IRS W-8BEN-E 2017 free printable template

Show details

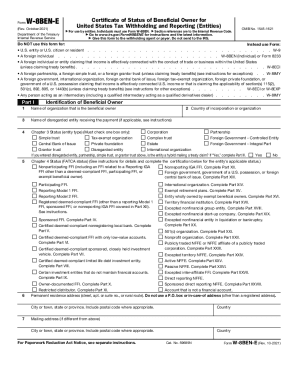

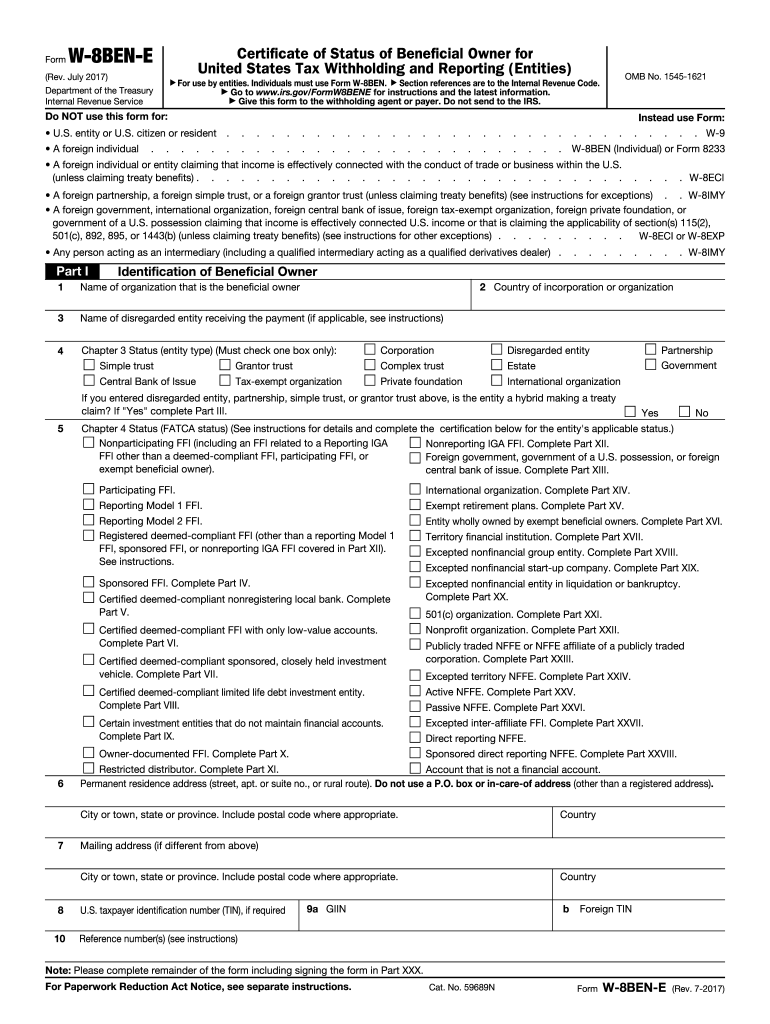

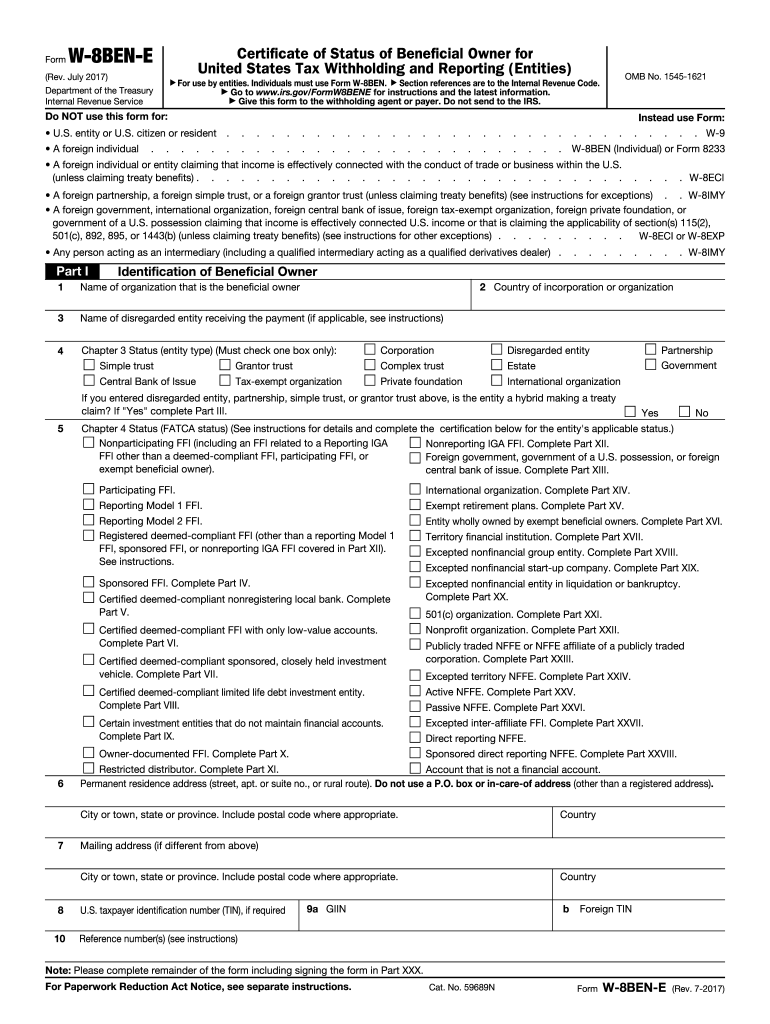

See instructions. Form W-8BEN-E Rev. 7-2017 Branch treated as nonparticipating FFI. U.S. Branch. Address of disregarded entity or branch street apt. Form W-8BEN-E Rev. July 2017 Department of the Treasury Internal Revenue Service Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities OMB No. 1545-1621 use by entities. Individuals must use Form W-8BEN* Section references are to the Internal Revenue Code. Go to www*irs*gov/FormW8BENE for instructions...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS W-8BEN-E

Edit your IRS W-8BEN-E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS W-8BEN-E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS W-8BEN-E online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS W-8BEN-E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS W-8BEN-E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS W-8BEN-E

How to fill out IRS W-8BEN-E

01

Obtain the IRS W-8BEN-E form from the IRS website.

