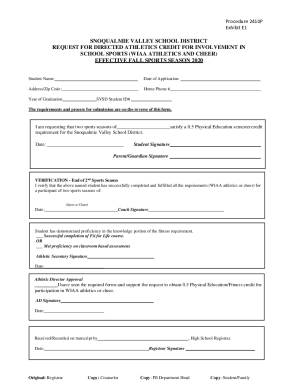

Step 1: Gather all necessary documents such as purchase invoices, bill of lading, packing list, and any other relevant supporting documents.

02

Step 2: Identify the duty exemption and drawback program that applies to your specific situation. This could vary based on factors such as the type of goods, country of import/export, and trade agreements.

03

Step 3: Prepare the duty exemption and drawback application form provided by the relevant customs authority. Ensure you accurately fill out all required fields and provide supporting information as requested.

04

Step 4: Attach all necessary supporting documents to the completed application form.

05

Step 5: Submit the application form and supporting documents to the designated customs authority. This can typically be done either in person, by mail, or electronically through an online portal.

06

Step 6: Await the customs authority's review of your application. This may involve verification of information provided and examination of submitted documents.

07

Step 7: If approved, you will receive a duty exemption and drawback confirmation notice or certificate. Keep this document safe as it may be required for future reference.

Who needs duty exemption and drawback?

01

Importers and exporters who engage in international trade and wish to reduce their financial burden by obtaining duty exemptions and drawbacks.

02

Businesses involved in manufacturing or processing that import raw materials or components for incorporation into finished products.

03

Companies participating in specific trade programs or initiatives that offer duty exemption and drawback benefits.

04

Small businesses and startups that want to maximize cost savings in their supply chain and improve competitiveness in the global market.

05

Individuals and organizations that qualify under specific customs regulations and provisions for duty exemption and drawback.

06

To determine if you need duty exemption and drawback, consult with customs professionals or relevant authorities to assess your trade activities and eligibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

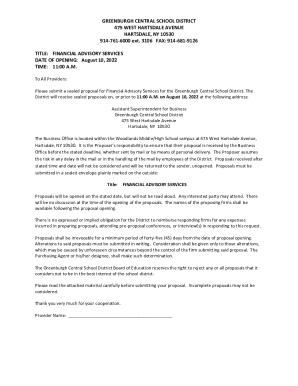

How can I modify duty exemption and drawback without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including duty exemption and drawback. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find duty exemption and drawback?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the duty exemption and drawback in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I fill out duty exemption and drawback on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your duty exemption and drawback. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

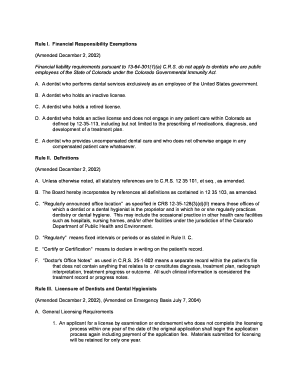

What is duty exemption and drawback?

Duty exemption and drawback refers to the process of waiving or refunding customs duties on imported goods that are later exported.

Who is required to file duty exemption and drawback?

Importers and exporters are required to file duty exemption and drawback.

How to fill out duty exemption and drawback?

Duty exemption and drawback forms can be filled out online or submitted in person to the customs authority.

What is the purpose of duty exemption and drawback?

The purpose of duty exemption and drawback is to promote international trade by reducing the cost of importing and exporting goods.

What information must be reported on duty exemption and drawback?

Information such as the description of goods, value, country of origin, and proof of export must be reported on duty exemption and drawback.

Fill out your duty exemption and drawback online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Duty Exemption And Drawback is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.