TX Comptroller 05-166 2018 free printable template

Show details

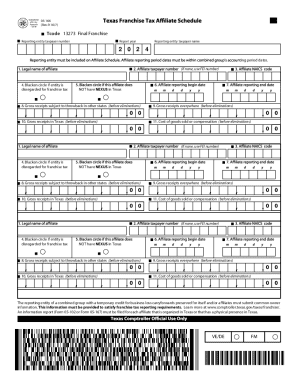

Learn more at www. comptroller. texas. gov/taxes/franchise/. An information report Form 05-102 or Form 05-167 must be filed for each affiliate that is organized in Texas or that has a physical presence in Texas. RESET FORM 05-166 Rev*9-16/7 FILING REQUIREMENTS Tcode 13273 Final FinalFranchise Reporting entity taxpayer number PRINT FORM Report year ng period dates. if none use FEI number 4. Blacken circle if entity is disregarded for franchise tax NOT have NEXUS in Texas m 8. Gross receipts...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 05-166

Edit your TX Comptroller 05-166 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 05-166 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 05-166 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX Comptroller 05-166. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 05-166 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 05-166

How to fill out TX Comptroller 05-166

01

Download the TX Comptroller 05-166 form from the official website.

02

Begin by entering your name, address, and contact information in the designated fields.

03

Provide your Texas Sales Tax Permit number, if applicable.

04

Indicate the type of transaction you are reporting.

05

Complete the sections related to the goods or services provided.

06

Add any additional information requested on the form.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form according to the instructions provided (by mail or electronically).

Who needs TX Comptroller 05-166?

01

Businesses and individuals who are applying for a sales tax exemption.

02

Non-profit organizations seeking to claim tax exempt status.

03

Vendors who need to report transactions related to specific tax exemption claims.

Fill

form

: Try Risk Free

People Also Ask about

What is the due date for Texas franchise tax return 2022?

An EFT payor may extend the filing date from May 16, 2022, to Aug. 15, 2022 by timely making an extension payment electronically using TEXNET (tax type code 13080 Franchise Tax Extension) or Webfile.

How do I file a second extension in Texas?

Request a second extension by making a timely TEXNET payment, using tax type code 13080 (Franchise Tax Extension), or use franchise tax Webfile to make the second extension payment on or before Aug. 15. The payment should equal the balance of the amount of tax that will be reported as due on Nov. 15.

What is the accounting year for franchise tax 2022 Texas?

For franchise tax reporting purposes, the entity would file its 2022 report based on the period 10-01-2020 through 12-31-2021, combining the relevant information from the two federal income tax reports.

Does Texas require quarterly tax payments?

Are quarterly estimated payments required? No.

What is the accounting year for franchise tax in Texas?

It uses a fiscal year (June 30) accounting period when reporting with the IRS. On its 2021 first annual franchise tax report, it enters its accounting year end date as 09/01/2021.

What is the due date for Texas franchise tax Return 2022?

An EFT payor may extend the filing date from May 16, 2022, to Aug. 15, 2022 by timely making an extension payment electronically using TEXNET (tax type code 13080 Franchise Tax Extension) or Webfile.

How often is franchise tax due in Texas?

In Texas, franchise tax reports must be filed every year by May 15. If your company doesn't meet the filing deadline, the comptroller's office will: Assess a $50 penalty for each report filed after May 15.

What is Form 05 166?

Each entity that is included on the Texas Franchise Tax Affiliate Schedule (Form 05-166) and marked as a Corporation or LLC, a Public Information Reports (PIR) (Form 05-102) is required to be filed with the report.

What is the reporting period for Texas franchise tax?

Due Date: A final report is due 60 days after the entity ceased doing business in Texas.

What are the dates for franchise tax in Texas?

Franchise tax reports are due on May 15 each year. If May 15 falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date. The Comptroller's office will tentatively grant an extension of time to file a franchise tax report upon timely receipt of the appropriate form.

What is the Texas 2022 tax filing deadline?

When Are Taxes Due? 2022 Tax Deadlines. Tax day, the deadline to file & pay taxes, is April 18, 2022.

What is an affiliate schedule?

Affiliate Transactions Schedule means the list of transactions with certain affiliates of the Group provided to the Agent by the Company on or prior to the date of this Agreement.

Is Texas franchise tax quarterly?

2022 Reporting Due Dates for Taxes, Fees and Reports For applicable taxes, quarterly reports are due in April, July, October and January. Note: When a reporting due date happens to fall on Saturday, Sunday, or a legal holiday, the reporting due date becomes the next business day.

How often do you pay franchise tax in Texas?

The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state. The tax is based upon the entity's margin, and can be calculated in a number of different ways. Each business in Texas must file an Annual Franchise Tax Report by May 15 each year.

What is the due date for Texas sales tax return?

For monthly filers, reports are due on the 20th of the month following the reporting month. For example, the April sales tax report is due May 20. For yearly filers, reports of sales for the previous year are due on Jan. 20.

Is Texas extending tax deadline?

Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. The relief postpones various federal tax filing and payment deadlines that occurred starting on February 11.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TX Comptroller 05-166 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your TX Comptroller 05-166 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify TX Comptroller 05-166 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including TX Comptroller 05-166, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the TX Comptroller 05-166 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your TX Comptroller 05-166 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is TX Comptroller 05-166?

TX Comptroller 05-166 is a form used by Texas taxpayers to report and remit taxes imposed by the state.

Who is required to file TX Comptroller 05-166?

Entities and individuals who are liable for specific state taxes, such as franchise tax or sales tax, are required to file TX Comptroller 05-166.

How to fill out TX Comptroller 05-166?

To fill out TX Comptroller 05-166, taxpayers need to provide their identification information, specify the type of tax being remitted, report the tax due, and sign the form.

What is the purpose of TX Comptroller 05-166?

The purpose of TX Comptroller 05-166 is to facilitate the accurate reporting and payment of state taxes owed by taxpayers in Texas.

What information must be reported on TX Comptroller 05-166?

The information that must be reported on TX Comptroller 05-166 includes the taxpayer's identification number, contact information, the type of tax being paid, the total amount due, and any applicable exemptions or credits.

Fill out your TX Comptroller 05-166 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 05-166 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.