Get the free az form 290 fillable

Show details

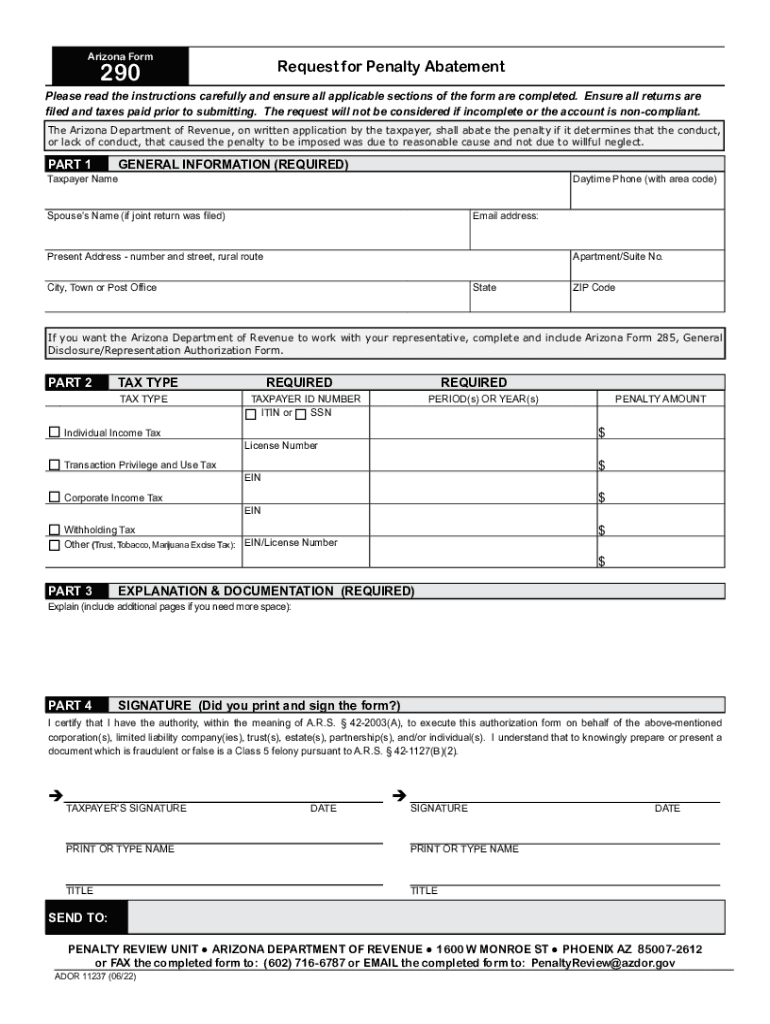

View Instructions Arizona FormRequest for Penalty Abatement290Please read the instructions carefully before completing this form. The Arizona Department of Revenue, on written application by the taxpayer,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign az form 290

Edit your az form 290 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your az form 290 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit az form 290 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit az form 290. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out az form 290

How to fill out AZ ADOR 11237 (Form 290)

01

Obtain the AZ ADOR 11237 (Form 290) from the Arizona Department of Revenue website or by contacting their office.

02

Fill out your personal information at the top of the form including your name, address, and taxpayer identification number.

03

Indicate the tax year you are filing for in the appropriate section.

04

Provide details regarding your income sources as requested on the form, including wages, self-employment income, and any other sources.

05

Fill out the sections regarding deductions and credits that you are eligible for.

06

Calculate your total tax due or refund based on the information you provided.

07

Sign and date the form at the bottom.

08

Submit the form electronically via the AZ Department of Revenue website or mail it to the provided address.

Who needs AZ ADOR 11237 (Form 290)?

01

Individuals who are required to report income for Arizona state tax purposes.

02

Taxpayers who need to claim specific deductions or credits related to their income.

03

Residents of Arizona who have taxable income and need to file a state income tax return.

Fill

form

: Try Risk Free

People Also Ask about

What is an IRS penalty abatement?

