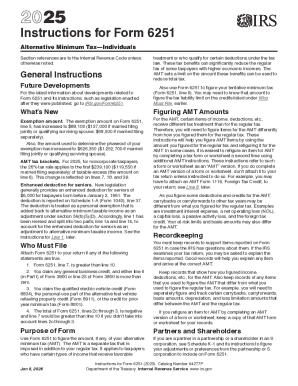

IRS Instruction 6251 2016 free printable template

Show details

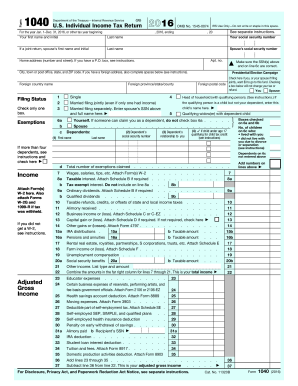

Ash enters a total negative adjustment of 118 000 on line 17 of his 2016 Form 6251 figured as follows Ash figures a negative adjustment of 65 000 for the difference between the 65 000 of regular tax ordinary income and the 0 of AMT ordinary income for the first sale. AMT Form 1116 only. Attach to your tax return after Form 6251 all AMT Forms 1116 you used to figure your AMTFTC. But don t attach AMT Forms 1116 if your AMTFTC is the same as your regular tax foreign tax credit. AMTFTC Carryback...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction 6251

Edit your IRS Instruction 6251 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction 6251 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instruction 6251 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instruction 6251. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 6251 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instruction 6251

How to fill out IRS Instruction 6251

01

Obtain IRS Form 6251 and its instructions from the IRS website.

02

Read the introduction to understand the purpose of Form 6251, which is to calculate the Alternative Minimum Tax (AMT).

03

Gather necessary financial documents, including your income, deductions, and credits.

04

Begin filling out the form by completing Part I, which outlines your taxable income and the adjustments needed to determine AMT.

05

Continue to Part II to calculate AMT using the Alternative Minimum Tax Income.

06

Complete Part III if you have a carryover of certain credits.

07

Double-check all entries for accuracy and ensure you've followed any specific instructions related to your situation.

08

Sign and date the form, and attach it to your federal income tax return before filing.

Who needs IRS Instruction 6251?

01

Individuals who have a large number of deductions or credits that significantly reduce their taxable income.

02

Taxpayers who have income above the AMT exemption level.

03

People involved in activities producing tax preference items, like certain business investments or large capital gains.

04

Individuals subject to AMT-related adjustments or requiring credits from previous years.

Fill

form

: Try Risk Free

People Also Ask about

What is my annual taxable income?

It's all your income from all sources before allowable deductions are made. This includes both earned income from wages, salary, tips, and self-employment and unearned income, such as dividends and interest earned on investments, royalties, and gambling winnings.

How do I calculate my taxable income?

Your gross income minus all available deductions is your taxable income. Compare that amount to your tax bracket to estimate the amount you'll owe before applying any available tax credits.

What is the salary bracket for tax in South Africa?

In South Africa, you are liable to pay income tax if you earn more than: R91 250 and you are younger than 65 years. If you are 65 to below 75 years old, the tax threshold (i.e. the amount above which income tax becomes payable) is R141 250. For taxpayers aged 75 years and older, this threshold is R157 900.

What is the tax rate for income 2022?

There are seven tax brackets for most ordinary income for the 2022 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.”

What is the tax bracket for 2022 in South Africa?

2022 tax year (1 March 2021 – 28 February 2022) Taxable income (R)Rates of tax (R)1 – 216 20018% of taxable income216 201 – 337 80038 916 + 26% of taxable income above 216 200337 801 – 467 50070 532 + 31% of taxable income above 337 800467 501 – 613 600110 739 + 36% of taxable income above 467 5003 more rows

What is tax rate for 2022 of South Africa?

2022 tax year (1 March 2021 – 28 February 2022) Taxable income (R)Rates of tax (R)1 – 216 20018% of taxable income216 201 – 337 80038 916 + 26% of taxable income above 216 200337 801 – 467 50070 532 + 31% of taxable income above 337 800467 501 – 613 600110 739 + 36% of taxable income above 467 5003 more rows

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)12%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,10032%$170,051 to $215,950$340,101 to $431,9003 more rows • Dec 5, 2022

What are NZ tax brackets 2022?

