Beneficial Bank Small Business Loan Application free printable template

Show details

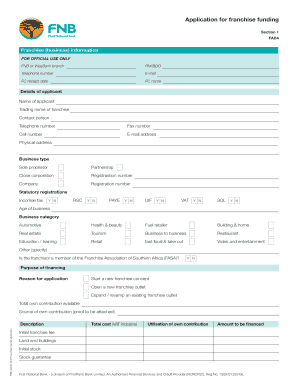

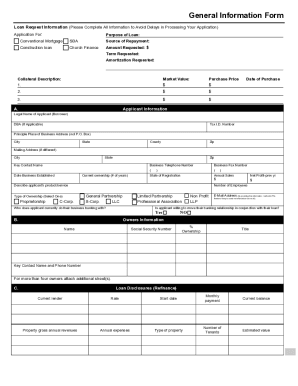

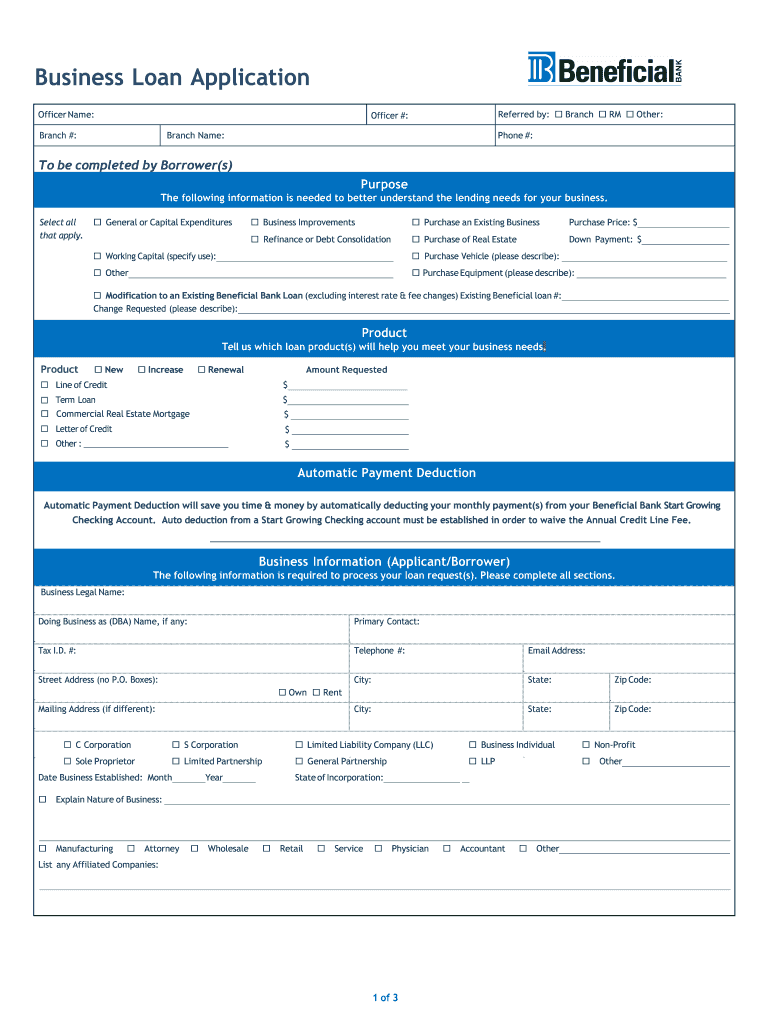

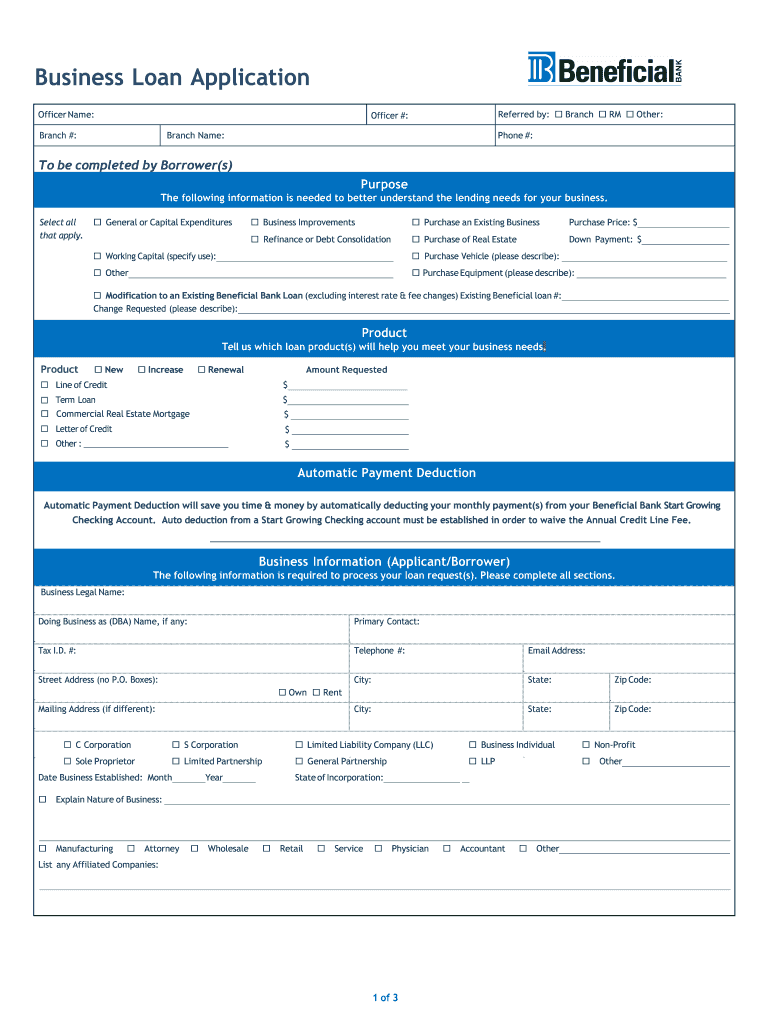

Business Loan Application Officer Name: Branch #: Referred by: ! Branch ! RM ! Other: Officer #: Branch Name: Phone #: To be completed by Borrower(s) Purpose The following information is needed to

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign beneficial bank business loan application form trial

Edit your small business loan application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business loan application form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit beneficial bank business loan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficial bank business loan

How to fill out Beneficial Bank Small Business Loan Application

01

Step 1: Gather all necessary business information, including your business name, address, and contact details.

02

Step 2: Prepare your personal information, such as your social security number and personal financial details.

03

Step 3: Compile your business financial statements, including profit and loss statements and balance sheets for the past few years.

04

Step 4: Create a detailed business plan that outlines your business model, target market, and how you plan to use the loan funds.

05

Step 5: Fill out the Beneficial Bank Small Business Loan Application form accurately, providing all required details.

06

Step 6: Review your application for any errors or missing information before submitting.

07

Step 7: Submit your completed application to Beneficial Bank, either online or in-person.

Who needs Beneficial Bank Small Business Loan Application?

01

Small business owners looking for funding to start, grow, or expand their business.

02

Entrepreneurs seeking financing for specific projects or working capital needs.

03

Business owners who need funds for equipment purchases or to cover operational costs.

Fill

form

: Try Risk Free

People Also Ask about

What is beneficial bank?

Founded in 1853, Beneficial was the oldest and largest bank headquartered in Philadelphia, with more than 58 locations throughout Pennsylvania and South Jersey.

What do I say to get a business loan?

Be as specific as possible, showing the lender that you've carefully considered what taking on this new debt will accomplish. For example, don't just say that you plan to use the loan for working capital. Say that you plan to increase inventory by 150% or hire three new hires who will increase revenues by $1 million.

What is the interest rate for beneficial state bank?

3-month, 6-month, and 12-month CD rates with 4.07% APY (Annual Percentage Yield)* Our bankers are ready to assist you over the phone or at a branch near you.

How does a bank decide to give you a business loan?

