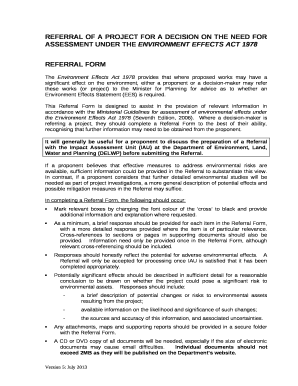

Get the free withholding tax ghana pdf

Show details

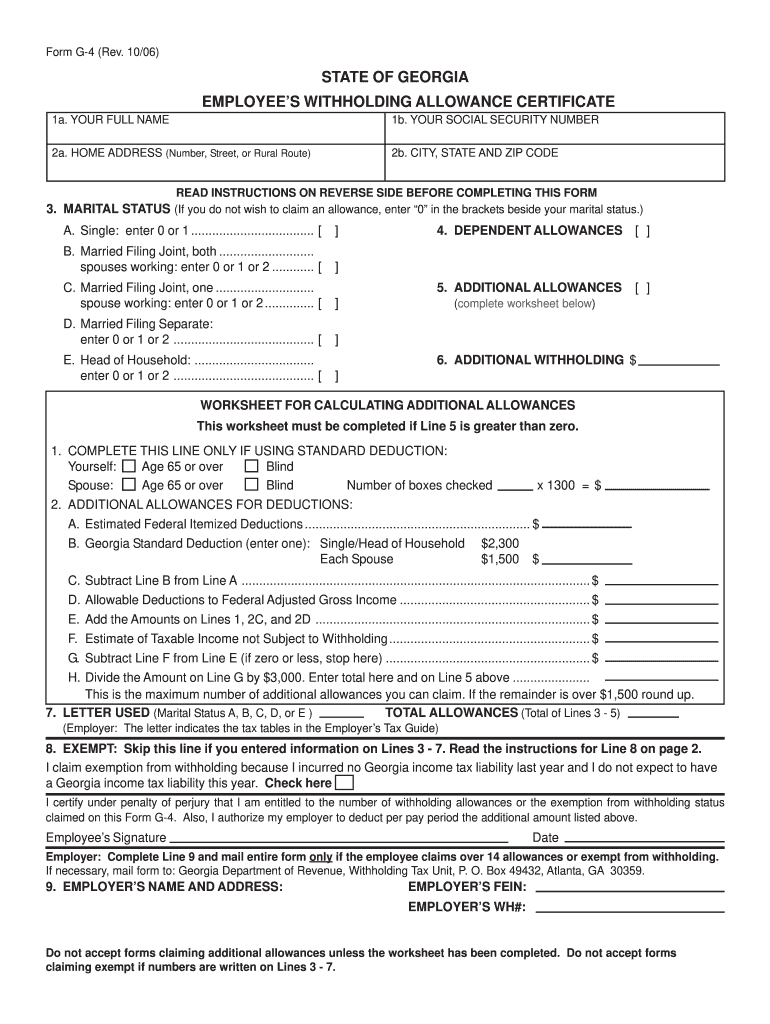

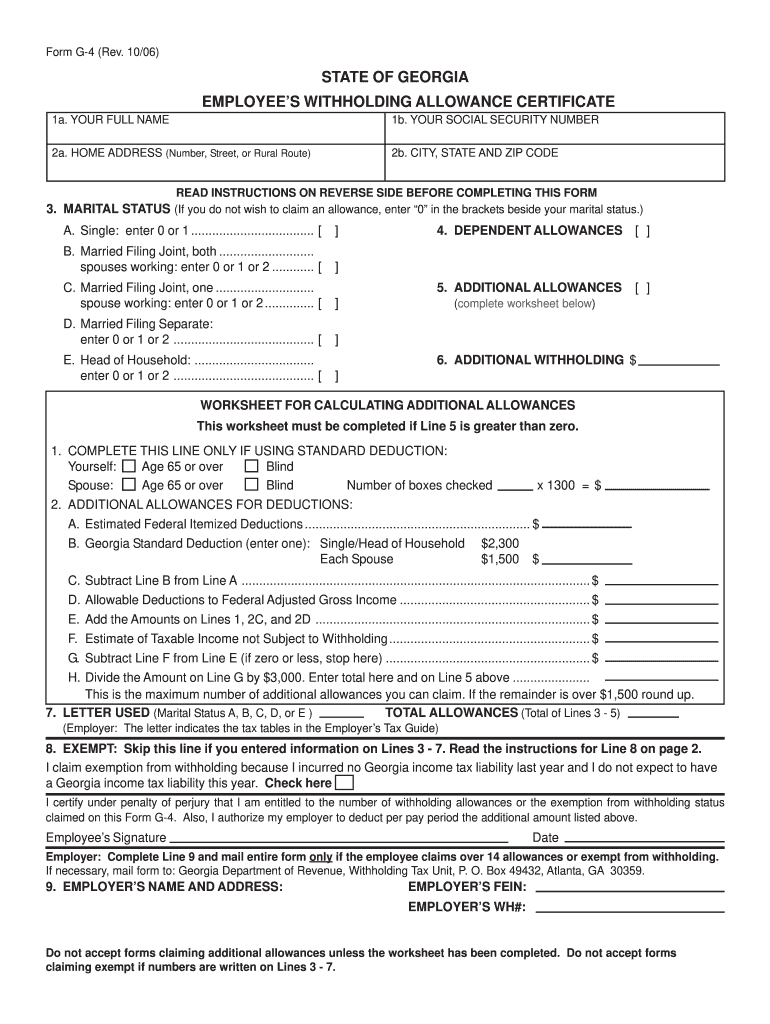

Form G-4 (Rev. 10/06) STATE OF GEORGIA EMPLOYEE S WITHHOLDING ALLOWANCE CERTIFICATE 1a. YOUR FULL NAME 1b. YOUR SOCIAL SECURITY NUMBER 2a. HOME ADDRESS (Number, Street, or Rural Route) 2b. CITY, STATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign georgia state withholding tax form blank

Edit your withholding tax ghana pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your withholding tax ghana pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit withholding tax ghana pdf online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit withholding tax ghana pdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out withholding tax ghana pdf

Point by point, here is how to fill out the withholding tax Ghana PDF and who needs it:

01

Obtain the withholding tax Ghana PDF form: Start by downloading or obtaining the official withholding tax Ghana PDF form. This form can typically be found on the website of the Ghana Revenue Authority (GRA) or obtained from their offices.

