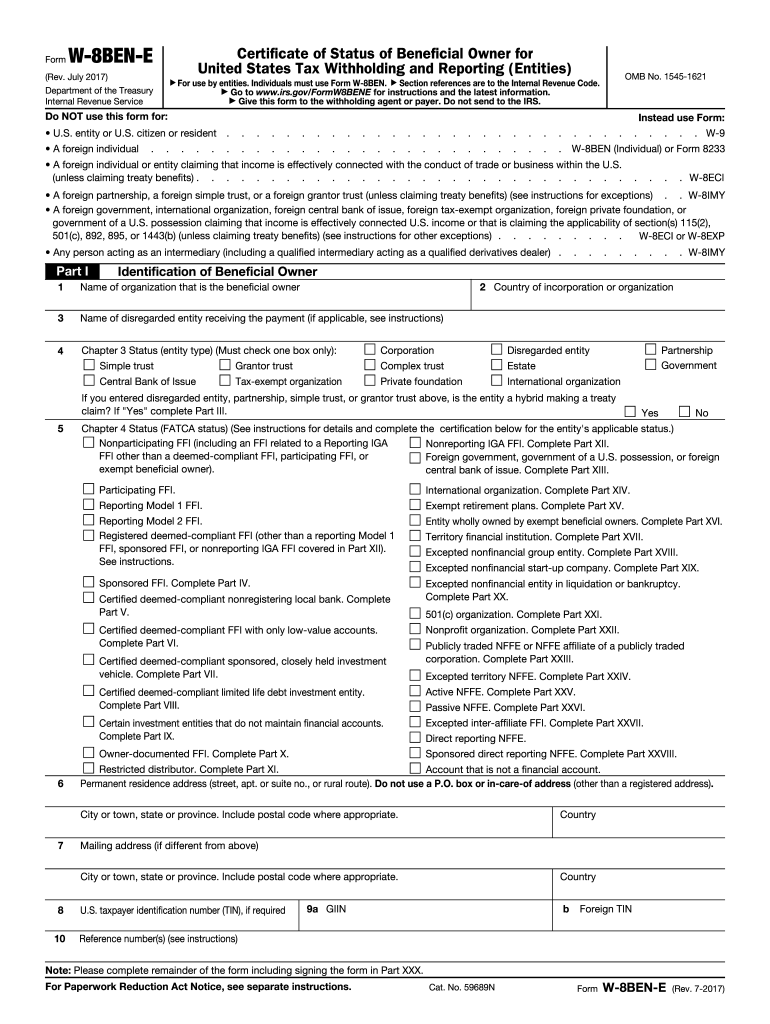

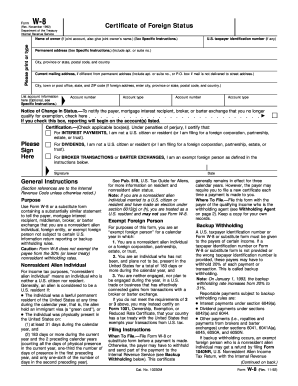

IRS W-8BEN-E 2017 free printable template

Get, Create, Make and Sign IRS W-8BEN-E

How to edit IRS W-8BEN-E online

Uncompromising security for your PDF editing and eSignature needs

IRS W-8BEN-E Form Versions

How to fill out IRS W-8BEN-E

How to fill out IRS W-8BEN-E

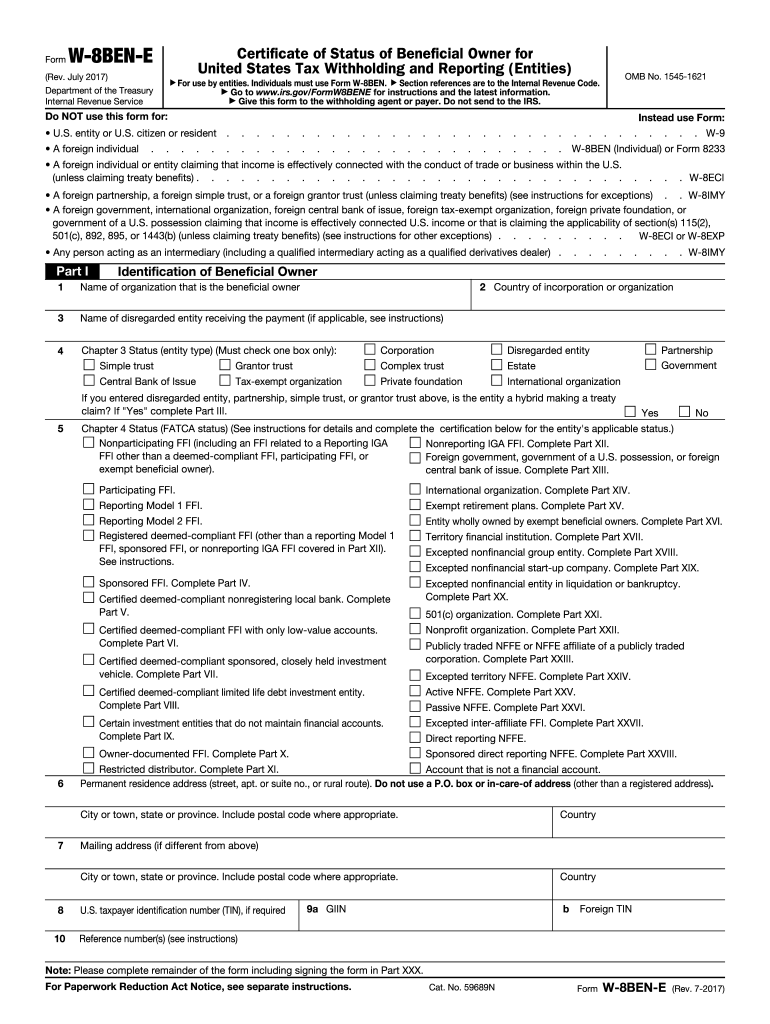

Who needs IRS W-8BEN-E?

Instructions and Help about IRS W-8BEN-E

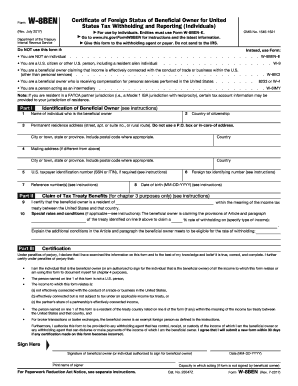

Hello YouTube Jim Baker here from Goteborg of tax consultants I had to prepare w8 been for a client and realize that there's nothing good on YouTube about this form so here I am making this video today explaining the purpose and how to complete the form so if you take a step back generally background the w8 been you see is certificate of status of beneficial owner of United States tax withholding and reporting so this form is going to be necessary when you have a US entity who is making reportable payments to a foreign or non-us entity so reportable payments are and if we go to the instructions here were talking dividends rents royalties premiums annuities compensation like a salary or substitute payments for was is and securities lending or other fixed determinable annual or periodic payments so if you are is you have a foreign entity that's receiving any kind of these payments from a US entity the US entity is by default required to withhold 30 percent of that payment and remit that payment to the IRS lets go back here put me back on the screen so this form the purpose of this form is to show the US company that you are not subject to the full 30 percent withholding and to certify that you're it's just to certify your status the benefit the status of the beneficial owner, so I'm going to go through how like very basic way to complete this form and because there's a lot of options here but most companies the majority of company is going to complete it the same way so lets say that you have a nineties Columbus uses a treaty, so Columbia is in that treaty country but let's go to the de Mexico so lets say you