India Acko Claim Form for Motor Vehicle 2018-2025 free printable template

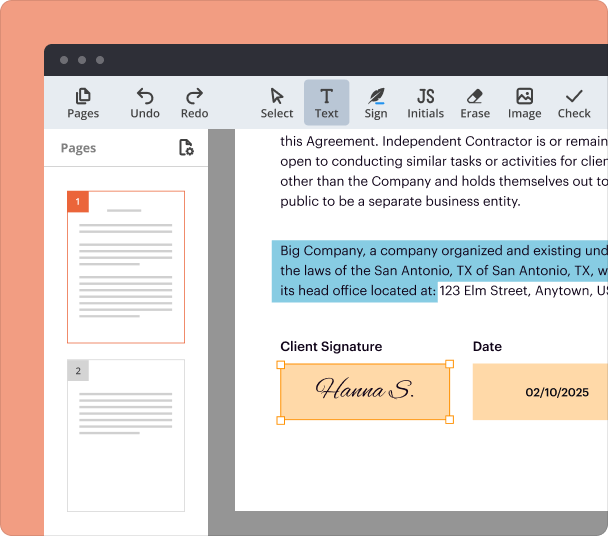

Fill out, sign, and share forms from a single PDF platform

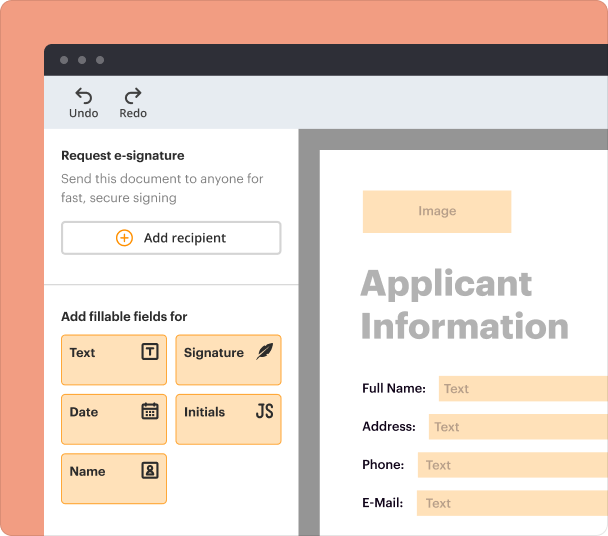

Edit and sign in one place

Create professional forms

Simplify data collection

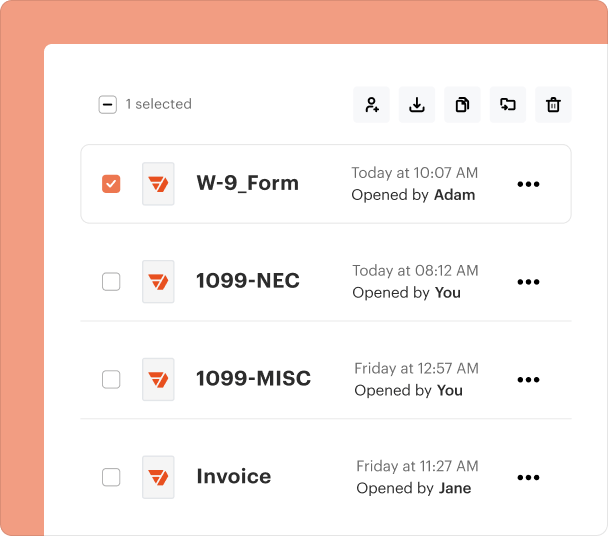

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the India Acko Claim Form

What is the India Acko Claim Form

The India Acko Claim Form is a document used to report and initiate a claim with Acko General Insurance for various types of insurance coverage, including motor vehicle insurance. This form collects essential information needed to process claims effectively and efficiently.

Eligibility Criteria for the India Acko Claim Form

To be eligible to use the India Acko Claim Form, the claimant must hold a valid insurance policy with Acko General Insurance. Additionally, the claim must pertain to incidents covered under the policy, such as accidents or theft involving the insured vehicle.

Required Documents and Information

Completing the India Acko Claim Form requires several documents and pieces of information. Key documents typically include:

-

Proof of vehicle ownership, necessary to validate the insurance policy.

-

Verification of the person driving the vehicle at the time of the incident.

-

A police report relevant to the accident or theft, enhancing the claim’s credibility.

-

To ensure the correct disbursement of funds in the event of a successful claim.

How to Fill the India Acko Claim Form

Filling out the India Acko Claim Form involves several steps. It's crucial to complete the form using capital letters for clarity and professionalism. Here are steps to follow:

-

Include your name, address, phone number, and email to establish contact.

-

Include the registration number, chassis number, and other relevant vehicle information.

-

Clearly articulate what occurred during the accident or theft, including time and location.

-

Ensure all necessary documents are included to support the claim.

Common Errors and Troubleshooting

When completing the India Acko Claim Form, certain common errors can delay the processing of claims. Awareness of these pitfalls can improve accuracy. Common mistakes include:

-

Leaving out sections of the form can result in delays or rejection.

-

Ensure the policy number provided matches the insurance record.

-

Submitting unclear copies can hinder processing.

-

Failure to provide a signature can invalidate the claim.

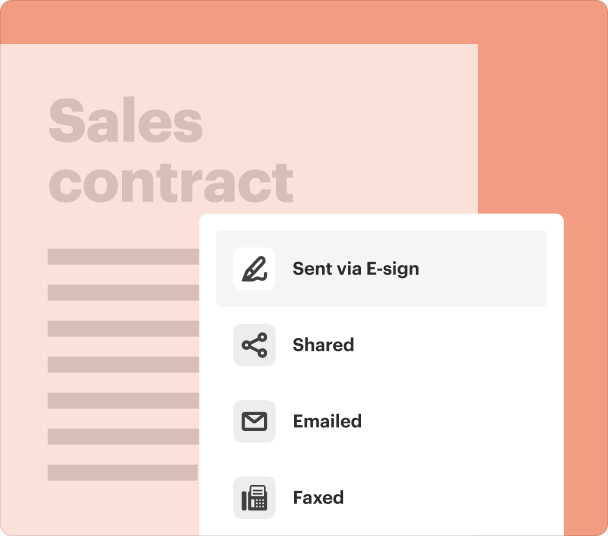

Submission Methods and Delivery

Once the India Acko Claim Form is completed, it must be submitted for processing. There are several methods by which the form can be delivered:

-

Many users prefer to submit claims digitally via Acko's online portal, which can expedite processing.

-

Alternatively, the completed form can be mailed to Acko's claims department.

-

Claimants can also choose to deliver forms to local Acko offices if they prefer face-to-face interactions.

Frequently Asked Questions about acko motor claim form

What should I do if I have questions about filling out the claim form?

If you have questions, it's advisable to contact Acko's customer support for guidance. They can provide assistance to ensure the form is filled out correctly.

How long does it take to process a claim after submission?

The processing time can vary but typically takes several days to a few weeks, depending on the complexity of the claim and required investigations.

pdfFiller scores top ratings on review platforms