Self-Employed Income Affidavit free printable template

Show details

Today Re: community full name address line1 address line2 address line3 city, state zip SS#: SSN SELF-EMPLOYED INCOME AFFIDAVIT Anticipated earnings for the next 12 months $ Previous year s income

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign affidavit for self employment pua form

Edit your self employment affidavit example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 100 200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing months income online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit affidavit of self employment sample form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

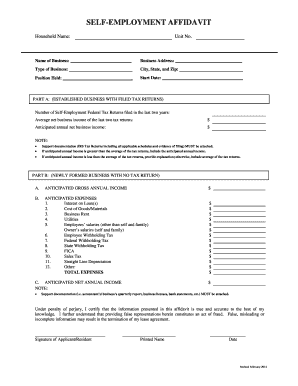

How to fill out self employment affidavit form

How to fill out Self-Employed Income Affidavit

01

Gather all necessary financial documents, including income statements, invoices, bank statements, and tax returns.

02

Obtain the Self-Employed Income Affidavit form from the relevant authority or organization.

03

Begin filling out the form by providing your full name, contact information, and business details.

04

Clearly state your business structure (sole proprietorship, LLC, etc.).

05

List your average monthly income and provide supporting documentation for your claims.

06

Include any additional sources of income, if applicable.

07

Sign and date the affidavit, confirming that the information provided is accurate.

08

Submit the completed affidavit along with the required supporting documents to the designated authority.

Who needs Self-Employed Income Affidavit?

01

Self-Employed individuals applying for loans, mortgages, or other financial assistance.

02

Freelancers and contractors needing to verify their income for rental agreements or leases.

03

Entrepreneurs seeking government benefits or grants that require proof of income.

Fill

self employment affidavit for pua

: Try Risk Free

People Also Ask about pua affidavit form

How do I get proof of income from EDD?

How to Submit a Request for Public Records. To inspect or request a copy of EDD public records, contact us in one of the following ways: Submit a request online through Ask EDD. Mail a request to EDD Legal Office, 800 Capitol Mall, MIC 53, Sacramento, CA 95814-4703.

What does EDD want as proof of income?

Tax documents such as the IRS 1040 and an associated Schedule C are preferred. For regular employment, the documents must show your gross income (total paid before taxes and payroll deductions), such as a W-2. Providing check stubs showing your earnings each quarter would also be helpful.

What is affidavit of wages mean?

1. The Employer Wage Affidavit and Information Sheet is for the purpose of providing the court with information and records concerning a party's income and benefits to assist the court in making decisions regarding that party's pending case.

Do I need income verification for Pua CA?

You will need to provide business receipts, bank statements from a business account, or other proof (such as a signed statement explaining when the work was performed) that at least some of your 2020 income was earned before the start of your PUA claim.

What is proof of income for EDD Pua?

Tax documents such as the IRS 1040 and an associated Schedule C are preferred. For regular employment, the documents must show your gross income (total paid before taxes and payroll deductions), such as a W-2. Providing check stubs showing your earnings each quarter would also be helpful.

How do I provide proof of income with EDD?

Tax documents such as the IRS 1040 and an associated Schedule C are preferred. For regular employment, the documents must show your gross income (total paid before taxes and payroll deductions), such as a W-2. Providing check stubs showing your earnings each quarter would also be helpful.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pua self employment affidavit?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific pua proof of self employment affidavit and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in affidavit for unemployment pua?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your self employment affidavit for unemployment to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for signing my pua affidavit in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your affidavit for edd self employment right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

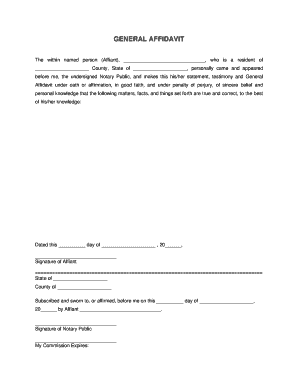

What is Self-Employed Income Affidavit?

A Self-Employed Income Affidavit is a legal document that verifies the income of an individual who is self-employed. It is often used for financial and legal purposes, such as applying for loans, mortgages, or government assistance.

Who is required to file Self-Employed Income Affidavit?

Individuals who are self-employed and need to provide proof of income for financial applications, such as freelancers, contractors, or business owners, are typically required to file a Self-Employed Income Affidavit.

How to fill out Self-Employed Income Affidavit?

To fill out a Self-Employed Income Affidavit, you need to provide your personal information, details about your business, your income sources, and your total annual income. You may also need to sign the affidavit in front of a notary public.

What is the purpose of Self-Employed Income Affidavit?

The purpose of a Self-Employed Income Affidavit is to provide an official declaration of income for self-employed individuals. It helps lenders, government agencies, and other entities assess the financial situation of the individual.

What information must be reported on Self-Employed Income Affidavit?

The information that must be reported on a Self-Employed Income Affidavit typically includes the individual's name, business name, nature of the business, income earned, expenses incurred, and any supporting documentation that can verify the claims made in the affidavit.

Fill out your self employment affidavit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit For Edd is not the form you're looking for?Search for another form here.

Keywords relevant to affidavit for pua unemployment

Related to edd self employment affidavit form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.