FS 5336 2018 free printable template

Show details

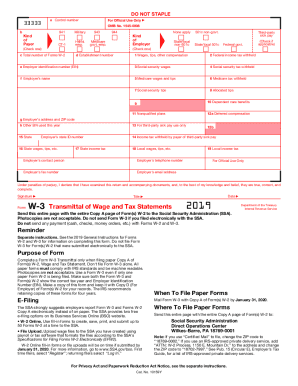

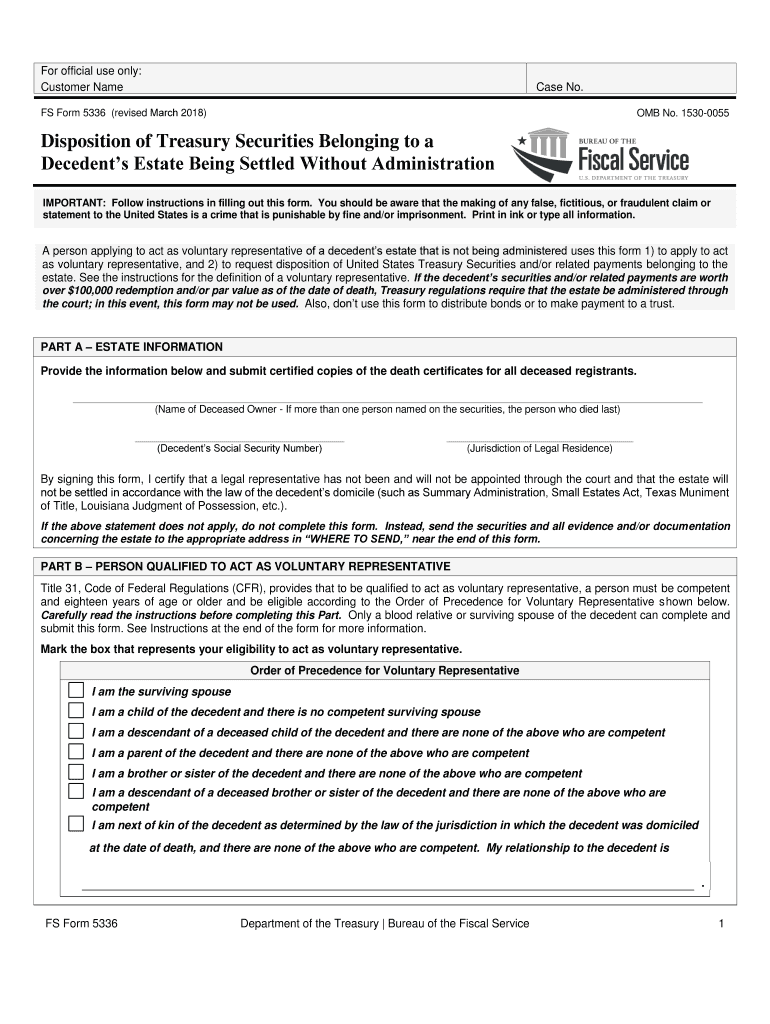

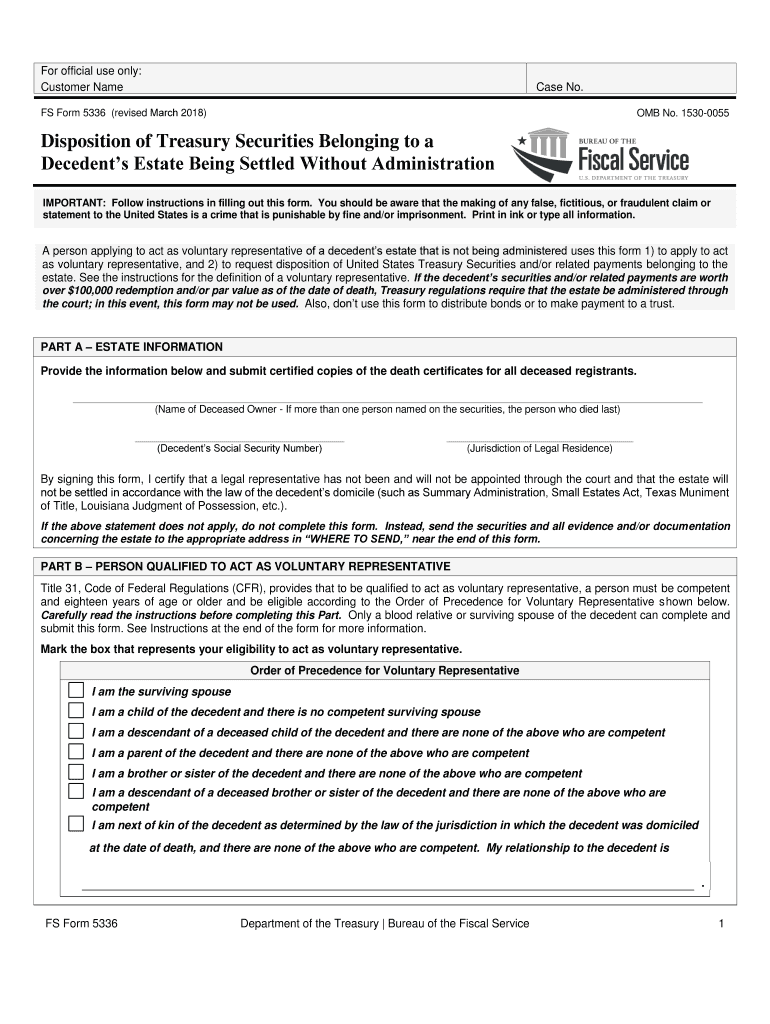

My relationship to the decedent is. FS Form 5336 Department of the Treasury Bureau of the Fiscal Service PART C TYPE OF DISPOSITION Payment to yourself as voluntary representative on behalf of all persons entitled to share in the decedent s estate except for unmatured marketable securities. RESET For official use only Customer Name Case No. FS Form 5336 revised March 2018 OMB No. 1530-0055 Disposition of Treasury Securities Belonging to a Decedent s Estate Being Settled Without...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FS 5336

Edit your FS 5336 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FS 5336 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FS 5336 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FS 5336. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FS 5336 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FS 5336

How to fill out FS 5336

01

Download the FS 5336 form from the official website.

02

Fill in your personal information at the top of the form, including your name and contact details.

03

Provide the relevant project or program details in the designated section.

04

Indicate the applicable type of assistance or funding you are applying for.

05

Review the instructions carefully for any specific documentation requirements.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form as directed in the instructions, either electronically or by mail.

Who needs FS 5336?

01

Individuals or organizations applying for federal assistance programs.

02

Grant seekers looking to access funds through specific government initiatives.

03

Any parties involved in projects requiring formal funding requests.

Fill

form

: Try Risk Free

People Also Ask about

What is a FS form 5336?

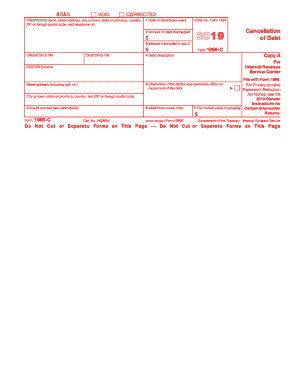

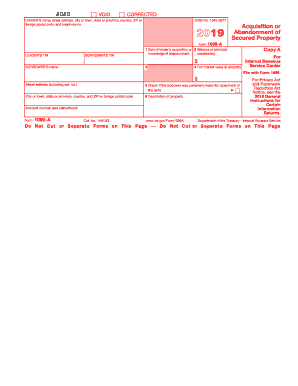

Document Type. Form FS Form 5336. Disposition of Securities Belonging to a Decedent's Estate Being Settled Without Administration. Form and Instruction. FS Form 5336 Application for Disposition of Treasury Securities Belon.

What happens when you inherit savings bonds?

If a surviving co-owner or beneficiary is named on the savings bond, the bond goes directly to that person. It does not become part of the estate of the person who died.

How can I avoid paying taxes on matured savings bonds?

