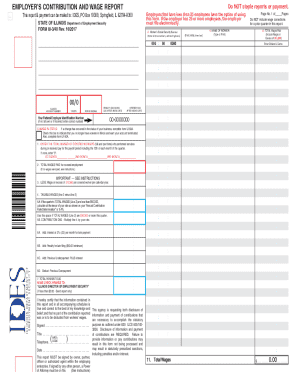

IL UI-3/40 2014 free printable template

Show details

UI 3/40 Employers Contribution and Wage Reporting submitting quarterly Contribution and Wage Reports: Log on to the Metal Illinois website at http://mytax.illinois.gov to establish your UI account,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL UI-340

Edit your IL UI-340 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL UI-340 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL UI-340 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL UI-340. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL UI-3/40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL UI-340

How to fill out IL UI-3/40

01

Obtain the IL UI-3/40 form from the Illinois Department of Employment Security website or your local IDES office.

02

Fill out your personal information, including your name, address, Social Security number, and contact information.

03

Provide details about your employment history, including the names of employers, dates of employment, and reasons for separation.

04

Complete any additional sections as required, such as information regarding your availability for work.

05

Review the completed form for accuracy and ensure all required fields are filled out.

06

Sign and date the form at the end to certify that the information provided is true and correct.

07

Submit the form according to the instructions: either online, by mail, or in person at an IDES office.

Who needs IL UI-3/40?

01

Individuals who are applying for unemployment benefits in Illinois.

02

Those who need to report their employment history when claiming unemployment insurance.

03

Job seekers looking to provide verification of their job search efforts.

04

Workers who have been recently laid off and need to file for unemployment compensation.

Fill

form

: Try Risk Free

People Also Ask about

What reasons can you be denied unemployment in Illinois?

For What Reasons Can You Be Denied Unemployment? Failing to Meet the Earnings Requirements. Quitting Your Last Job. Getting Fired for Misconduct.

What disqualifies you from unemployment in Illinois?

There are several ways you can be disqualified from receiving unemployment benefits in Illinois: You quit your job without good cause. You were fired due to misconduct connected to your work. You did not have a good reason to apply for Illinois unemployment or did not accept a suitable job offered to you.

What is a UI 3 40 form Illinois?

Filing Reports - The Employer's Contribution and Wage Report, IDES Form UI-3/40, must be filed quarterly by each employer subject to the Illinois Unemployment Insurance Act.

How do I file a wage claim in Illinois?

You can visit any of the offices for the Department of Labor and submit a complaint in person. Depending upon the type of complaint, you may need to provide certain documents such as W-2, pay stubs, and/or any other supporting documents verifying the complaint.

What is a ui340?

Employers must file wage reports (Form UI-3/40) and pay contributions in the month after the close of each calendar quarter - that is, on or before April 30, July 31, October 31, and January 31.

What is Section 601 of the Illinois Unemployment Act?

Under Section 601 of the Illinois Unemployment Insurance Act, an individual who quits his/her job without good cause attributable to his/her employer is ineligible for unemployment benefits.

What is the UI rate for 2023 in Illinois?

This rate is provided for in the Illinois Unemployment Insurance Act and is included in the rate calculation to aid in the maintenance of a solvent Unemployment Insurance Trust Fund. The minimum contribution rate for 2023 is 0.850% (0.2% x 127% plus the 0.55% Fund Building Rate).

How do I file a monthly wage report in Illinois?

Using MyTax Illinois monthly wage filing must be done via MyTax Illinois, the Department's online tax filing and wage reporting application. Employers that are already registered on MyTax Illinois can file using their existing MyTax Illinois account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IL UI-340 to be eSigned by others?

Once your IL UI-340 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find IL UI-340?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the IL UI-340 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the IL UI-340 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IL UI-340 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IL UI-3/40?

IL UI-3/40 is a form used by employers in Illinois to report their unemployment insurance contributions and claims.

Who is required to file IL UI-3/40?

Employers who have employees in Illinois and are subject to the Illinois Unemployment Insurance Act are required to file IL UI-3/40.

How to fill out IL UI-3/40?

To fill out IL UI-3/40, employers must provide their business information, employee wages, and any claims for unemployment benefits during the reporting period.

What is the purpose of IL UI-3/40?

The purpose of IL UI-3/40 is to enable the Illinois Department of Employment Security to monitor and collect unemployment insurance contributions and to process claims.

What information must be reported on IL UI-3/40?

The information that must be reported on IL UI-3/40 includes the employer's identification details, employee wages, any unemployment claims made, and the contributions owed for the reporting period.

Fill out your IL UI-340 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL UI-340 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.