Get the free composite claim form in death cases

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

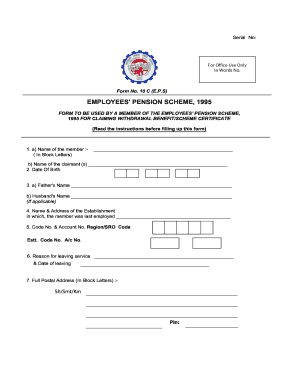

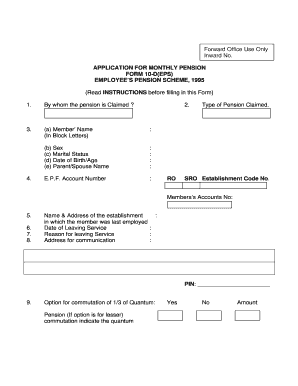

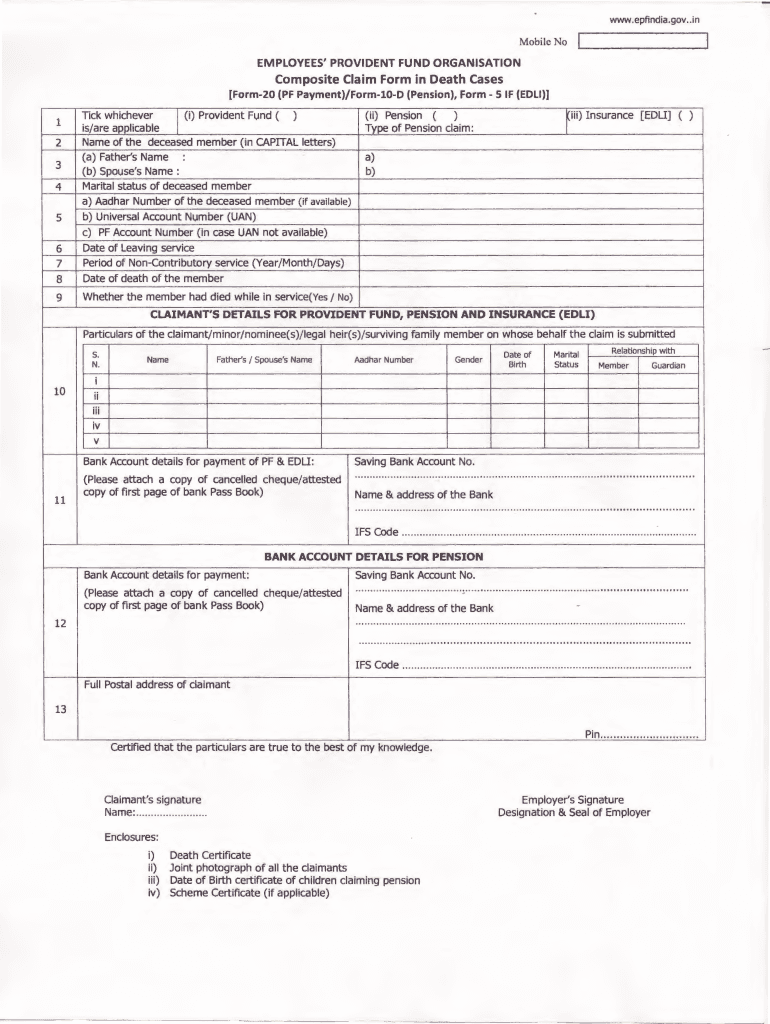

Comprehensive guide to the EPF composite claim form

Filling out the EPF Composite Claim Form can seem daunting, but it’s crucial for withdrawing funds and receiving benefits. This guide provides a detailed overview of the form, types, prerequisites, and more, ensuring you can navigate the process seamlessly.

What is the EPF Composite Claim Form?

The EPF Composite Claim Form is a standardized document utilized by employees for claiming their Provident Fund or pension upon certain events like retirement or demise. This form is important as it streamlines the withdrawal process of Provident Fund and Pension benefits for the members or their nominees.

-

A formal document required for claiming funds from the Employees’ Provident Fund.

-

This form is essential to receive accumulated funds and pension benefits securely.

