Get the free (3) The RSUs vest as to 1/8 of the RSUs on June 15, 2017 and 1/8 of the RSUs will ve...

Show details

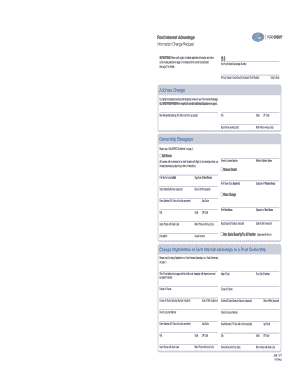

UMBRELLA INC Reported by WANG FENGMINGFORM 4(Statement of Changes in Beneficial Ownership)Filed 06/20/17 for the Period Ending 06/16/17Address Telephone CIK Symbol SIC Code Industry Sector3101 JAY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3 form rsus vest

Edit your 3 form rsus vest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3 form rsus vest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 3 form rsus vest online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 3 form rsus vest. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3 form rsus vest

How to fill out 3 form rsus vest

01

Step 1: Begin by gathering all the necessary information and documents. This includes the details of your RSUs (Restricted Stock Units) such as grant date, vesting schedule, and number of units.

02

Step 2: Understand the IRS Form 8949 and Schedule D, which are used for reporting capital gains and losses from stock transactions. Familiarize yourself with these forms and their instructions.

03

Step 3: Determine your tax filing status and the reporting method you will be using. This will depend on whether you are filing as an individual or a business entity.

04

Step 4: Report the RSU vesting on Form 1099-B. This form is provided by your brokerage firm and includes the details of the RSU vesting, such as the date of vesting and the fair market value of the shares at the time of vesting.

05

Step 5: Calculate the cost basis of the vested RSUs. This is usually the fair market value of the shares at the time of vesting.

06

Step 6: Complete Form 8949 by entering the relevant details of the RSU vesting, such as the date of acquisition, date of sale, cost basis, and proceeds. Repeat this step for each RSU vesting transaction.

07

Step 7: Transfer the information from Form 8949 to Schedule D. Calculate the total capital gains or losses from all your RSU vesting transactions and enter the result on Schedule D.

08

Step 8: Include Schedule D along with your tax return when filing with the IRS. Make sure to double-check all the information and attach any required supporting documentation.

09

Step 9: Keep a copy of all the forms and documentation for your records. It is recommended to maintain these records for at least three years in case of any future audits or inquiries.

Who needs 3 form rsus vest?

01

Employees who receive RSUs (Restricted Stock Units) as part of their compensation package need to complete Form 3 when their RSUs vest.

02

Form 3 is required by the Internal Revenue Service (IRS) to report the taxable income resulting from the vesting of RSUs.

03

Individuals who have vested RSUs and need to report the capital gains or losses from the subsequent sale of the shares acquired through the vesting process also need to fill out Form 3.

04

Form 3 is an essential requirement for employees who want to comply with the tax regulations and accurately report their income from RSU vesting.

05

It is important to consult with a tax advisor or accountant to ensure the proper completion and filing of Form 3, as the tax implications of RSU vesting can be complex.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 3 form rsus vest from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 3 form rsus vest, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send 3 form rsus vest to be eSigned by others?

3 form rsus vest is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out 3 form rsus vest on an Android device?

On an Android device, use the pdfFiller mobile app to finish your 3 form rsus vest. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is 3 form rsus vest?

3 form RSUs vest refers to the process by which restricted stock units (RSUs) granted to an individual employee fully mature and become available for the employee to sell or transfer.

Who is required to file 3 form rsus vest?

Employees who have been granted RSUs and have reached the vesting period are required to file 3 form RSUs vest.

How to fill out 3 form rsus vest?

To fill out 3 form RSUs vest, employees must provide information about the RSUs granted, vesting period, and any income or taxes related to the vested RSUs.

What is the purpose of 3 form rsus vest?

The purpose of 3 form RSUs vest is to report the maturity of RSUs granted to an employee and any related income or taxes.

What information must be reported on 3 form rsus vest?

On 3 form RSUs vest, employees must report details of the RSUs granted, vesting date, number of RSUs vested, and any income or taxes associated with the vesting.

Fill out your 3 form rsus vest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3 Form Rsus Vest is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.