Lenders will want to know how you plan to use the money and see that you have a strong ability to repay. They may require a business plan that explains what your business goals are and how you plan to reach them.

How to convince a bank to give you a business loan?

5 Tips for Creating a Convincing Forecast for the Bank First, Build a Real Relationship. It is very difficult for any small business owner to walk up to someone to ask for assistance. Know the Numbers. Explain How You Made Your Forecasts. Show How They Get Their Money Back. Personally Guarantee the Loan.

How to write a letter to get a business loan?

How To Write A Request Letter For A Business Loan Heading And Greeting. Summary of Your Business Loan Request Letter. Basic Information About Your Business. Description Of The Purpose Of The Loan. Show Your Ability to Repay the Loan. Concluding Elements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficial bank business loan directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your beneficial bank business loan along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit beneficial bank business loan online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your beneficial bank business loan to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the beneficial bank business loan in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your beneficial bank business loan and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is Beneficial Bank Small Business Loan Application?

The Beneficial Bank Small Business Loan Application is a formal request that small business owners submit to Beneficial Bank to secure financing for their business needs, such as expansion, equipment purchases, or working capital.

Who is required to file Beneficial Bank Small Business Loan Application?

Small business owners or entrepreneurs seeking financial assistance from Beneficial Bank must file the application, typically including sole proprietors, partnerships, and corporations.

How to fill out Beneficial Bank Small Business Loan Application?

To fill out the Beneficial Bank Small Business Loan Application, applicants should gather necessary financial documents, provide detailed business information, and complete the application form accurately, ensuring all sections are filled out and supported by required documentation.

What is the purpose of Beneficial Bank Small Business Loan Application?

The purpose of the Beneficial Bank Small Business Loan Application is to assess the financial needs of small businesses, determine their eligibility for loans, and facilitate the lending process for obtaining funds.

What information must be reported on Beneficial Bank Small Business Loan Application?

The application typically requires information such as the applicant's personal and business details, financial statements, business plans, projected cash flows, and any existing debts or financial obligations.

Fill out your beneficial bank business loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficial Bank Business Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.