Get the free standard form 1199a

Show details

Standard Form 1199A (EG)OMB No. 15100007(Rev. August 2012)Prescribed by TreasuryDepartment

Treasury Dept. Cir. 1076DIRECT DEPOSIT SIGN UP REDIRECTIONS

The claim number and type of payment are printed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1199a direct deposit form

Edit your form date form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment paid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment set online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 12. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment payee paid form

How to fill out GSA SF 1199A

01

Begin by obtaining a GSA SF 1199A form from the official website or a government office.

02

Fill out the 'Name of Payee' section with the individual's or entity's name as it appears on their bank account.

03

In the 'Social Security Number' or 'Employer Identification Number' section, enter the appropriate identification number.

04

Specify the type of account by selecting 'Checking' or 'Savings'.

05

Provide the bank routing number, which is usually a 9-digit number located on the bottom of a check.

06

Enter the bank account number, which is typically found next to the routing number on a check.

07

If applicable, complete the 'Type of Deposit' section to indicate whether this is a new account or a change to an existing account.

08

Review the completed form for accuracy, ensuring all information is correct and matches the bank's records.

09

Sign and date the form to certify that the information provided is accurate.

10

Submit the completed GSA SF 1199A form to the appropriate agency or office as directed.

Who needs GSA SF 1199A?

01

Individuals or entities receiving federal payments who need to establish direct deposit for their funds.

02

Federal employees, contractors, beneficiaries, and vendors who conduct business with the government.

03

Anyone who needs to update their banking information for federal payments.

Fill

date payment paid

: Try Risk Free

People Also Ask about epa centers

What is the difference between CMS 1500 and ub04 forms?

The UB-04 (CMS-1450) form is the claim form for institutional facilities such as hospitals or outpatient facilities. This would include things like surgery, radiology, laboratory, or other facility services. The HCFA-1500 form (CMS-1500) is used to submit charges covered under Medicare Part B.

What is a claim form?

A claim form is the document that tells your insurance company more details about the accident or illness in question. This will help them determine if the expenses you are claiming for are covered under your insurance plan or not, so the more information on this form the better.

What are the different types of claim forms?

The two most common claim forms are the CMS-1500 and the UB-04. These two forms look and operate similarly, but they are not interchangeable. The UB-04 is based on the CMS-1500, but is actually a variation on it—it's also known as the CMS-1450 form.

How to fill out a 1500 claim form?

How to fill out a CMS-1500 form The type of insurance and the insured's ID number. The patient's full name. The patient's date of birth. The insured's full name, if applicable. The patient's address. The patient's relationship to the insured, if applicable. The insured's address, if applicable. Field reserved for NUCC use.

What is the CMS-1500 claim form?

The CMS-1500 form is the standard claim form used by a non-institutional provider or supplier to bill Medicare carriers and durable medical equipment regional carriers (DMERCs) when a provider qualifies for a waiver from the Administrative Simplification Compliance Act (ASCA) requirement for electronic submission of

Who is responsible for filling out a claim form?

Your employer should fill out the “employer” section and forward the completed claim form to the insurance company. You should receive a copy of the completed claim form from your employer.

How do I fill out a claim form?

You can proceed to fill out part A of the form by entering a few primary details of yours, including your full name, policy number, residential address, phone number, and e-mail id. Then, you may need to provide the details of your medical history and hospitalisation.

What is a ub04 claim form?

The CMS-1450 form (aka UB-04 at present) can be used by an institutional provider to bill a Medicare fiscal intermediary (FI) when a provider qualifies for a waiver from the Administrative Simplification Compliance Act (ASCA) requirement for electronic submission of claims.

What is the first step in completing a claim form?

What is the first step in completing a claim form? Check for a photocopy of the patient's insurance card. Which carriers will accept physicians' typed name and credentials as an indication of their signature?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form payee?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific epa administrative and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the payment account electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your people claim in minutes.

How can I fill out date payee check on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form department. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

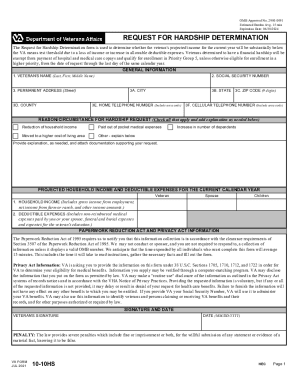

What is GSA SF 1199A?

GSA SF 1199A is a form used by individuals and entities to provide banking information for the Electronic Funds Transfer (EFT) payment process for federal agencies.

Who is required to file GSA SF 1199A?

Individuals or entities receiving payment from a federal agency are required to file GSA SF 1199A to ensure proper funds transfer.

How to fill out GSA SF 1199A?

To fill out GSA SF 1199A, users must provide their bank account information, including account number, routing number, and their personal or business details in the designated fields on the form. It is important to follow the instructions provided with the form to ensure accuracy.

What is the purpose of GSA SF 1199A?

The purpose of GSA SF 1199A is to facilitate the electronic transfer of payments to individuals and businesses by collecting necessary banking information.

What information must be reported on GSA SF 1199A?

GSA SF 1199A requires reporting information such as the payee's name, address, bank account number, bank routing number, and type of account (checking or savings), as well as the payee's taxpayer identification number.

Fill out your standard form 1199a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Payee Set is not the form you're looking for?Search for another form here.

Keywords relevant to check paid

Related to postmarked faxed winding

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.