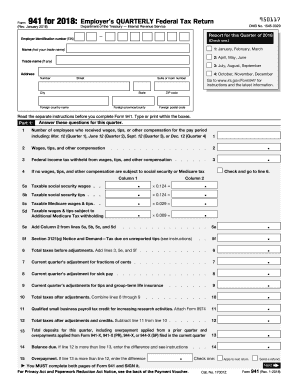

IRS Instructions 941 2017 free printable template

Get, Create, Make and Sign 941 instructions 2017 form

Editing 941 instructions 2017 form online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 941 Form Versions

How to fill out 941 instructions 2017 form

How to fill out IRS Instructions 941

Who needs IRS Instructions 941?

Instructions and Help about 941 instructions 2017 form

Hi welcome to easy payroll guide my name is Karen Hutchinson and in this video I'm going to be showing you how to complete the IRS 941 form this is the employers quarterly federal tax return this form is due at the end of each quarter so for example quarter one ends on March 31st this would be due by April 30th so April 30th July 31st October 31st and January 31st are the due date for the IRS 941 form this form is going to detail all the tax liabilities for that quarter this is how the IRS reconciles your w3 forms, so you want to make sure that the information on this form is correct what I'm going to do is I'm going to give you a scenario of a small business who had three employees, and I've taken the information from their paychecks, and I've put them into an Excel spreadsheet and this is something that you could do as well for your record-keeping in order to help you to complete or just to check the 941 form, so I have three employees, and I've included their gross pay for each employee and then in the last column I've totaled the gross pay so my total four gross pay is twenty-five thousand four hundred sixty-five dollars and twenty-seven cents I've also included in the spreadsheet the taxes that were withheld from each employee's paycheck now this is just the employee portion of the taxes, so I've included the federal withholding that I've included from each paycheck the employee Medicare portion the employer employee Social Security portion, and I've included the state withholding the state withholding we're not going to need to use or the 941, but I wanted to point that out this is only federal taxes that are going to go on the 941 form, so we are going to be using this portion not the state portion in the 941 form okay now this is the federal withholding so Medicare and Social Security for the entire quarter, so this is what my employees have been paid for all of January all of February and all of March now I'm sorry we're doing fourth-quarter so all of October all of November all of December, so it doesn't matter for three months these are the totals now along with withholding and paying taxes for your employee you also must pay an employer share of those taxes so when you major deposits you would have multiplied the Medicare portion by two and the Social Security portion by two because the employee is paying half, but you're paying half as well so as you can see here in blue the Medicare portion for the employee and the employer are the same and the same for Social Security, so these taxes were paid as well and will be noted on the 941 form so in this red box here I've kind of just summarized what we're going to be using for the nine forty-one we're going to need the total gross pay that you've paid all three employees for all three months of the quarter you will also need to know the withholding total and the total Medicare and Social Security pain it will not be broken out by employee and employer on the nine forty-one form, but you...

People Also Ask about

How to fill out form 941 Employer's Quarterly Federal Tax Return?

Can you file 941 quarterly federal tax return online?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 941 instructions 2017 form directly from Gmail?

Can I create an eSignature for the 941 instructions 2017 form in Gmail?

How do I fill out 941 instructions 2017 form using my mobile device?

What is IRS Instructions 941?

Who is required to file IRS Instructions 941?

How to fill out IRS Instructions 941?

What is the purpose of IRS Instructions 941?

What information must be reported on IRS Instructions 941?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.