-

There are three primary types of claims citizens may file: PF Payment, Pension, and EDLI (Employee Deposit Linked Insurance).

What are the prerequisites for filling the composite claim form?

Before you can fill out the EPF Composite Claim Form, certain eligibility criteria must be met, and documentation must be gathered to avoid delays.

-

Ensure that you are a valid member of the EPF and meet all necessary conditions for withdrawal.

-

Documents such as Death Certificate and Bank Details are necessary for processing the claim.

-

A verification of the deceased member’s information is mandatory to ensure legitimacy in claims.

What are the types of composite claim forms?

Several different types of composite claim forms exist, each tailored for specific scenarios. Understanding these will help you choose the right one to expedite your claims.

-

Each of these forms serves a different aspect of claims; Form-20 for PF withdrawal, Form-10-D for pension and Form-5 IF for insurance payout.

-

Form selection is based on whether you're withdrawing funds, applying for a pension, or claiming insurance.

-

Understanding the occasion of your claim will determine the suitable form to fill.

How do you fill the composite claim form?

Filling out the EPF Composite Claim Form accurately is essential to avoid delays. Utilizing available resources can make this process smooth.

-

Follow a structured approach to fill in personal information, employment details, and the type of claim.

-

Be wary of misentered details or the absence of required documents, which can lead to delays.

-

Use pdfFiller for editing, signing, and managing your form directly online, facilitating a user-friendly experience.

How do you fill the composite claim form in death cases?

Filling the claim form correctly in the case of deceased members is particularly sensitive. Certain fields require nuances that must be handled with care.

-

You'll need to provide specific information about the deceased, including their EPF membership number.

-

Nominators or legal heirs must be clear about their rights and responsibilities when filing.

-

Examples can serve as a reference point to ensure all information is accurate and complete.

Are there fees associated with the composite claim form?

Understanding any potential fees is crucial before submitting a composite claim form. Some usual expenses are less discussed but can affect your overall claim process.

-

Potential fees may apply depending on the claim circumstances and processing requirements.

-

Check which payment methods are accepted to ensure a seamless transaction.

-

Research local regulations that might affect fees to avoid unexpected costs.

How can you check the status of your composite claim form?

Once your claim is submitted, it's vital to track its status to ensure timely processing. There are various methods to stay updated.

-

Utilize online tools or customer service helplines to track the progress of your claim.

-

Understanding expected processing times can help you manage your expectations.

-

If in doubt, contacting your EPF regional office can provide clarity and assistance.

What are the tax implications for the composite claim form?

It is imperative to understand the taxation aspects of withdrawing from the Provident Fund or claiming pension benefits, as there could be tax liabilities involved.

-

Withdrawals may be subject to tax based on local laws, so awareness is key.

-

Keep accurate records of your claims to properly report income for tax purposes.

-

Be informed about specific taxation laws in your region that can impact your overall claim.

What are a claimant’s rights and responsibilities?

Understanding your rights and responsibilities as a claimant of the EPF is essential to secure your benefits and ensure proper compliance.

-

Claimants have specific rights to receive their dues and timely responses from EPF.

-

Ensure all required documentation and information are complete to avoid delays.

-

Various resources are available to aid claimants in understanding their entitlement and process.

Frequently Asked Questions about composite claim form

What is the EPF composite claim form used for?

The EPF composite claim form is used for withdrawing funds from the Employees’ Provident Fund. It allows members or their nominees to access their benefits, including Provident Fund and pensions.

What documents are needed to fill out the composite claim form?

You will need important documents such as a Death Certificate (if applicable) and your bank details. Ensuring all paperwork is ready beforehand is crucial for a smooth process.

How can I check the status of my claim?

You can check the status of your claim through online tools provided by EPF or by contacting their customer service. It is important to have your claim number handy for efficient tracking.

Are there any fees for filing the composite claim form?

Some costs may be associated with filing. It’s advisable to check the specific fees relevant to your situation to prevent any surprises during the process.

Is there a tax on my EPF withdrawal?

Tax may be applicable based on local laws when you withdraw from your Provident Fund. Keeping track of your withdrawals and consulting a tax professional is recommended.

pdfFiller scores top ratings on review platforms