Get the free itr format

Show details

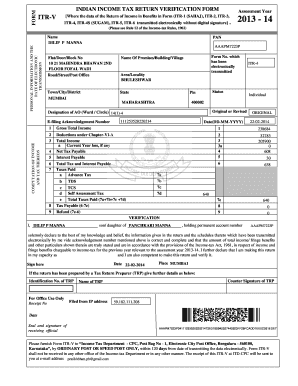

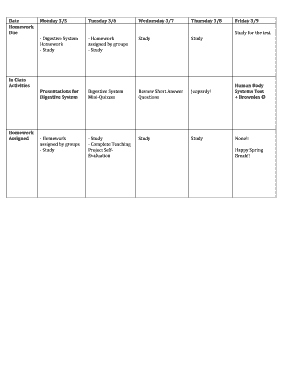

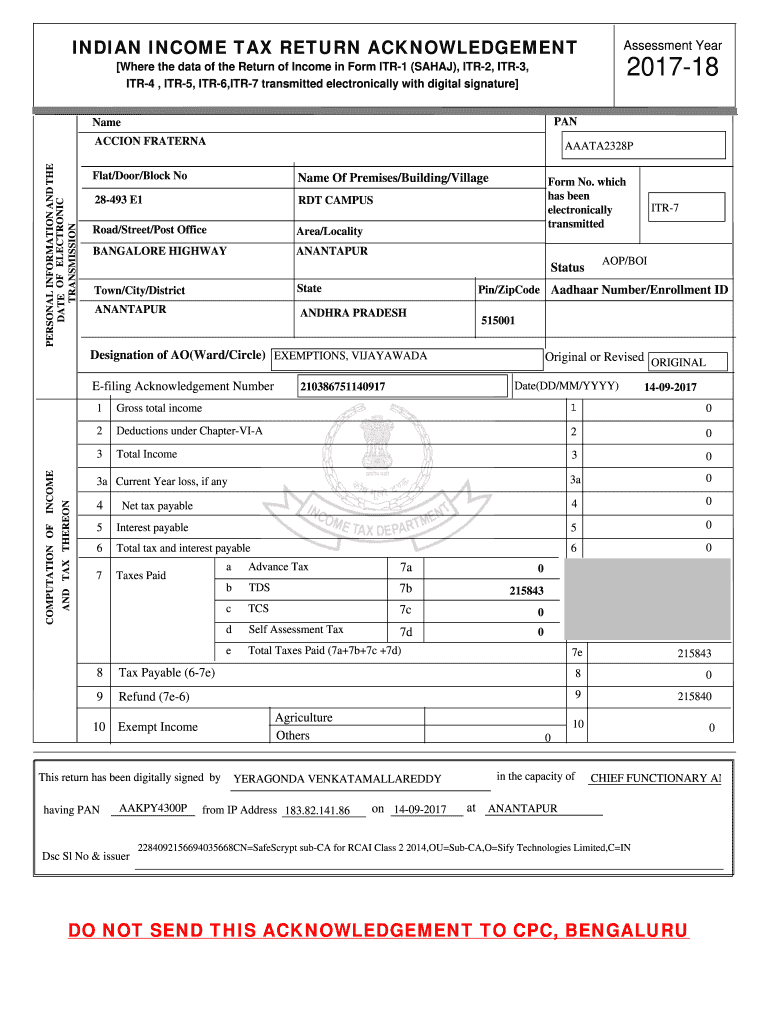

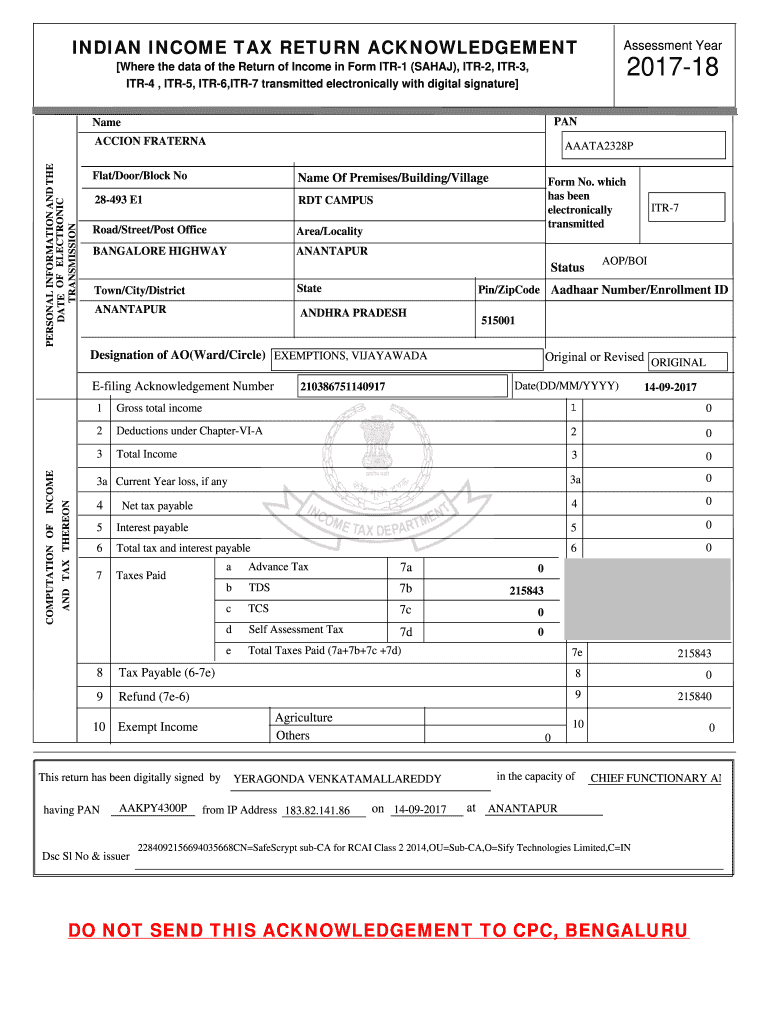

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENTAssessment Year201718 Where the data of the Return of Income in Form ITR1 (SAH AJ), ITR2, ITR3, ITR4, ITR5, ITR6,ITR7 transmitted electronically with digital

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign itr format

Edit your itr format form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your itr format form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit itr format online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit itr format. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out itr format

Point by point guide on how to fill out an ITR format:

Gather all necessary documents and information:

01

Personal details such as name, address, PAN number, and contact information.

02

Valid proof of identity and address.

03

Details of income sources including salary, business income, capital gains, etc.

04

Details of deductions and exemptions you are eligible for.

05

Bank account details for refund purposes.

Choose the correct ITR form:

01

ITR-1: For individuals having income from salary, house property, or other sources.

02

ITR-2: For individuals and HUFs (Hindu Undivided Families) having income from multiple sources.

03

ITR-3: For individuals and HUFs who are partners in a firm or own a proprietary business.

04

ITR-4: For individuals and HUFs with income from a presumptive business or profession.

Fill in the basic information:

Carefully enter your personal details like name, PAN, and contact information in the respective sections of the ITR form.

Report income from various sources:

Provide accurate details of your income from salary, business, capital gains, house property, and any other sources as applicable.

Claim deductions and exemptions:

Mention all eligible deductions and exemptions under relevant sections like 80C for investments, 80D for medical insurance, etc.

Calculate the total tax liability:

Use the provided tax calculation sheets or online tax calculators to determine the total tax payable by you.

Pay any remaining tax:

If there is any tax liability remaining after considering TDS (Tax Deducted at Source) and advance tax, pay it before filing the ITR.

Fill in the tax payment details:

Enter the details of taxes already paid such as TDS, advance tax, and self-assessment tax in the appropriate sections.

