PA DoR REV-1220 AS 2017 free printable template

Show details

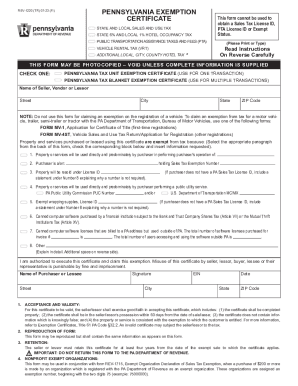

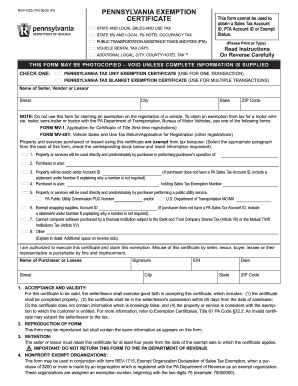

ReV-1220 as 05-17 START bureau of business trust fund taxes Po box 280901 harrisburg Pa 17128-0901 PENNSYLVANIA EXEMPTION CERTIFICATE This form cannot be used to obtain a Sales Tax Account ID PTA Account ID or Exempt Status. DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE. 4. EXEMPT ORGANIZATIONS made by an organization which is registered with the PA Department of Revenue as an exempt organization. These organizations are assigned an exemption number beginning with the two digits 75...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DoR REV-1220 AS

Edit your PA DoR REV-1220 AS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DoR REV-1220 AS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA DoR REV-1220 AS online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA DoR REV-1220 AS. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR REV-1220 AS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DoR REV-1220 AS

How to fill out PA DoR REV-1220 AS

01

Obtain the PA DoR REV-1220 AS form from the Pennsylvania Department of Revenue website or local office.

02

Begin filling out the top section with your name, address, and Social Security number.

03

In the designated area, indicate the type of tax or subject applicable to your request.

04

Clearly state the reason for your request in the 'Explanation' section.

05

Provide any necessary supporting documentation as required for your specific request.

06

Review all entries for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form through mail or online as per the instructions provided.

Who needs PA DoR REV-1220 AS?

01

Individuals filing for a tax extension or adjustment in Pennsylvania.

02

Businesses seeking to request a change or clarification regarding their tax status.

03

Tax professionals assisting clients with their tax filings in Pennsylvania.

Fill

form

: Try Risk Free

What is form pa rev 1220?

When should I use a REV-1220 PA Exemption Certificate? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.

People Also Ask about

How long is a Texas exemption certificate good for?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

How do I get a PA sales tax exemption certificate?

You may register for a Sales Tax License online at .pa100.state.pa.us or you can order a Combines Enterprise Registration Application from our forms ordering service by dialing toll-free, 24 hours a day, 1-800-362-2050.

Who is exemption from hotel occupancy tax in Pennsylvania?

Hotel Occupancy Tax – Guidance for U.S. Government Employees Traveling on Government Business. If an employee of the United States government is staying in a Pennsylvania hotel on official government business, the room is generally exempt from Pennsylvania hotel occupancy taxes if the room is paid for by the government

Does PA Rev 1220 expire?

The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies.

How do I fill out a Pennsylvania exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What is PA Rev 1220?

1. Revised 9/8/2022. Purpose: Use this guide to properly completing the PA Exemption Certificate (REV-1220). NOTE: This. form may be used in conjunction with your sales tax/wholesaler license to claim exemptions from sales tax for the purpose of resale.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA DoR REV-1220 AS without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including PA DoR REV-1220 AS, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete PA DoR REV-1220 AS online?

pdfFiller has made it easy to fill out and sign PA DoR REV-1220 AS. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit PA DoR REV-1220 AS on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign PA DoR REV-1220 AS on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is PA DoR REV-1220 AS?

PA DoR REV-1220 AS is a tax form used in Pennsylvania for reporting specific tax information related to businesses. It is primarily used for the annual financial reporting to the Pennsylvania Department of Revenue.

Who is required to file PA DoR REV-1220 AS?

Businesses operating within Pennsylvania that meet certain income thresholds or have specific tax obligations are required to file the PA DoR REV-1220 AS form.

How to fill out PA DoR REV-1220 AS?

To fill out PA DoR REV-1220 AS, gather the necessary financial data from the business's accounting records, then complete the form by entering the required figures in the designated fields, ensuring to follow the provided instructions for accurate reporting.

What is the purpose of PA DoR REV-1220 AS?

The purpose of PA DoR REV-1220 AS is to ensure that businesses report their financial activity accurately for state tax assessments, and to assist the Pennsylvania Department of Revenue in evaluating tax obligations.

What information must be reported on PA DoR REV-1220 AS?

PA DoR REV-1220 AS requires the reporting of business income, deductions, credits, and any other relevant financial information that reflects the business's tax liability for the year.

Fill out your PA DoR REV-1220 AS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR REV-1220 AS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.