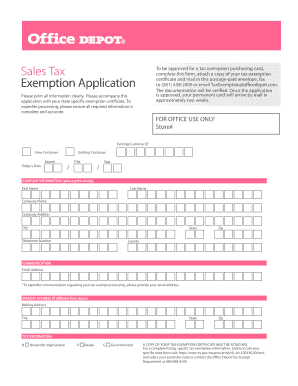

Get the free home depot tax exempt

Show details

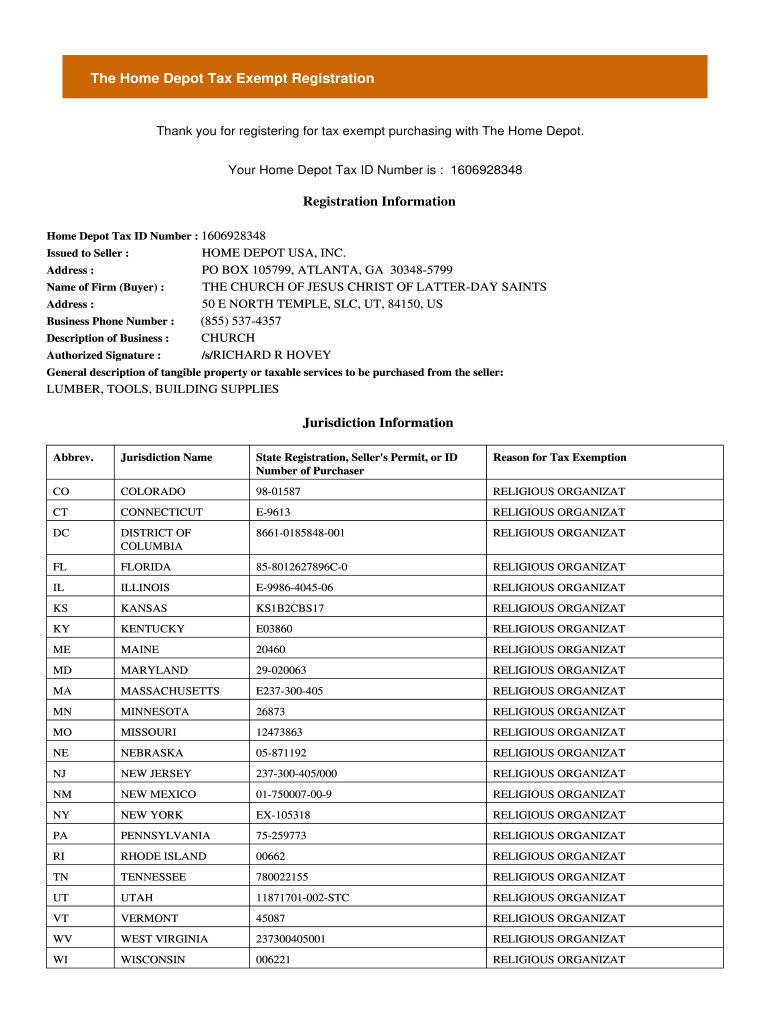

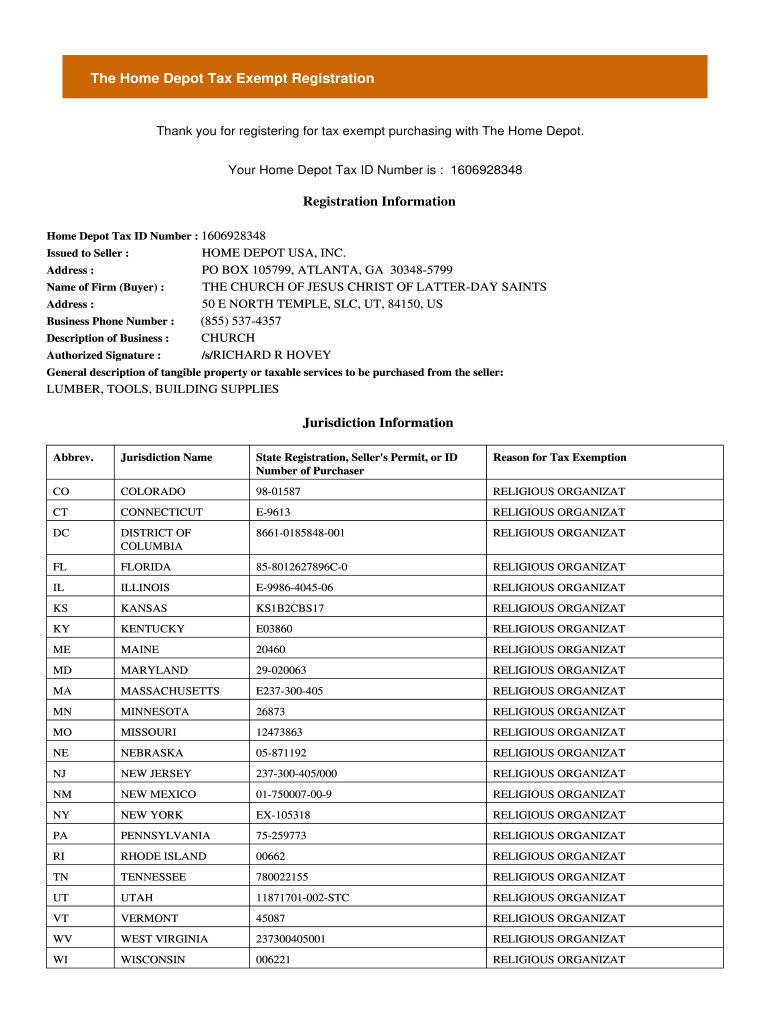

The Home Depot Tax Exempt Registration Thank you for registering for tax exempt purchasing with The Home Depot. Your Home Depot Tax ID Number is 1606928348 Registration Information Home Depot Tax ID Number 1606928348 Issued to Seller Address Name of Firm Buyer Business Phone Number Description of Business Authorized Signature HOME DEPOT USA INC. 1606928348 Please present this card to the cashier each time you make a tax exempt purchase If you have any questions about Home Depot Tax Exemption...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home depot tax exempt id california form

Edit your home depot tax id number form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxhelp homedepot com form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home depot resale certificate online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit home depot tax exempt id new york form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home depot tax exempt id lookup form

How to fill out home depot tax exempt:

01

Visit the official website of Home Depot.

02

Look for the "Tax Exempt" section or search for "Tax Exempt Form."

03

Download the tax exempt form provided by Home Depot.

04

Fill in the required information, such as your name, organization name, and tax identification number.

05

Provide any additional documentation that may be required, such as your tax-exempt certificate.

06

Make sure to double-check all the information entered on the form for accuracy.

07

Submit the completed tax exempt form to Home Depot as per their instructions.

Who needs home depot tax exempt:

01

Non-profit organizations that are exempt from paying sales tax.

02

Government entities and agencies.

03

Educational institutions and schools.

04

Qualifying religious organizations.

05

Some resellers and wholesalers who are exempt from sales tax on certain purchases.

Video instructions and help with filling out and completing home depot tax exempt

Instructions and Help about home depot tax exempt id number

Fill

home depot tax exempt application form

: Try Risk Free

People Also Ask about tax exempt home depot

How do I become tax exempt in California?

There are 2 ways to get tax-exempt status in California: Exemption Application (Form 3500) Download the form. Determine your exemption type , complete, print, and mail your application. Submission of Exemption Request (Form 3500A) If you have a federal determination letter:

How to not pay taxes at Home Depot?