There are five PAYE tax brackets for the 2021-2022 tax year: 10.50%, 17.50%, 30%, 33% and 39%. Your tax bracket depends on your total taxable income.

How do you use an income tax table?

How tax tables work. Step 1: Determine your filing status. Step 2: Calculate your taxable income. Step 3: Determine your income bracket. Step 4: Identify your tax filing status. Step 5: Find the amount of tax you owe.

How do I find my tax table?

You can find the latest tax table which you'll use in 2023 to file 2022 taxes on the IRS' website, specifically its publication named Tax Year 2022—1040 and 1040-SR Tax and Earned Income Credit Tables.

What is the income tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)10%Up to $10,275Up to $20,55012%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,1003 more rows • Dec 5, 2022

How is taxable income calculated in Australia?

All you have to do is figure out your taxable income, which you can calculate by subtracting any allowable deductions from your assessable income. The amount that remains is your taxable income.

What is a tax table and how does it work?

A tax table is a chart that displays the amount of tax due based on income received. The IRS provides tax tables to help taxpayers determine how much tax they owe and how to calculate it when they file their annual tax returns. Tax tables are divided by income ranges and filing status.

What is income tax table?

Tax tables are a tool the IRS provides to make it easy to calculate the exact amount of taxes to report on your federal income tax return when filing by hand. States with state income tax returns also provide tax tables to aid in this portion of the tax preparation process.

What tax bracket will I be in 2022?

2022 federal income tax brackets Tax rateTaxable income bracketTaxes owed10%$0 to $10,275.10% of taxable income.12%$10,276 to $41,775.$1,027.50 plus 12% of the amount over $10,275.22%$41,776 to $89,075.$4,807.50 plus 22% of the amount over $41,775.24%$89,076 to $170,050.$15,213.50 plus 24% of the amount over $89,075.3 more rows • Oct 20, 2022

What are the income tax brackets for 2022 vs 2021?

The 2022 tax rates themselves are the same as the rates in effect for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

What are examples of taxable income?

In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options. You should receive a Form W-2, Wage and Tax Statement, from your employer showing the pay you received for your services.

What is the average tax rate in the US 2022?

For the tax year 2022, the federal income tax brackets range from 10% to 37%. The top 50% of taxpayers paid 97.1% of all federal income taxes in 2018. Among those taxpayers, the average income tax rate was 14.6% and the average tax paid was $20,663.

What is the tax threshold for 2022 in South Africa?

Who is it for? R91 250 if you are younger than 65 years. If you are 65 years of age to below 75 years, the tax threshold (i.e. the amount above which income tax becomes payable) is R141 250. For taxpayers aged 75 years and older, this threshold is R157 900.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instruction 6251 to be eSigned by others?

To distribute your IRS Instruction 6251, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute IRS Instruction 6251 online?

pdfFiller has made it simple to fill out and eSign IRS Instruction 6251. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I fill out IRS Instruction 6251 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IRS Instruction 6251. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IRS Instruction 6251?

IRS Instruction 6251 provides guidance on how to calculate the Alternative Minimum Tax (AMT) for individuals, helping taxpayers determine if they owe AMT.

Who is required to file IRS Instruction 6251?

Taxpayers who have certain tax preferences, significant deductions, or credits that could trigger the Alternative Minimum Tax are required to file IRS Instruction 6251.

How to fill out IRS Instruction 6251?

To fill out IRS Instruction 6251, taxpayers must gather their financial information, follow the form's structure to calculate their AMT taxable income, and compare it to the regular tax to determine any additional tax owed.

What is the purpose of IRS Instruction 6251?

The purpose of IRS Instruction 6251 is to ensure taxpayers pay a minimum level of tax by calculating the Alternative Minimum Tax, which limits the benefits of certain deductions and credits.

What information must be reported on IRS Instruction 6251?

Taxpayers must report income, adjustments, tax preference items, and any necessary deductions on IRS Instruction 6251 to accurately compute their Alternative Minimum Tax liability.

Fill out your IRS Instruction 6251 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction 6251 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.