Get the free z103 form

Show details

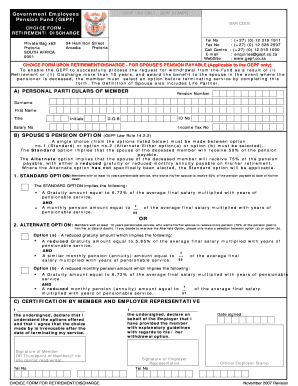

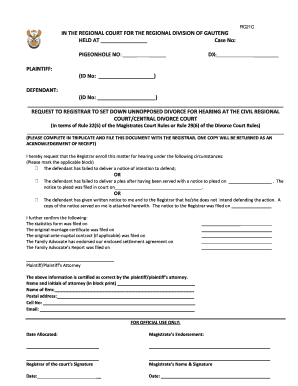

This document is used to notify the Government Employees Pension Fund (GEPF) about the divorce of a member and includes necessary personal and employment details as well as certifications from both

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign z103 form is used for purchase of service

Edit your z103 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your z103 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit z103 form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit z103 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out z103 form

How to fill out z103 form:

01

Gather all required information: Before starting the form, make sure you have all the necessary information at hand, such as your personal details, contact information, and any relevant documentation.

02

Read the instructions carefully: Take the time to thoroughly go through the instructions provided with the form. This will help you understand the purpose of each section and how to accurately fill it out.

03

Begin with personal information: Start by providing your full name, date of birth, address, and any other requested personal information. Ensure that you double-check the accuracy of the information provided.

04

Fill out employment details: If applicable, provide information about your current or previous employment, including your job title, employer name and address, and duration of employment.

05

Provide financial information: Depending on the purpose of the form, you may be required to disclose your financial situation. This can include details about your income, assets, debts, and any other relevant financial information. Be sure to provide accurate and up-to-date information.

06

Complete any additional sections: Some z103 forms may have specific sections related to certain situations or purposes. Make sure to carefully fill out any additional sections relevant to your situation.

07

Review and verify: Before submitting the form, take the time to review all the information you have provided. Make sure there are no errors or missing details. Double-check the form's instructions to ensure you haven't overlooked anything.

08

Submit the form: Once you are confident that all the information is accurate and complete, follow the instructions for submitting the z103 form. This can include mailing it to a specific address, submitting it online, or delivering it in person.

Who needs z103 form:

01

Individuals seeking employment verification: The z103 form may be required by employers as a part of the employee verification process. It helps to verify and validate the details provided by job applicants.

02

Those applying for certain government benefits: Some government benefit programs may require applicants to fill out the z103 form to assess their eligibility. This can include programs related to income support, housing assistance, or health care.

03

Individuals involved in legal proceedings: The z103 form may be necessary for individuals involved in legal proceedings, such as court cases or insurance claims. It helps provide necessary information for these processes.

04

Individuals applying for financial assistance or loans: When applying for loans or financial assistance, institutions might ask for the z103 form to assess the applicant's financial situation and ability to repay the borrowed amount.

05

Organizations conducting background checks: Companies or organizations that perform background checks on individuals may request the z103 form to gather relevant information about the applicant's employment history, financial status, or legal history.

It's important to note that the specific requirements for the z103 form may vary depending on the country, organization, or purpose for which it is being used. Therefore, it is always advisable to consult the instructions provided with the form or seek guidance from the relevant authority.

Video instructions and help with filling out and completing z103 form

Instructions and Help about z103 form

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for GEPF to pay out after divorce?

GEPF has 60 days to pay the non- member spouse from date of receipt of the duly completed choice form. Payment may take as long as 60 days from said date and GEPF must pay interest for every day that payment is late.

What is a Z103 form?

NOTIFICATION OF DIVORCE Z103. Page 1. A) PERSONAL DETAILS OF MEMBER (Compulsary)

How long does it take to get paid from GEPF?

How long does it take Gepf to pay out? Once you've filed and submitted your documents, GEPF will process your claim within 60 days with the exception of death claims involving distribution of benefits.

How is pension calculated in divorce settlement?

Courts will normally add the value of private pensions (both occupational and personal) of both husband and wife to the matrimonial pot. When they get divorced, the value of any pensions will be divided up as part of the overall pot, with a starting point of a 50:50 split.

How do I claim divorce pension?

GEPF's toll-free Call Centre at 0800 117 669. You can also go to their local office to talk to them and would need to bring your ex-husband's GEPF member's number, your ID, and divorce order.

Can my ex wife claim my pension after divorce?

An ex-partner can lay claim to your pension fund at any time after your divorce. Yes, this means that even years after the divorce, they're entitled to a portion of your pension fund.

Will my wife get half my pension divorce?

During a divorce, the judge may deem it necessary to make a pension sharing order so that this pot of money is split between you and your ex-spouse. As a marital asset, a pension can be considered within the financial settlement in order to ensure a fair agreement is reached by both parties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send z103 form to be eSigned by others?

Once your z103 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get z103 form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the z103 form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit z103 form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute z103 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is z103 form?

The z103 form is a tax form used to report specific financial information to the relevant tax authorities.

Who is required to file z103 form?

Individuals or entities that meet certain financial thresholds or have specific types of income are required to file the z103 form.

How to fill out z103 form?

To fill out the z103 form, gather the necessary financial information, complete each section accurately, and submit it by the due date to the appropriate tax authority.

What is the purpose of z103 form?

The purpose of the z103 form is to ensure compliance with tax reporting requirements and to provide the government with data necessary for assessing taxes.

What information must be reported on z103 form?

The z103 form requires reporting of income, deductions, and any other financial information relevant to the taxpayer's fiscal situation.

Fill out your z103 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

z103 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.