02

Fill out Part I: Identification of Beneficial Owner, including name, country of incorporation, and address.

03

Complete Part II: Claim of Tax Treaty Benefits, if applicable, indicating which country has a tax treaty with the U.S.

04

Fill out Part III: Notional Principal Contracts, if relevant to your situation.

05

Complete Parts IV through XX, depending on the reason for filing (e.g., if you are a foreign government or international organization).

06

Sign and date the form to certify that the information provided is accurate.

Who needs IRS W-8BEN-E?

01

Foreign entities (such as corporations, partnerships, and trusts) that receive income from U.S. sources and seek to claim a reduced rate of withholding tax under applicable tax treaties.

02

Entities that need to certify their foreign status to avoid backup withholding on certain payments.

03

Foreign organizations that participate in U.S. investment activities.

Fill

form

: Try Risk Free

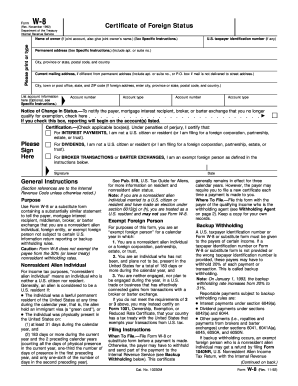

What is form w 8ben e?

W-8BEN-E is an important tax document which allows businesses operating outside of the U.S. to claim tax exemption on U.S.-sourced income. The official document title is Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities).

People Also Ask about

What is W-8BEN E form used for?

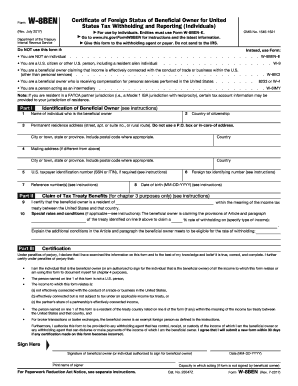

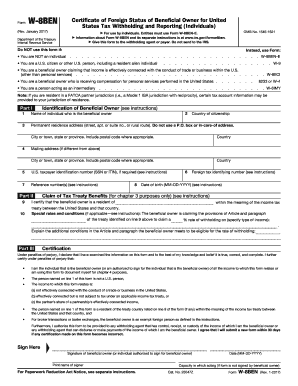

What is the W-8BEN-E and what is its purpose? The W-8BEN-E is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for entities for reporting purposes and to document their status for tax reporting purpose. (The form for individuals is the W-8BEN.)

What is W-8BEN-E form used for?

What is the W-8BEN-E and what is its purpose? The W-8BEN-E is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for entities for reporting purposes and to document their status for tax reporting purpose. (The form for individuals is the W-8BEN.)

Who needs to fill out W-8BEN E?

You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

Does W-8BEN go to IRS?

▶ Give this form to the withholding agent or payer. Do not send to the IRS. Note: If you are resident in a FATCA partner jurisdiction (that is, a Model 1 IGA jurisdiction with reciprocity), certain tax account information may be provided to your jurisdiction of residence.

What is the difference between w8ben and w8bene?

However, the key difference between the two is that W-8BEN applies to income from individuals or single owner entities like independent contractors and sole proprietors and the W-8BEN-E is for income from entities. In other words, W-8BEN is only for individuals, while entities are required to fill out W-8BEN-E.

Can a U.S. citizen file a w8ben?

Submit Form W-8BEN when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding. You are a U.S. citizen (even if you reside outside the United States) or other U.S. person (including a resident alien individual).

What is the difference between a W-8BEN and a W-8BEN E?

However, the key difference between the two is that W-8BEN applies to income from individuals or single owner entities like independent contractors and sole proprietors and the W-8BEN-E is for income from entities. In other words, W-8BEN is only for individuals, while entities are required to fill out W-8BEN-E.

Who needs to fill out W-8BEN-E?

You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the IRS W-8BEN-E electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your IRS W-8BEN-E in seconds.

How do I edit IRS W-8BEN-E straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IRS W-8BEN-E.

How do I edit IRS W-8BEN-E on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign IRS W-8BEN-E. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is IRS W-8BEN-E?

IRS W-8BEN-E is a form used by foreign entities to certify their foreign status and claim benefits under an applicable tax treaty.

Who is required to file IRS W-8BEN-E?

Foreign entities receiving income that is subject to withholding tax in the United States are required to file IRS W-8BEN-E.

How to fill out IRS W-8BEN-E?

To fill out IRS W-8BEN-E, provide the entity's name, country of incorporation, address, taxpayer identification number, and applicable tax treaty benefits information.

What is the purpose of IRS W-8BEN-E?

The purpose of IRS W-8BEN-E is to prevent foreign entities from being subject to U.S. withholding taxes on certain types of income and to claim any applicable tax treaty benefits.

What information must be reported on IRS W-8BEN-E?

The information that must be reported on IRS W-8BEN-E includes the entity's name, country of incorporation, address, taxpayer identification number, entity classification, and claims for tax treaty benefits.

Fill out your IRS W-8BEN-E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS W-8ben-E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.