have a foreign company Mexico company in Mexico, and it's receiving foreign payment just Mason corporation receiving royalties from a US company for software licensing out suicidal Mexico chapter three status just an entity type its pretty simple it's going to be a corporation or if it's a pass-through a discarded entity or partnership but most are going to be corporations and in this example it's a Mexican corporation fine and then the chapter four status is a little more complicated it goes through all these different options, so FFI is a foreign financial institution, so this is all about doing stuff with banks and then so down here this box active non-financial non-foreign non-financial foreign entities so its yes I'm going to double-check non-financial foreign entities so just a regular active non-bank foreign corporation this is going to be most of these companies if you have a bank or a non-profit or something wacky you should find an account that can help you out with this, so you don't have to have your payments if you're getting a million dollars you don't want to receive 700000 instead of a million when you do a million and then have 30 percent you sent to the US government you don't want that so make sure is this filled out right okay, so you're active non-financial foreign entities you put your address on here I'm almost certain...

What is form w 8ben e?

People Also Ask about

What is W-8BEN E form used for?

What is W-8BEN-E form used for?

Who needs to fill out W-8BEN E?

Does W-8BEN go to IRS?

What is the difference between w8ben and w8bene?

Can a U.S. citizen file a w8ben?

What is the difference between a W-8BEN and a W-8BEN E?

Who needs to fill out W-8BEN-E?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the IRS W-8BEN-E electronically in Chrome?

How do I edit IRS W-8BEN-E straight from my smartphone?

How do I edit IRS W-8BEN-E on an iOS device?

What is IRS W-8BEN-E?

Who is required to file IRS W-8BEN-E?

How to fill out IRS W-8BEN-E?

What is the purpose of IRS W-8BEN-E?

What information must be reported on IRS W-8BEN-E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.