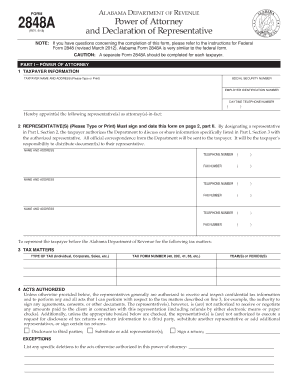

AL ADoR 2848A 2017 free printable template

Get, Create, Make and Sign AL ADoR 2848A

How to edit AL ADoR 2848A online

Uncompromising security for your PDF editing and eSignature needs

AL ADoR 2848A Form Versions

How to fill out AL ADoR 2848A

How to fill out AL ADoR 2848A

Who needs AL ADoR 2848A?

Instructions and Help about AL ADoR 2848A

Hey guys end up here today we#39’re looking at the cornerstone from our let this into 848 a 30-foot wide 1435 on the square footage, and it includes a porch so Paris from the door family room and here is the dining room that leads to the Kitchener#39’s check out the porch here nice completely covered goes along the front of I guess the side of the mobile manufactured sorry here we have plenty of countertops in fact let's get wide angle this there is the kitchen the plugs underneath the counter here is pantry walk-in pantry or other stuffs nice French oh Jesus region brothers we have covers and dishwasher last topstovehow'’s that cream there's another little pantry I guess for the one groom like this little island in between the dryer and washer this is laundry room mushroom back door here is the second bathroom pull inlet's sink drove it goes all the way through go and shower the tub now we aback to the living room the hall here ISA bedroom and it kind of has a walk-incloset goes back pretty deep say three or four feet three feet and let's look at the second bedroom from the door, and it has smaller closet then let#39’s go to the master from the door, and it has a walk-in closet here hmm there it is the second bathroom first bathroom whichever we have here showered she seats cabinets for towels and whatnot three of them yeah that#39’s what the tub sound pretty deep mirror on the wall there windows two sinks a big mirror a lot of cupboards that#39’s all behave for this video as always done#39;forget to come rate subscribe check us out on the website, and we'll see you guys on the next one

People Also Ask about

Is form 2848 required?

How do I get power of attorney in Alabama?

What is a general and durable power of attorney in Alabama?

What is a 2848 form in Alabama?

What is the purpose of form 2848?

What is a power of attorney for healthcare in Alabama?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AL ADoR 2848A to be eSigned by others?

Can I create an electronic signature for signing my AL ADoR 2848A in Gmail?

How do I edit AL ADoR 2848A on an Android device?

What is AL ADoR 2848A?

Who is required to file AL ADoR 2848A?

How to fill out AL ADoR 2848A?

What is the purpose of AL ADoR 2848A?

What information must be reported on AL ADoR 2848A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.