MA DoR IFTA-1 2018 free printable template

Show details

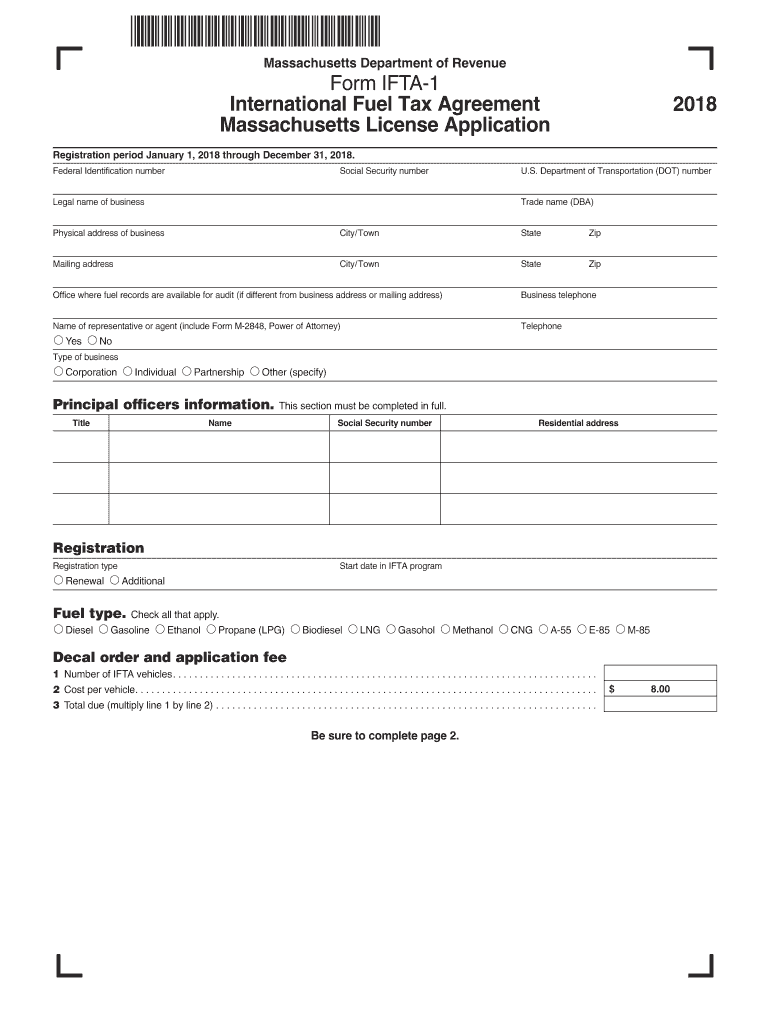

Massachusetts Department of Revenue Form IFTA-1 International Fuel Tax Agreement Registration period January 1 2018 through December 31 2018. Enter the date you began or will begin IFTA in Massachusetts based on the current identification number entered. All trucks that go interstate and are over 10 000 pounds are required to have a Department of Transportation DOT number. Make check payable to Commonwealth of Massachusetts. Mail to Massachusetts Department of Revenue P. O. Box 7027 Boston MA...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR IFTA-1

Edit your MA DoR IFTA-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR IFTA-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA DoR IFTA-1 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MA DoR IFTA-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR IFTA-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR IFTA-1

How to fill out MA DoR IFTA-1

01

Begin by downloading the MA DoR IFTA-1 form from the Massachusetts Department of Revenue website.

02

Enter your business name and address in the designated fields at the top of the form.

03

Provide the IFTA account number assigned to your business.

04

Fill in the reporting period for which you are filing, typically a quarter.

05

Detail the mileage traveled in each jurisdiction on the corresponding lines.

06

Report the fuel purchased in each jurisdiction in the appropriate section.

07

Calculate the total miles and fuel for the reporting period.

08

Ensure all calculations are accurate and double-check your entries.

09

Sign and date the form at the bottom before submitting.

10

Submit the completed form to the Massachusetts Department of Revenue by the deadline.

Who needs MA DoR IFTA-1?

01

Businesses that operate commercial vehicles and travel across state lines.

02

Transport companies and trucking firms that need to report fuel usage and mileage.

03

Any entity required to comply with the International Fuel Tax Agreement (IFTA).

Instructions and Help about MA DoR IFTA-1

Fill

form

: Try Risk Free

People Also Ask about

Why is IFTA important?

IFTA allows US states and Canadian provinces, known as jurisdictions, to get their fair share of fuel use taxes. Drivers report mileage to their base state only, which in turn takes care of distributing the taxes among the jurisdictions on that driver's route.

How to apply for IFTA in Louisiana?

You will need to submit a Louisiana application online or in person. There is a $35 application fee and $2 per set of decals fee. You will need one set of decals per qualified vehicle. Decals should be received within 7-10 business days.

How does IFTA work Oregon?

In Oregon, IFTA requires you to submit an IFTA sticker application to The Department of Transportation. A fee is charged based on the number of motor vehicles being operated under IFTA jurisdictions, starting at $280 for one vehicle.

