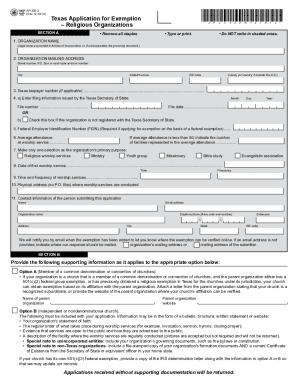

TX Comptroller AP-209 2017 free printable template

Get, Create, Make and Sign TX Comptroller AP-209

How to edit TX Comptroller AP-209 online

Uncompromising security for your PDF editing and eSignature needs

TX Comptroller AP-209 Form Versions

How to fill out TX Comptroller AP-209

How to fill out TX Comptroller AP-209

Who needs TX Comptroller AP-209?

Instructions and Help about TX Comptroller AP-209

TAXES. Nobody likes them. Everybody pays for them. IN#39’m sure when you thought about purchasing a home, you heard about theta savings you can get from that. Well now you own your own home, and you pay your own property taxes. You want to pay little as you have to because who wants to pay more? Well the good news is that you can reduce the property taxes that you pay by claiming a homestead exemption. Hi guys! IN#39’m Kyle Pfeiffer, REALTOR, and welcome boreal Estate. Real Answers. Here we provide you with honest answers to your real estate questions. Today I want to help you understand how you can save money and your property taxes by claiming homestead exemption. First, what ISA homestead exemption? Well, a homestead exemption removes a slice of your home#39;value from being taxed. A homestead is any structure, condominium or manufactured home on a piece of property that you own of less than 20 acres. To claim your homestead exemption, their#39;SA few criteria that you have to meet. First, you have to own your homeland have to use it as your primary residence as of January 1st in the year for which you are applying for your homestead exemption. Also, the address on your driver#39’s license or state issued Ideas to match the address of the property for which you#39;reclaiming your homestead exemption. Secondly, how much is your homestead exemption. Well, Texas law mandates that all school districts must provide a×25,000 exemption for property tax. So if your home is worth $100,000, that means that you#39’re only going to be taxed on $75,000 of that. Texas law also allows other taxing units to provide exemptions to you if they choose and that will be based on where you live. Travis County offers a 20% exemption on your property taxes and Williamson County offers a ×3000 exemption on a special tax for roads. It#39’s also important to know that with your homestead exemption, the county cannot raise the appraised value of your homely more than 10% each year even if the actual value is greater. With the current rate of appreciation we#39’ve seen over the past few years, a lot of homeowners are saving money on their property tax because of that provision. A third question what other exemptions are available? Well the most common other exemptions are a senior citizen exemption, a disabled exemption and an exemption for disabled veterans. For both a senior exemption and the disabled exemption, school districts are required to give a ×10,000 exemption for your property taxes, but you can only claim one of the other even if you qualify for both. When you turn 65, you may also qualify for a tax ceiling. That is, the school district may not increase your taxes as long as you live in that home. The veterans' exemption usable to disabled veterans and their surviving dependents. It entitles disabled vet an exemption equal to aservice-connected disability, up to 100×I put a list of all the exemptions available to you in Texas in the link below. Another...

People Also Ask about

What does it mean when you put exempt on your tax form?

What is the difference between a w9 and tax exemption certificate?

Is it better to claim 0 or exempt?

How do I become tax exempt in Texas?

What does IRS tax-exempt mean?

Is 0 the same as exempt?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete TX Comptroller AP-209 online?

How do I fill out TX Comptroller AP-209 using my mobile device?

How do I fill out TX Comptroller AP-209 on an Android device?

What is TX Comptroller AP-209?

Who is required to file TX Comptroller AP-209?

How to fill out TX Comptroller AP-209?

What is the purpose of TX Comptroller AP-209?

What information must be reported on TX Comptroller AP-209?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.