You can request First Time Abate for a penalty even if you haven't fully paid the tax on your return. However, the Failure to Pay Penalty will continue to increase until you pay the tax in full. Example: You didn't fully pay your taxes in 2021 and got a notice with the balance due and penalty charges.

What is AZ 285?

A taxpayer may use Arizona Form 285 to authorize the department to release confidential information to the taxpayer's Appointee.

Can I file an Arizona tax extension online?

Can I submit a filing extension request online for Individual Income or Small Business Income Tax? No. However, if you have an approved federal extension from the Internal Revenue Service, you do not need to file an extension with Arizona.

Do I need to file a state tax extension Arizona?

If you owe AZ income taxes, you will either have to submit a AZ tax return or extension by the April 18, 2022 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 15, 2022 Oct. 17, 2022.

What is the extended tax deadline for 2022?

While October 17 is the last day for most people to file a Form 1040 to avoid the late filing penalty, those who still need to file should do so as soon as possible. If they have their information ready, there's no need to wait. However, some taxpayers may have additional time.

What is an ad 285 request?

Download. Download. 09/26/2022. A taxpayer may use Form 285 to authorize the department to release confidential information to the taxpayer's Appointee. The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the Appointee.

How do I fill out Arizona Form 285?

0:56 9:18 Learn How to Complete the Arizona Form 285, General - YouTube YouTube Start of suggested clip End of suggested clip Available in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for theMoreAvailable in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for the taxpayer. Information. There is space to enter the taxpayers. Name address and a time telephone.

Is there a penalty for filing taxes late if you don't owe?

Here are some tips to help you: There is no penalty for filing a late return after the tax deadline if a refund is due. If you didn't file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

Can I electronically file a tax extension?

E-file Your Extension Form for Free Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. Filing this form gives you until October 15 to file a return.

Is there a way to get tax penalties waived?

Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. Written requests for a waiver of the penalty will be considered on a case-by-case basis. If the waiver is denied, the penalties will be billed at a future date.

How do I file an extension in AZ?

Extensions - To receive an automatic extension until October 15, file Form 204, Application for Filing Extension. Arizona will also accept the federal extension for the period covered by the federal extension.

How do I get tax forms in the mail?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is a Form 290 used for?

Use Form 290 to request an abatement of non-audit penalties. form is incomplete or if the account is not compliant. IMPORTANT: If the penalty being addressed is the result of an audit, do not use Form 290. Contact the Audit Unit at the phone number shown on the assessment.

What is the penalty for filing taxes late in Arizona?

Individuals who plan on filing their taxes late may incur a late file penalty of 4.5 percent of the tax required to be shown on the return for each month or fraction of a month the return is late. The late payment penalty is . 5 percent of the tax due on the return per month.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit az form 290 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing az form 290 right away.

Can I edit az form 290 on an iOS device?

Create, modify, and share az form 290 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out az form 290 on an Android device?

Complete az form 290 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is AZ ADOR 11237 (Form 290)?

AZ ADOR 11237 (Form 290) is a tax form used in Arizona for reporting specific business income and expenses as part of the state's income tax reporting requirements.

Who is required to file AZ ADOR 11237 (Form 290)?

Businesses and individuals who earn income that falls under Arizona's tax regulations, particularly those with specific business activities defined by the state, are required to file AZ ADOR 11237 (Form 290).

How to fill out AZ ADOR 11237 (Form 290)?

To fill out AZ ADOR 11237 (Form 290), taxpayers need to provide their identification information, detail business income, list expenses, and calculate the tax owed. It is recommended to follow the instructions provided with the form closely.

What is the purpose of AZ ADOR 11237 (Form 290)?

The purpose of AZ ADOR 11237 (Form 290) is to allow the Arizona Department of Revenue to assess and collect income tax from individuals and entities engaged in business activities within the state.

What information must be reported on AZ ADOR 11237 (Form 290)?

The information that must be reported on AZ ADOR 11237 (Form 290) includes the taxpayer's identification details, total business income, business expenses, and any other relevant deductions or credits.

Fill out your az form 290 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Az Form 290 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.