Bad Debt Write-off Worksheet free printable template

Show details

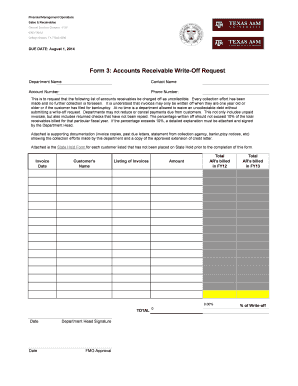

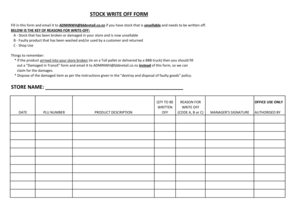

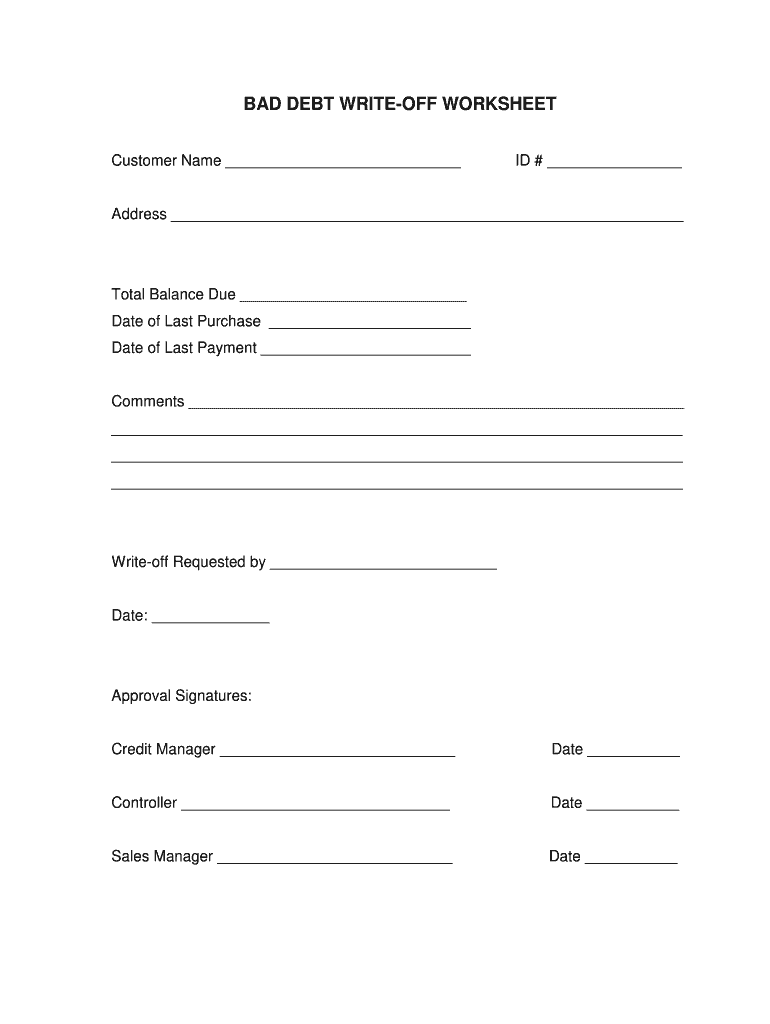

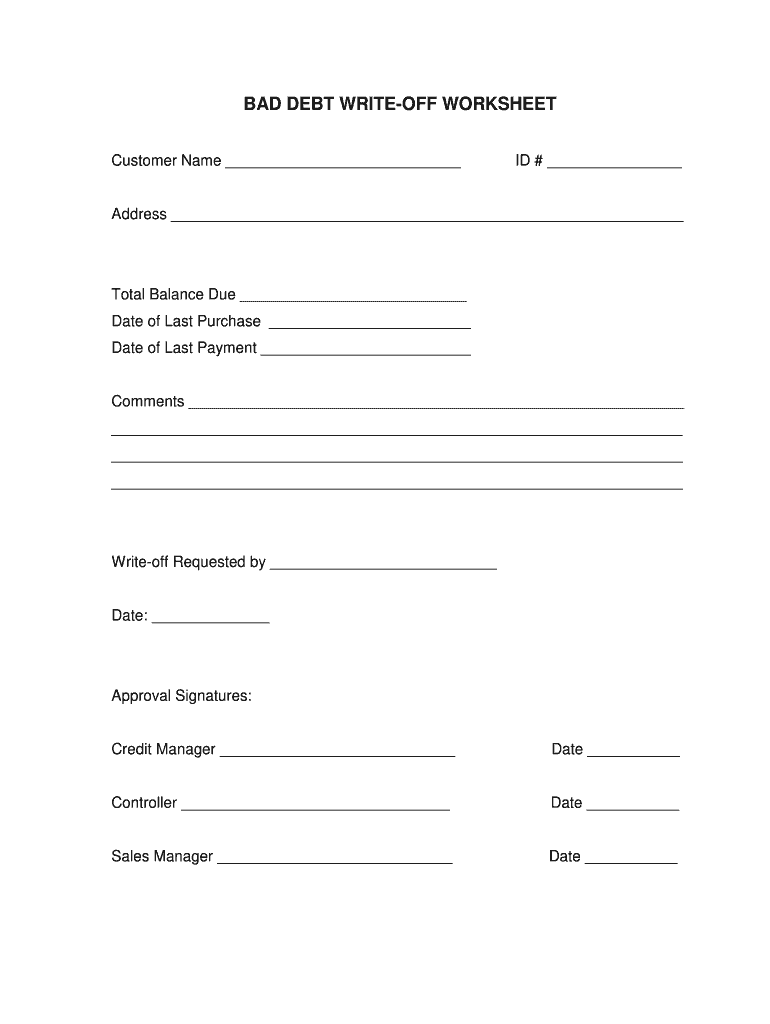

BAD DEBT WRITE-OFF WORKSHEET Customer Name ID # Address Total Balance Due Date of Last Purchase Date of Last Payment Comments Write off Requested by Date: Approval Signatures: Credit Manager Date

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bad debt write off worksheet pdffiller form

Edit your debt write off worksheet printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bad debt write off worksheet template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bad debt write off worksheet online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit debt write off worksheet form printable. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt write off worksheet form template

How to fill out Bad Debt Write-off Worksheet

01

Gather all necessary financial documents and records related to the debts.

02

Open the Bad Debt Write-off Worksheet.

03

List each bad debt individually, including the name of the debtor.

04

Enter the amount owed for each bad debt.

05

Provide a brief explanation or reason for the write-off next to each entry.

06

Calculate the total amount of bad debts to be written off.

07

Review the worksheet for accuracy and completeness.

08

Save and submit the worksheet as per your organization’s guidelines.

Who needs Bad Debt Write-off Worksheet?

01

Businesses that have outstanding debts they believe will not be collected.

02

Accounting departments responsible for managing financial records.

03

Tax professionals preparing financial statements for write-offs.

04

Financial analysts assessing the company's bad debt levels.

Fill

debt write off worksheet create

: Try Risk Free

People Also Ask about bad debt write off worksheet form download

How do you account for bad debt write-off?

Direct Write Off Method The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. It may also be necessary to reverse any related sales tax that was charged on the original invoice, which requires a debit to the sales taxes payable account.

How do you account for debt write-off?

Direct Write Off Method The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. It may also be necessary to reverse any related sales tax that was charged on the original invoice, which requires a debit to the sales taxes payable account.

What can you write-off for bad debt?

Getting stuck in a bad debt situation can be taxing. However, it is important that you "write off" your bad debts. Writing off a bad debt simply means that you are acknowledging that a loss has occurred. This is in contrast with bad debt expense, which is a way of anticipating future losses.

Where do write-offs go on balance sheet?

In a balance sheet, write-offs include a credit to the associated asset account and a debit to an expense account. Expenses will also be entered in the income statement after deducting from the revenues already reported.