How Does It Work? Use your Federal Government Purchase Card at checkout. No need to register. Use your Home Depot tax exempt ID at checkout. Establish your tax exempt status. If you qualify as a tax exempt shopper and already have state or federal tax IDs, register online for a Home Depot tax exempt ID number.

How do I set up a tax exempt account with Home Depot?

On the “Account Profile” page, scroll down to “Company Details”. Enter your Home Depot Tax Exempt ID number in the “Home Depot Provided Tax Exempt ID” field. Select “Save.” Your tax exempt ID will be automatically applied to online purchases.

What is Home Depot's Ein?

Tax ID 58-1853319 4. CAGE Code 1MX07 5. Geographic coverage All U.S. Home Depot Stores. 7.

How do I add a tax ID to Home Depot?

On the “Account Profile” page, scroll down to “Company Details”. Enter your Home Depot Tax Exempt ID number in the “Home Depot Provided Tax Exempt ID” field. Select “Save.” Your tax exempt ID will be automatically applied to online purchases.

How do I file for tax exemption in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my home depot tax exempt not working directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your home depot tax exempt id along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I fill out the home depot tax exempt form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign home depot tax exempt and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit home depot tax exempt on an Android device?

The pdfFiller app for Android allows you to edit PDF files like home depot tax exempt. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is home depot tax exempt?

Home Depot tax exempt refers to a program that allows qualifying customers, such as government agencies and nonprofit organizations, to purchase items without paying sales tax.

Who is required to file home depot tax exempt?

Typically, government entities, educational institutions, and nonprofit organizations that qualify for tax exemption must file for Home Depot's tax exempt program.

How to fill out home depot tax exempt?

To fill out Home Depot tax exempt, customers need to complete the relevant tax exemption form provided by Home Depot, ensuring they provide accurate information and documentation proving their tax-exempt status.

What is the purpose of home depot tax exempt?

The purpose of Home Depot tax exempt is to support eligible customers by allowing them to make purchases without incurring sales tax, thereby reducing overall costs on necessary supplies.

What information must be reported on home depot tax exempt?

Information that must be reported includes the customer's tax-exempt status, the reason for the exemption, and specific details such as tax identification numbers or exemption certificates.

Fill out your home depot tax exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Depot Tax Exempt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.