02

Provide your personal details: Begin by filling out your personal information, such as your name, address, taxpayer identification number (TIN), and contact details. This information helps the GRA identify the taxpayer responsible for withholding tax.

03

Include the payer's details: Next, provide the details of the entity or individual who is responsible for making payments subject to withholding tax. This includes their name, TIN, address, and contact information. Ensuring accurate information is crucial for proper tax administration.

04

Specify tax period and due date: Indicate the applicable tax period and due date for the withholding tax. This typically corresponds to the tax period in which the withholding occurred. Check with the GRA or refer to the instructions accompanying the form for the correct period and due date.

05

Fill in income details: List the specific income payments subject to withholding tax. This could include salary, professional fees, interest, dividends, royalties, rent, or other relevant forms of income. Provide the necessary details for each income category, such as the payment amount, date, and description.

06

Calculate and deduct withholding tax: Calculate the withholding tax amount based on the rates specified by the GRA for each income category. Deduct this tax amount from the total income payment and enter the resulting net amount on the form. Make sure to apply the correct tax rates for each income type.

07

Declare and sign the form: Review the completed form for accuracy, ensuring all relevant sections are properly filled out. Sign the form to affirm the accuracy of the information provided.

08

Submit the form to the GRA: Once the withholding tax Ghana PDF form is correctly filled out and signed, submit the form to the GRA within the specified deadline. The exact submission process may vary depending on whether it is done electronically or in-person.

Who needs withholding tax Ghana PDF?

Any individual or entity in Ghana who makes payments subject to withholding tax is required to complete the withholding tax Ghana PDF form. This includes employers who withhold tax from employee salaries, businesses that make payments to vendors or contractors, financial institutions paying interest or dividends, and individuals or organizations making rental or royalty payments. The withholding tax Ghana PDF form helps the GRA keep track of these withholding tax transactions and ensures compliance with tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I make tax withholding?

Here are the steps to calculate withholding tax: Gather Relevant Documents. First, gather all the documentation you need to reference to calculate withholding tax. Review the Employee's W-4 Forms. Next, make sure you have the correct form. Review Payroll Details. Choose Your Calculation Method.

What is the current withholding tax in Ghana?

Company income As for residents but only on Ghanaian source income. 20% withheld at source on part or whole amount. Note: The tax rate for non-resident individuals is 25%.

What is the deadline for WHT payment in Ghana?

Statement and payment of tax withheld or treated as withheld A withholding agent shall file and pay to the Commissioner-General within fifteen (15) days after the end of the month a statement in the prescribed form and tax withheld. A withholding agent who fails to withhold the tax shall be liable to pay the tax.

How does withholding tax work in Ghana?

The general withholding tax rates for payments for contracts for the supply or use of goods, supply of works and for the supply of any services involving one resident person to another resident person ranges from 3% to 7.5% and is on account of tax liability.

What is withholding on VAT in Ghana?

Withholding of VAT VAT withholding agents are required to withhold from payments for standard rated supplies 7% of the taxable output value for VAT purposes, i.e. the taxable value inclusive of NHIL and GETFL, and issue a Withholding VAT Credit Certificate at the time of payment.

How much is the withholding tax?

Withholding Tax on Compensation is based on graduated withholding tax rates ranging from 0% to 35% and will be based on or dependant on net taxable compensation of a particular employee. The BIR has developed and issued a Withholding Tax table which is available on the BIR website.

What is the deadline for filing withholding tax in Ghana?

Tax returns Employers are required to file monthly pay-as-you-earn (PAYE) returns within 15 days after the end of the month. Employers are required to file a return of income for all their employees working in Ghana not later than 31 March following the end of every year of assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send withholding tax ghana pdf to be eSigned by others?

withholding tax ghana pdf is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute withholding tax ghana pdf online?

pdfFiller has made filling out and eSigning withholding tax ghana pdf easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete withholding tax ghana pdf on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your withholding tax ghana pdf by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is withholding tax ghana pdf?

Withholding tax Ghana PDF is a tax document that outlines the details of tax withheld by a payer from payments made to a payee.

Who is required to file withholding tax ghana pdf?

Any individual or entity making payments subject to withholding tax in Ghana is required to file withholding tax Ghana PDF.

How to fill out withholding tax ghana pdf?

To fill out withholding tax Ghana PDF, one must provide details of the payer, payee, amount of payment, percentage of tax withheld, and other relevant information.

What is the purpose of withholding tax ghana pdf?

The purpose of withholding tax Ghana PDF is to document and report the tax withheld on payments made to ensure compliance with tax regulations.

What information must be reported on withholding tax ghana pdf?

Information such as payer details, payee details, payment amount, tax withheld, and any relevant deduction details must be reported on withholding tax Ghana PDF.

Fill out your withholding tax ghana pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Withholding Tax Ghana Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.