What states do not participate in IFTA?

IFTA jurdictions are all US states except Alaska, Hawaii and the District of Columbia and Canadian provinces and territories except Yukon Territory, Northwest Territory and Nunavut.

What is the meaning of IFTA?

IFTA – or the International Fuel Tax Agreement – is a way to simplify how truckers and trucking companies pay their fuel taxes.

What does IFTA sticker stand for?

IFTA stands for The International Fuel Tax Agreement.

How do I register for IFTA in Massachusetts?

IFTA registration and filing You can complete your IFTA registration and filings through DOR's online system MassTaxConnect. This includes registering for IFTA decals and filing quarterly returns. It's quick and easy to use. If you do not wish to register and file electronically IFTA paper forms are available.

What states are not a part of IFTA?

What states are not part of IFTA? Alaska, Hawaii and the District of Columbia in the US and Yukon Territory, Northwest Territory and Nunavut in Canada are not part of IFTA.

Which states are not included in IFTA?

The 48 contiguous US States and 10 Canadian Provinces are members of IFTA. Alaska, Hawaii, D.C., and territories from the USA and Canada are not members of IFTA.

How do I get my IFTA stickers in SC?

In South Carolina, to obtain an IFTA license, you must submit an application to the Motor Carrier Service Department. There are currently no charges associated with application. If your application for a license is approved, you will be issued an IFTA license and two IFTA decals for each registered vehicle.

What does IFTA mean in trucking?

The International Fuel Tax Agreement, also known as IFTA, is an agreement for fuel tax collection and sharing among 48 states and 10 provinces.

What is IFTA carrier tax?

International Fuel Tax Agreement (IFTA) License IFTA is an agreement among U.S. states and provinces in Canada that simplifies the reporting of fuel use taxes by interstate motor carriers who operate in two or more member states or provinces.

Do local trucks need IFTA?

The IFTA applies to you if you meet the following criteria: Your truck has a gross vehicle weight (GVW) of 26,000 pounds or has three or more axles or both. For example, if your truck has a GVW of 25,000 pounds but has three axles, then you fall within IFTA jurisdiction.

How many states participate in IFTA?

IFTA, or International Fuel Tax Agreement, is a cooperative agreement between 10 Canadian provinces and 48 US states to simplify the process of listing and paying taxes by interjurisdictional carriers on the fuels they use. Alaska, Hawaii and the Canadian territories are not part of this agreement.

Is IFTA good for all states?

Your International Fuel Tax Agreement credentials (license and decals) are valid in all jurisdictions that are members of the IFTA. If you travel in a non-IFTA jurisdiction, you must continue to follow the procedures and file the fuel tax returns required by the non-IFTA jurisdiction.

Is Kentucky part of IFTA?

Kentucky is one of 48 states in the U.S. that has joined the IFTA. Kentucky is your base jurisdiction for licensing and reporting if you meet the following IFTA requirements: Established a business in Kentucky from which motor carriers operations are conducted.

Who needs IFTA in Texas?

Qualifying commercial motor vehicles traveling in more than one U.S. state or Canadian province are required to file a consolidated report of motor fuels taxes (e.g., gasoline, diesel fuel, liquefied gas, compressed natural gas and liquefied natural gas taxes) under the International Fuel Tax Agreement (IFTA).

Is IFTA tax deductible?

If you made a retail fuel purchase, it can only be claimed as a tax-paid credit on the IFTA tax return if it was placed directly into the fuel tank of a qualified motor vehicle and the purchase price includes fuel tax paid to a member jurisdiction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MA DoR IFTA-1 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your MA DoR IFTA-1 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send MA DoR IFTA-1 to be eSigned by others?

When you're ready to share your MA DoR IFTA-1, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit MA DoR IFTA-1 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing MA DoR IFTA-1.

What is MA DoR IFTA-1?

MA DoR IFTA-1 is a form used for reporting and paying the International Fuel Tax Agreement (IFTA) taxes for motor carriers operating in Massachusetts.

Who is required to file MA DoR IFTA-1?

Motor carriers who operate qualified motor vehicles in Massachusetts and are registered under the IFTA agreement are required to file MA DoR IFTA-1.

How to fill out MA DoR IFTA-1?

To fill out MA DoR IFTA-1, you need to provide information on the jurisdictions traveled, the total miles driven, fuel purchased, and the fuel consumed in each jurisdiction, along with any taxes due.

What is the purpose of MA DoR IFTA-1?

The purpose of MA DoR IFTA-1 is to facilitate the reporting of fuel usage and taxes owed by motor carriers for interstate travel, ensuring compliance with IFTA regulations.

What information must be reported on MA DoR IFTA-1?

The information that must be reported on MA DoR IFTA-1 includes the total miles driven in each jurisdiction, fuel purchased in each jurisdiction, and the gallons of fuel consumed, along with any tax calculations.

Fill out your MA DoR IFTA-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR IFTA-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.