UK NHS RF12 2018 free printable template

Show details

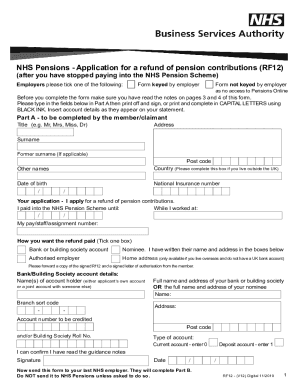

NHS Pensions Application for a refund of pension contributions (RF12) (after you have stopped paying into the NHS Pension Scheme)Employers please tick one of the following:Form keyed by employerForm

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rf12 form

Edit your rf12 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rf12 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rf12 form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rf12 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK NHS RF12 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rf12 form

How to fill out UK NHS RF12

01

Obtain the RF12 form from the NHS website or your local healthcare provider.

02

Read the instructions carefully before filling out the form.

03

Fill in your personal details such as name, address, and date of birth.

04

Provide information regarding your medical history, including any ongoing treatments.

05

Specify your healthcare needs and the reason for completing the form.

06

Include any additional documentation or evidence as required.

07

Review the completed form for accuracy and completeness.

08

Submit the form through the appropriate channel, whether online or via post.

Who needs UK NHS RF12?

01

Individuals seeking access to NHS services who require a formal assessment.

02

Patients needing to clarify their healthcare needs or eligibility for specific services.

03

People looking to update their medical information for their healthcare providers.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim my pension back?

Ask your pension scheme provider for information on your pension refund eligibility and how to claim back pension contributions. They will be able to provide you with specific information on how to request your refund.

What happens to my NHS pension if I move abroad?

We will make payments direct to your bank account, held in the country specified on the bank mandate, in local currency. A small processing fee will be collected from each net payment to facilitate conversion to local currency and onward transmission overseas.

Can I get my pension money back if I leave UK?

If you have less than two years service, you will be entitled to a refund of contributions, unless your employer used a salary sacrifice scheme in which case this doesn't apply. Deductions will be made for tax and National Insurance.

How long does it take to receive NC retirement refund?

A refund of your contributions (along with four percent interest compounded annually) is available to you 60 days after your effective date of resignation or termination. The 60-day waiting period is required by the General Statutes of North Carolina.

What happens to your NHS pension if you leave the NHS?

If you opt out or leave the Scheme, we may be able to transfer your pension benefits to another provider. If you want to transfer to another UK scheme, read and complete the transfer out guide and application pack (PDF: 618KB).

What form do I need for refund of NHS pension contributions?

To claim a refund you must complete an RF12 form. If you're in active NHS employment, submit this to your employer. If you have more than one NHS employer, you only need to submit one RF12 form. This must go to the most recent employer to which the refund period relates.

What happens to your pension plan when you leave a company?

Answer: Generally, if you are enrolled in a 401(k), profit sharing or other type of defined contribution plan (a plan in which you have an individual account), your plan may provide for a lump sum distribution of your retirement money when you leave the company.

How long does it take to get your retirement refund?

You can typically expect to receive your refund within 30 to 45 days from the date we receive all your necessary forms.

How long does it take for pension refund?

A Once an employer has submitted the application for a refund of pension contributions (RF12) form to NHS Pensions electronically, payment can be received in your bank in 3-10 working days. A payable order will be issued within 5–10 working days.

What is an RF12 form?

NHS Pensions - Application for a refund of pension contributions (RF12) (after you have stopped paying into the NHS Pension Scheme) Employers please tick one of the following: Form keyed by employer.

Can I get back my pension contributions?

If you leave your pension scheme within two years of joining, you might be able to get your contributions refunded. This will depend on the type of scheme. It's worth being aware that if you do this, you won't have any pension savings from this time.

What is a RF12 form?

NHS Pensions - Application for a refund of pension contributions (RF12) (after you have stopped paying into the NHS Pension Scheme)

How do I get a refund for my pension?

Ask your pension scheme provider for information on your pension refund eligibility and how to claim back pension contributions. They will be able to provide you with specific information on how to request your refund.

Can you get a refund on your pension?

If you have re-entered pensionable NHS employment after a break of 12 months or more, you may be entitled to a refund of your earlier contributions. If you have requested a transfer of this earlier membership (within the transfer time limits) to another pension arrangement you will not be able to request a refund.

How do I get my NHS Pension back?

Applying for a refund You should print off and complete Part 1 of the application for a refund of pension contributions (RF12) form and then forward this along with Part 2 to the NHS employer where you last paid pension contributions.

How do I claim my NHS pension from abroad?

The overseas bank mandate forms are available to download from the NHS Pensions website under Members Hub, Applying for your pension. Please note that direct credit payments abroad take a little longer to process than payments to a UK bank account and your pension will arrive a few days after your usual payment date.

What happens to my NHS Pension if I move abroad?

Transferring your NHS pension abroad The pensions agencies permit the transfer of benefits abroad if the scheme is recognised by HMRC as a qualifying recognised overseas pension scheme and if such a qualifying scheme accepts the transfer.

Where do I send my RF12 form?

If you're in active NHS employment, submit this to your employer. If you have more than one NHS employer, you only need to submit one RF12 form. This must go to the most recent employer to which the refund period relates. If you're no longer paying into the NHS Pension Scheme, send your RF12 form to NHS Pensions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rf12 form to be eSigned by others?

Once your rf12 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get rf12 form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the rf12 form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in rf12 form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your rf12 form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is UK NHS RF12?

UK NHS RF12 is a reporting form used by the National Health Service (NHS) in the UK to collect data related to healthcare organizations' financial and operational performance.

Who is required to file UK NHS RF12?

NHS organizations, including hospitals and other healthcare providers, are required to file the UK NHS RF12 form to ensure compliance with financial reporting standards and regulations.

How to fill out UK NHS RF12?

To fill out UK NHS RF12, organizations must gather the required financial and operational data, complete each section of the form accurately, review for completeness, and submit it by the specified deadline.

What is the purpose of UK NHS RF12?

The purpose of UK NHS RF12 is to provide a standardized method for NHS organizations to report their financial performance and operational metrics, which aids in improving transparency and accountability within the healthcare system.

What information must be reported on UK NHS RF12?

The information that must be reported on UK NHS RF12 includes financial statements, performance indicators, service delivery metrics, and other relevant data reflecting the organization’s health and operational efficiency.

Fill out your rf12 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rf12 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.