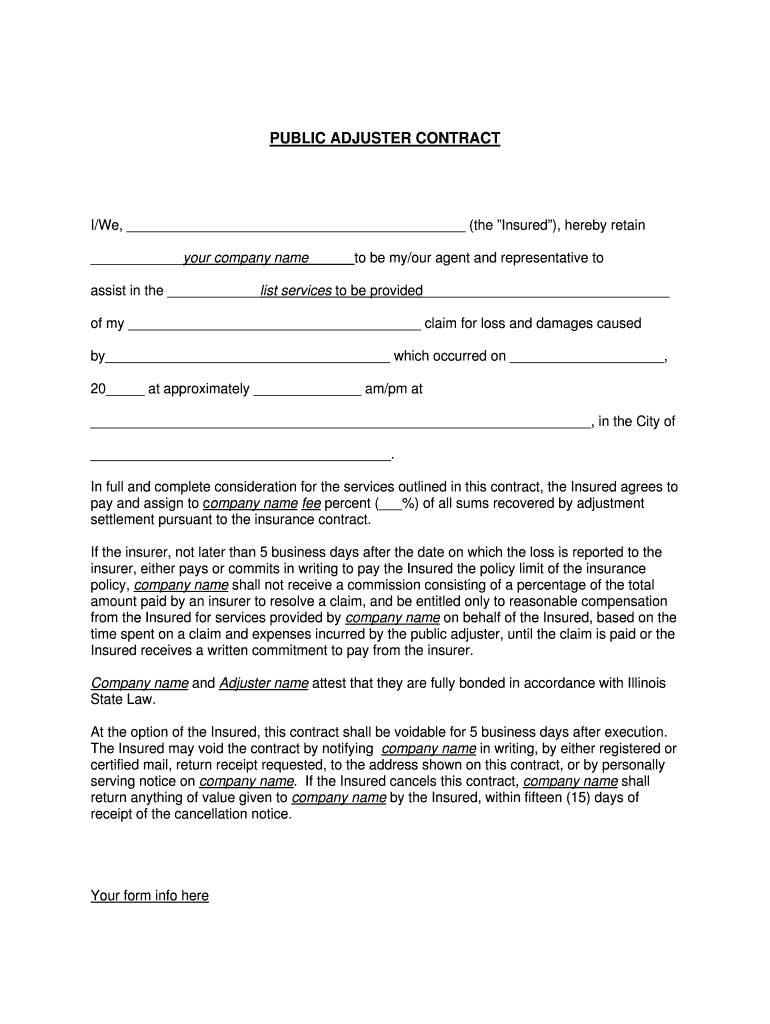

Get the free contract insurance

Get, Create, Make and Sign insurance agreement form

How to edit insurance agreement template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance contract template form

How to fill out insurance contract example:

Who needs insurance contract example?

Video instructions and help with filling out and completing contract insurance

Instructions and Help about agreement insurance

Music you have now learned legal concepts of the insurance contract let's review some key areas from this section that will help you prepare to pass insurance contract insurance policies are legal contracts contract law defines contract as a legally binding agreement between two or more parties where promise of benefits is exchanged for consideration in order for an insurance contract to be legally binding it must have four essential elements offer an acceptance consideration legal purpose and competent parties offer and acceptance an offer is made when the applicant submits an application for insurance to the insurance company the offer is accepted after has been approved by the insurance company'underwriters consideration is something of value that each party gives to the other the consideration on the part of the insureds the payment of premium the consideration on the part of the insurance company is a promise to pay in the event of loss legal purpose an insurance contract must be legal and not against public policy if an insurance contract has an insurable interest and the insured has provided written consent it has legal purpose competent parties all parties must be of legal competence meaning they must be a legal age mentally capable of understanding the terms and not under the influence of drugs or alcohol to review a legal contract must have offered and acceptance considerations competent parties and legal purpose special features of insurance contracts a Lahore insurance contracts are a Lahore which means that there is not an equal exchange of value the premiums paid by the insured are small in relation to the amount that will be paid by the insurance company in the event of a loss for example if you purchase a life insurance policy worth×100,000and your payments for $50 per month you die three months later you have only paid the insurance company $150, but they will give your beneficiary 100,000adhesion adhesion is also known as take it or leave it agreements because they're prepared by only one party the insurance company they are accepted or rejected by the other party the applicant with no negotiations or changes unilateral a unilateral contract a one-sided agreement in which only one party the insurance company illegally bound to do anything the policy owner is under no legally binding promise to pay premiums however the insurance company is legally bound today losses covered by the policy please note if the policy owner does not pay their premiums the insurance company does have the right to terminate the insurance policy personal contract insurance contracts are personal contracts between an individual and the insurance company and cannot transfer ownership without the insurancecompany'’s written consenconditional insurance contracts are conditional because certain conditions must be met by all parties when a loss occurs otherwise the contract would not be legally enforceable meaning that if the policy owner is past due on...

People Also Ask about sample insurance contract

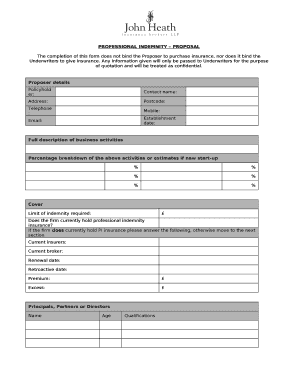

What are the basic parts of an insurance contract?

What is considered a simple contract?

What is the written document of a contract for insurance?

What are examples of insurance contracts?

What is an example of a simple contract?

What is an example of a simple contract between two people?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit insurance contract pdf online?

How do I fill out life insurance contract sample using my mobile device?

How do I fill out example of insurance contract on an Android device?

What is insurance contract example?

Who is required to file insurance contract example?

How to fill out insurance contract example?

What is the purpose of insurance contract example?

What information must be reported on insurance contract example?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.