Get the free sblc format

Show details

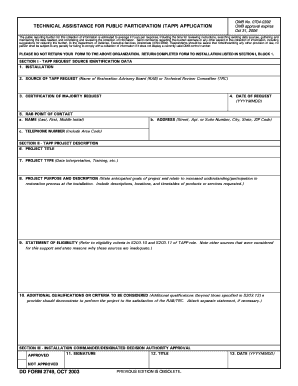

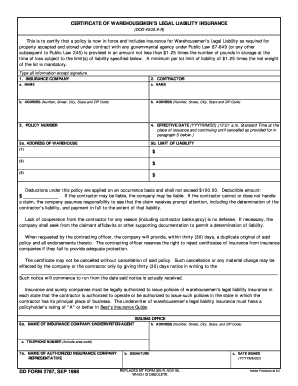

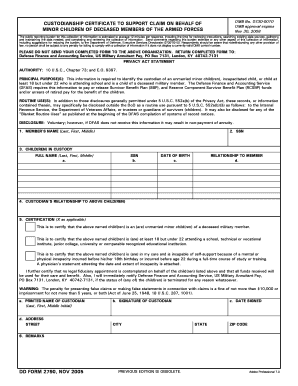

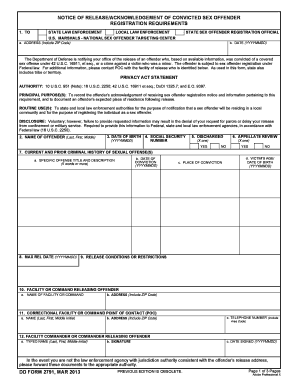

BACKDRAFT FINANCECOMMERCE INTERNATIONALINVESTISSEMENTMT760 ISSUE OF A STANDBY LETTER OF CREDIT. CREDIT NUMBER :SBLC/XXXIX. DATE OF ISSUE : XXXIX. DATE AND PLACE OF EXPIRY : XXXIX / XXXXXXXXXX. CREDIT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sblc template form

Edit your sample of standby letter of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sblc sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sblc form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sblc full form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sblc format pdf

Steps to fill out an sblc sample:

01

Gather all required information: Before starting to fill out the sblc sample, make sure you have all the necessary information at hand. This may include details such as the beneficiary's name, address, and contact information, as well as the applicant's details, desired terms, and conditions.

02

Review the sblc sample thoroughly: Take the time to carefully read through the sblc sample, understanding each section and requirement. This will ensure that you properly fill out the necessary fields and provide accurate information.

03

Start with the applicant's information: Begin by entering the applicant's name, address, contact details, and any other relevant information as requested in the sblc sample. It is crucial to double-check for errors and ensure all information is accurate and up-to-date.

04

Proceed with the beneficiary's details: Next, fill in the beneficiary's name, address, and contact information. Make sure to verify the accuracy of these details as any mistakes could cause delays or complications.

05

Provide desired terms and conditions: Depending on the specific requirements of the sblc sample, you may be asked to enter the desired terms and conditions of the standby letter of credit. This may include the expiry date, payment details, and any additional provisions that need to be mentioned.

06

Attach necessary documents: Some sblc samples may require additional documentation to be attached, such as financial statements, bank guarantee forms, or proof of collateral. Ensure that you have these documents ready and submit them as instructed.

07

Review and proofread: Before submitting the filled-out sblc sample, it is essential to review all the entered information thoroughly. Check for any spelling errors, inaccuracies, or missing details. It is crucial to provide a complete and error-free application to avoid any complications or delays.

08

Sign and submit the sblc sample: Once you are satisfied with the accuracy of the filled-out sblc sample, sign it as required and submit it to the relevant party or institution, as per their instructions.

Who needs sblc sample?

01

Importers and exporters: Companies involved in international trade often require an sblc sample. It serves as a form of financial guarantee to ensure payment to the beneficiary in case the importer fails to fulfill their obligations.

02

Contractors and suppliers: Contractors or suppliers bidding for projects or supplying goods to government agencies or large corporations might need an sblc sample to provide assurance of their financial capability.

03

Financial institutions: Banks and financial institutions may require an sblc sample when providing financing or credit facilities to their clients. The sblc sample acts as collateral and mitigates the risk for the lending institution.

Fill

form

: Try Risk Free

People Also Ask about

How do I create a SBLC?

The process generally involves the following steps: The buyer applies to their bank for SBLC in favor of the seller. The issuing bank conducts due diligence on the buyer's creditworthiness and financial standing. If the issuing bank is satisfied with the buyer's application, it issues the SBLC to the seller's bank.

What is the minimum amount for SBLC?

Current § 120.471, paragraph (a)(1) addresses minimum capital requirements for SBLCs and states that beginning on January 4, 2024, each SBLC that makes or acquires a 7(a) loan must maintain, at a minimum, unencumbered paid-in capital and paid-in surplus of at least $5,000,000, or 10 percent of the aggregate of its

What is SBLC MT 760?

What is MT760 standby letter of credit? A Standby Letter of Credit (SBLC) is a payment guarantee that is issued by a bank or financial institution by a SWIFT MT760 message, and is used as payment for a client in the case that the applicant defaults.

What is SBLC format?

A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment.

How do I set up a SBLC?

The process generally involves the following steps: The buyer applies to their bank for SBLC in favor of the seller. The issuing bank conducts due diligence on the buyer's creditworthiness and financial standing. If the issuing bank is satisfied with the buyer's application, it issues the SBLC to the seller's bank.

What is the SBLC amount?

Once the buyer fulfills all the conditions and the bank deems them fit for receiving the credit, the bank issues them an SBLC and charges 1% to 10% of the total amount as an annual fee for as long as the standby letter of credit is valid.

What are the requirements for SBLC?

with §§ 120.400 through 120.413, an SBLC must meet the following requirements: (1) Business structure. . It must be a corporation (profit or non- profit). (2) Written agreement. It must sign a written agreement with SBA. (3) Capital structure. . It must have unencumbered paid-in capital and paid-in surplus of.

What is an example of a SBLC?

An SBLC helps ensure that the buyer will receive the goods or service that's outlined in the document. For example, if a contract calls for the construction of a building and the builder fails to deliver, the client presents the SLOC to the bank to be made whole.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sblc format on an iOS device?

You certainly can. You can quickly edit, distribute, and sign sblc format on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit sblc format on an Android device?

You can make any changes to PDF files, such as sblc format, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete sblc format on an Android device?

Complete your sblc format and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is sblc template?

An SBLC template is a standardized form used to request a Standby Letter of Credit, which provides a guarantee of payment from a bank if the applicant defaults on a transaction.

Who is required to file sblc template?

Typically, businesses or individuals who need assurance of payment in a contractual agreement are required to file the SBLC template with their bank.

How to fill out sblc template?

To fill out an SBLC template, you need to provide details about the applicant, the beneficiary, the terms of the credit, and other necessary information as required by the issuing bank.

What is the purpose of sblc template?

The purpose of the SBLC template is to facilitate the issuance of a standby letter of credit, which serves as a safety net for beneficiaries if the applying party fails to fulfill their contractual obligations.

What information must be reported on sblc template?

The SBLC template must include information such as the names of the applicant and beneficiary, the amount of credit, the duration, the purpose of the credit, and the conditions under which it may be drawn.

Fill out your sblc format online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sblc Format is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.