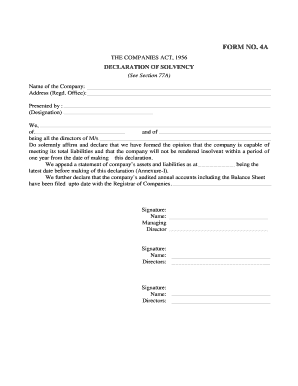

Get the free declaration of solvency template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out a declaration of solvency template form

What is a declaration of solvency?

A declaration of solvency is a legal document issued by a company's directors stating that the company can pay its debts as they become due. This declaration is crucial in maintaining transparency and accountability in financial practices, especially during restructuring or insolvency situations. It is required by law in certain circumstances, such as before a company is wound up voluntarily.

Why is the declaration important in legal and financial contexts?

-

It ensures companies adhere to regulations that prevent fraudulent activities, protecting creditors and stakeholders.

-

This declaration preserves the financial credibility of a company, maintaining trust with investors and financial institutions.

-

It helps outline a company's ability to handle debts responsibly, which is crucial during financial assessments.

What situations require a declaration of solvency?

Typically, a declaration of solvency is required in scenarios such as initiating voluntary liquidation, during a merger, or while restructuring the company’s finances. It acts as a safeguard against wrongful trading, ensuring that directors are aware of their obligations to the company's creditors.

What does the declaration of solvency template include?

-

This section captures essential details such as the company name, registration number, and the address of the registered office.

-

Directors must provide a statement affirming that they have made a full inquiry into the company’s affairs and that it can pay its debts.

-

The form should be dated and signed by all directors, indicating their agreement and understanding of the declaration.

How can you fill out the declaration of solvency?

Filling out the declaration of solvency requires attention to detail and accuracy. Begin by gathering the required company details, and proceed to complete each section of the form thoroughly. Ensure that all directors review the document to verify its correctness before signing.

What are the legal implications of misrepresenting a declaration?

-

Making false statements in a declaration of solvency can result in severe legal consequences, including potential criminal charges against the directors.

-

Misrepresentation can lead to claims from creditors, resulting in significant financial losses for the company.

-

The company's reputation can suffer, undermining stakeholder trust and investment opportunities.

How can pdfFiller assist with managing your declaration of solvency?

pdfFiller provides a robust platform for editing, eSigning, and managing your declaration of solvency forms effectively. The tool allows users to modify templates easily, ensuring that all entries remain accurate and up to date. Additionally, the cloud storage options provide easy access from anywhere, enhancing collaboration with team members.

What common mistakes should you avoid when filling out the form?

-

Ensure that all required fields are filled out. Leaving out information can lead to delays or rejections.

-

Double-check figures and statements to ensure the accuracy of all entries. This protects against future legal complications.

-

Verify that all required directors have signed the form before submission to ensure its legality.

What are the best practices for compliance in your region?

Compliance with local regulations regarding the declaration of solvency is crucial. Familiarize yourself with the specific legal requirements in your region, including any variations in documentation standards. Adopting best practices like regular training for directors on legal responsibilities and maintaining accurate records can aid in adhering to these standards.

Frequently Asked Questions about declaration of solvency template individual form

What is the purpose of a declaration of solvency?

The purpose of a declaration of solvency is to confirm that a company can pay its debts. This document provides assurance to creditors that the company is financially stable during specific transactions like liquidation.

How do I ensure my declaration of solvency is accurate?

To ensure accuracy, double-check all financial figures and details before finalizing the form. Collaboration among directors and utilizing tools like pdfFiller can enhance the accuracy of the information provided.

What happens if I fill out the solvency declaration incorrectly?

An incorrectly filled solvency declaration can lead to legal consequences for directors, including potential criminal liability. It’s critical to verify that all entries are correct and that signatures are obtained.

Can pdfFiller help with eSigning my declaration of solvency?

Yes, pdfFiller allows you to eSign your declaration of solvency digitally, simplifying the signing process. This feature streamlines document management and ensures your forms are properly executed.

Are there any regional regulations impacting the declaration of solvency?

Yes, regional regulations may impose specific requirements on the declaration of solvency process. It's important to consult local laws to ensure compliance with any additional documentation or procedural needs.

pdfFiller scores top ratings on review platforms