How do you write-off bad debts on a balance sheet?

Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. When you decide to write off an account, debit allowance for doubtful accounts and credit the corresponding receivables account.

How do you calculate write-off amount?

How do you Calculate a Write Off Ratio ? A write-off ratio is calculated by dividing the total amount of write-offs by the total amount of loans.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit accounts receivable write off form template straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing bad write off worksheet form edit right away.

How do I fill out the bad write off worksheet edit form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign debt write off worksheet sample and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit bad write off worksheet sample on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as bad write off worksheet form fill. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Bad Debt Write-off Worksheet?

The Bad Debt Write-off Worksheet is a document used by businesses to formally record and process debts that are considered uncollectible, allowing them to remove these amounts from their accounts receivable and reflect their true financial position.

Who is required to file Bad Debt Write-off Worksheet?

Businesses and organizations that have outstanding debts which they deem uncollectible are required to file the Bad Debt Write-off Worksheet. This includes corporations, partnerships, and sole proprietors that need to report losses from bad debts for tax purposes.

How to fill out Bad Debt Write-off Worksheet?

To fill out the Bad Debt Write-off Worksheet, businesses need to gather documentation of the debts being written off, including customer names, amounts owed, dates of the debts, and reasons for the uncollectibility. Then, they should enter this information into the appropriate sections of the worksheet as specified by tax regulations.

What is the purpose of Bad Debt Write-off Worksheet?

The purpose of the Bad Debt Write-off Worksheet is to provide a structured format for businesses to identify, document, and deduct bad debts from their taxable income, ensuring accurate financial reporting and compliance with tax laws.

What information must be reported on Bad Debt Write-off Worksheet?

The Bad Debt Write-off Worksheet must typically report information such as the debtor's name, the amount of the debt, the date the debt became uncollectible, the reason for writing off the debt, and any relevant account numbers or identifiers.

Fill out your Bad Debt Write-off Worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bad Debt Write Off Worksheet Sample is not the form you're looking for?Search for another form here.

Keywords relevant to bad debt write off worksheet form blank

Related to write off sheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.