HairstylistManicurist Deductions free printable template

Show details

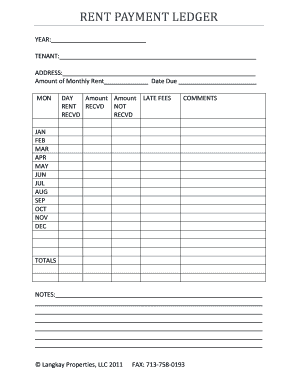

HAIRSTYLIST/MANICURIST DEDUCTIONS Client:ID×Tax Earth purpose of this worksheet is to help you organize your tax-deductible hairstylist/manicurist expenses. In order for an expense to be deductible,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign self employed hairdresser spreadsheet pdf form

Edit your hair stylist tax deduction checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hair stylist tax deduction worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employed hair stylist tax deduction worksheet online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit self employed hairdresser spreadsheet form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deductions for self employed hair stylist form

How to fill out Hairstylist/Manicurist Deductions

01

Gather all necessary financial documents related to your hairstylist or manicurist services, including receipts, invoices, and bank statements.

02

Identify all eligible deductions you can claim, such as the cost of hair products, nail products, tools, equipment, and any educational expenses related to continuing education.

03

Document your business expenses meticulously, noting each transaction and its purpose.

04

Calculate the total amount of deductions you are eligible for, ensuring they directly relate to your work as a hairstylist or manicurist.

05

Fill out the appropriate tax forms, ensuring that you include your deductions in the correct sections.

06

Double-check your work for accuracy and to ensure that you've included all relevant deductions.

Who needs Hairstylist/Manicurist Deductions?

01

Licensed hairstylists and manicurists operating as self-employed individuals or independent contractors.

02

Individuals looking to claim business expenses related to their hairstyling or nail services.

03

Self-employed beauty professionals who want to minimize their taxable income through legitimate deductions.

Fill

hair stylist expense sheet

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax write offs for hair stylists?

With pdfFiller, the editing process is straightforward. Open your hairstylist write offs in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit hairstylist tax write offs in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing hair stylist tax write offs and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the printable self employed tax deductions worksheet electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your hair salon expenses list and you'll be done in minutes.

What is Hairstylist/Manicurist Deductions?

Hairstylist/Manicurist Deductions are specific tax deductions available to hairstylists and manicurists for business-related expenses incurred in the course of their work. These may include costs for tools, products, and other necessities.

Who is required to file Hairstylist/Manicurist Deductions?

Individuals who work as hairstylists or manicurists and have incurred out-of-pocket expenses related to their profession are required to file Hairstylist/Manicurist Deductions when they prepare their tax returns.

How to fill out Hairstylist/Manicurist Deductions?

To fill out Hairstylist/Manicurist Deductions, gather all relevant receipts and documentation of expenses, complete the appropriate tax forms (such as Schedule C for self-employed individuals), and list all deductible expenses in the designated areas.

What is the purpose of Hairstylist/Manicurist Deductions?

The purpose of Hairstylist/Manicurist Deductions is to allow professionals in the beauty industry to recover some of their business-related costs, thereby reducing their overall taxable income and tax liability.

What information must be reported on Hairstylist/Manicurist Deductions?

Information that must be reported on Hairstylist/Manicurist Deductions includes the total amount of deductible expenses, a detailed list of specific expenses (like supplies, tools, and education), and any income generated from their hairstyling or manicuring services.

Fill out your HairstylistManicurist Deductions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Itemized Deductions Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to how to file taxes for hairstylist

Related to printable tax deduction cheat sheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.