Use the Education Exclusion With that in mind, you have one option for avoiding taxes on savings bonds: the education exclusion. You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs.

How do I avoid tax on inherited savings bonds?

How to Avoid Paying Taxes on Savings Bonds. The IRS lets you avoid paying taxes on interest earned by Series EE and Series I savings bonds when you redeem them if you use the money toward qualified higher education costs for yourself, your spouse, or any of your dependents.

Do I pay taxes on inherited U.S. Savings Bonds?

The short answer is yes, you generally will be responsible for taxes owed on savings bonds you inherit from someone else. The good news is that you may be able to defer taxes on inherited savings bonds or avoid it altogether in certain situations.

How do I cash a deceased person's savings bond?

Get a certified copy of the death certificate for everyone who has died who is named on any of the bonds. Have each person who is entitled to a distributed bond also fill out and sign the appropriate forms: If they want cash for their bond: FS Form 1522. If it is an EE or I bond and they want to keep it: FS Form 4000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify FS 5336 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your FS 5336 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I edit FS 5336 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like FS 5336. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out FS 5336 on an Android device?

Complete your FS 5336 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is FS 5336?

FS 5336 is a form used by certain taxpayers to report information related to foreign financial accounts.

Who is required to file FS 5336?

Individuals or entities with foreign financial accounts exceeding specific thresholds are required to file FS 5336.

How to fill out FS 5336?

To fill out FS 5336, provide accurate details about foreign accounts including account numbers, financial institutions, and account balances as required.

What is the purpose of FS 5336?

The purpose of FS 5336 is to ensure compliance with Foreign Account Tax Compliance Act (FATCA) regulations by reporting foreign assets.

What information must be reported on FS 5336?

Information required includes taxpayer identification, foreign account details, financial institution information, and account balances.

Fill out your FS 5336 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FS 5336 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.