Verify the information and submit the form:

Double-check all the information provided, attach necessary documents, and electronically submit or physically file the ITR as per the prescribed method.

Who needs ITR format?

Individuals with taxable income:

Any individual, including salaried employees, self-employed professionals, freelancers, and businessmen, who have taxable income exceeding the specified threshold limit within a financial year.

Hindu Undivided Families (HUFs):

HUFs with income from various sources, including property, business, investments, or any other taxable source.

Partners of a firm or owners of a proprietary business:

Individuals who are partners in a partnership firm or owners of a sole proprietorship business, regardless of the income earned.

Please note that the eligibility for filing an ITR may vary depending on factors like age, income slab, and types of income earned. It is always advisable to consult a tax professional or refer to the official guidelines for accurate and up-to-date information.

Fill

form

: Try Risk Free

People Also Ask about

How do we calculate ITR?

Step 1: Log in and choose the “View Returns / Forms” option on the Income Tax E-Filing website. Step 2: Choose “Income Tax Return” and “Assessment Year” from the menu. Select “Submit.” Step 3: Select the income tax return's acknowledgment number from which you wish to get the ITR-V.

What is ITR example?

An Income tax return (ITR) is a form used to file information about your income and tax to the Income Tax Department. The tax liability of a taxpayer is calculated based on his or her income.

How do I write an ITR?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

What is meant by ITR?

Income Tax Return (ITR) is a form which a person is supposed to submit to the Income Tax Department of India. It contains information about the person's income and the taxes to be paid on it during the year.

What is ITR form type?

Income Tax Return (ITR) forms refer to those forms in which taxpayers file information about their income earned and tax applicable to the department of income tax. The department has notified 7 types of ITR forms – ITR 1. ITR 2. ITR 3.

What is my ITR form?

Income Tax Return (ITR) is a form in which the taxpayers file information about their income earned and tax applicable, to the income tax department.

What are ITR numbers?

Which ITR Form to File When Filing Income Tax Return? FormApplicabilityBusiness IncomeITR 1Resident Indian individuals and HUFsNoITR 2HUFs and individualsNoITR 3Partner in a firm, HUF, or individualsYesITR 4Firm, HUF, or individualOnly for business income that is presumptive3 more rows

What are ITR types?

FAQs About ITR Forms There are seven ITR forms for individuals, namely, ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 & ITR 7. Firms and companies can use ITR-5, ITR-6 and ITR-7 to file their income tax return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find itr format?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the itr format in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the itr format form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign itr format and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit itr format on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign itr format. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is itr format?

The ITR format refers to the Income Tax Return format that taxpayers in India use to report their income, claim deductions, and calculate their tax liability for a financial year.

Who is required to file itr format?

Individuals, Hindu Undivided Families (HUFs), and entities like companies and firms whose income exceeds the basic exemption limit, as well as those who have certain types of income, are required to file the ITR format.

How to fill out itr format?

To fill out the ITR format, gather all necessary documents like Form 16, bank statements, details of investments, and expenses, then complete the relevant sections for your income details, deductions, and tax calculations, and finally submit it online through the income tax department's website.

What is the purpose of itr format?

The purpose of the ITR format is to provide a structured way for taxpayers to disclose their income and tax details to the income tax authorities, ensure compliance with tax laws, and determine tax liability.

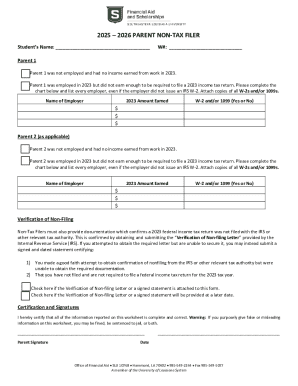

What information must be reported on itr format?

The ITR format must report personal details (like name, PAN, address), income from various sources (salaries, business, capital gains), deductions claimed under sections like 80C and 80D, and any tax paid in advance or deducted at source.

Fill out your itr format online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Itr Format is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.