CA CDTFA-230-G-1 2017-2025 free printable template

Show details

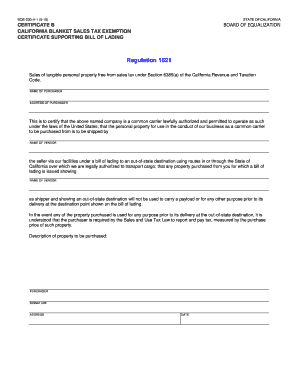

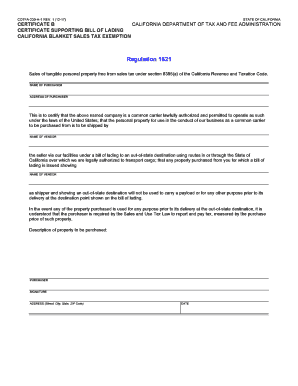

CDTFA230G1 REV. 1 (1217)CERTIFICATE A

CALIFORNIA SALES TAX EXEMPTION

CERTIFICATE SUPPORTING BILL OF LADINGSTATE OF CALIFORNIACALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATIONRegulation 1621

Sales

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax exemption certificate california

Edit your tax exemption certificate california form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exemption certificate california form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax exemption certificate california online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax exemption certificate california. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exemption certificate california

How to fill out CA CDTFA-230-G-1

01

Start by downloading the CA CDTFA-230-G-1 form from the California Department of Tax and Fee Administration website.

02

Fill in your name, address, and account number in the appropriate fields on the form.

03

Indicate the reason for your request in the designated section.

04

Provide any necessary details or supporting documentation as required.

05

Review all filled sections for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form via mail or online, based on the instructions provided.

Who needs CA CDTFA-230-G-1?

01

Anyone who has overpaid their California state taxes or who needs to claim a refund of a tax or fee is required to fill out the CA CDTFA-230-G-1 form.

Fill

form

: Try Risk Free

People Also Ask about

Is California resale certificate tax exempt?

When purchasing items for resale, registered sellers may avoid the sales tax by giving their supplier adequate documentation in the form of a resale certificate. A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale.

How to fill California resale certificate form?

2:23 6:20 How to Fill Out Your California Resale Certificate - YouTube YouTube Start of suggested clip End of suggested clip In the state of California. So sports cards I'm engaged in the business of selling the followingMoreIn the state of California. So sports cards I'm engaged in the business of selling the following type of tangible personal property sports cards. This certificate is is for the purchase from blank of

Does California require a reseller certificate?

Making sales of merchandise, goods, or other items in California without first getting a seller's permit violates the law and subjects you to fines and penalties. California law requires a seller's permit be held for warehouse locations when: the retailer has one or more sales offices in this state, the sale is

What is a Cdtfa 230 form?

CDTFA-230, General Resale Certificate, can be issued by purchasers when purchasing goods they will resell in the regular course of their business operations. Generally, resale certificates are used: When purchasing finished items for resale.

Who needs to file CDTFA?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

Is a California seller's permit the same as a tax exempt certificate?

A seller's permit provides a business with authority to make sales inside California. In contrast a resale certificate is a form that is provided from a buyer to a seller to support the exempt nature of a sale for resale that would otherwise be taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the tax exemption certificate california in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your tax exemption certificate california right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the tax exemption certificate california form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign tax exemption certificate california and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit tax exemption certificate california on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign tax exemption certificate california right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is CA CDTFA-230-G-1?

CA CDTFA-230-G-1 is a form used by the California Department of Tax and Fee Administration for reporting certain tax-related information.

Who is required to file CA CDTFA-230-G-1?

Businesses that are registered to collect sales and use tax in California and have certain transactions to report are required to file CA CDTFA-230-G-1.

How to fill out CA CDTFA-230-G-1?

To fill out CA CDTFA-230-G-1, you need to provide business identification information, the relevant reporting periods, and details relating to sales, tax collected, and any exemptions or deductions being claimed.

What is the purpose of CA CDTFA-230-G-1?

The purpose of CA CDTFA-230-G-1 is to ensure compliance with sales and use tax reporting requirements, allowing the California state tax authority to accurately assess tax obligations.

What information must be reported on CA CDTFA-230-G-1?

The information that must be reported on CA CDTFA-230-G-1 includes total sales, taxable sales, any exemptions claimed, the amount of tax collected, and other relevant transaction details.

Fill out your tax exemption certificate california online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exemption Certificate California is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.