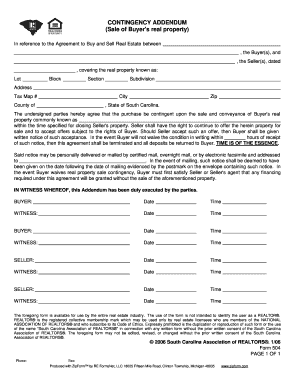

Get the free appraisal contingency addendum

Fill out, sign, and share forms from a single PDF platform

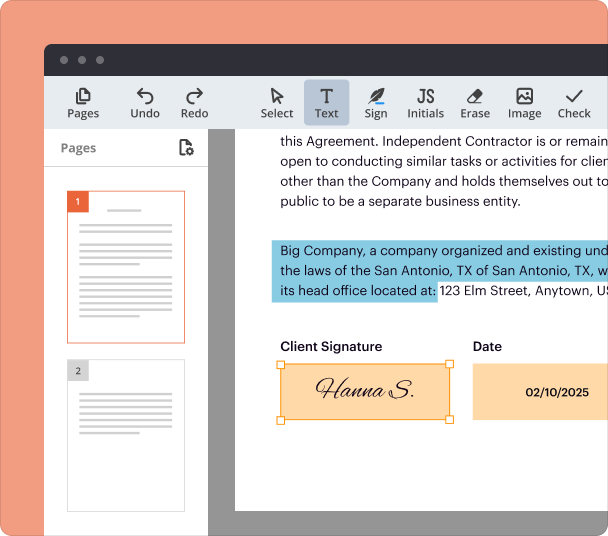

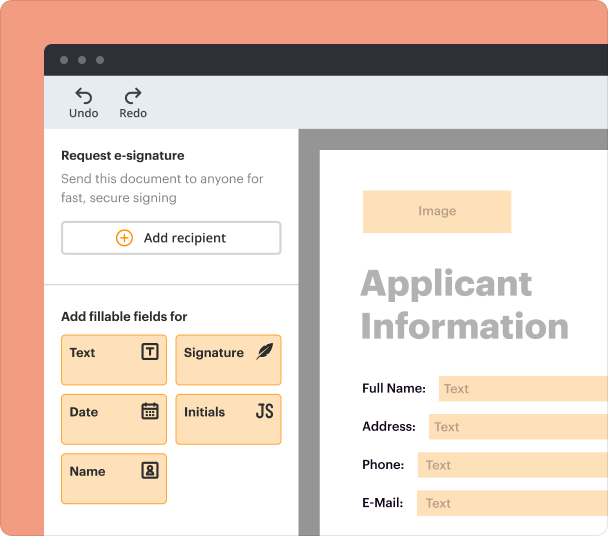

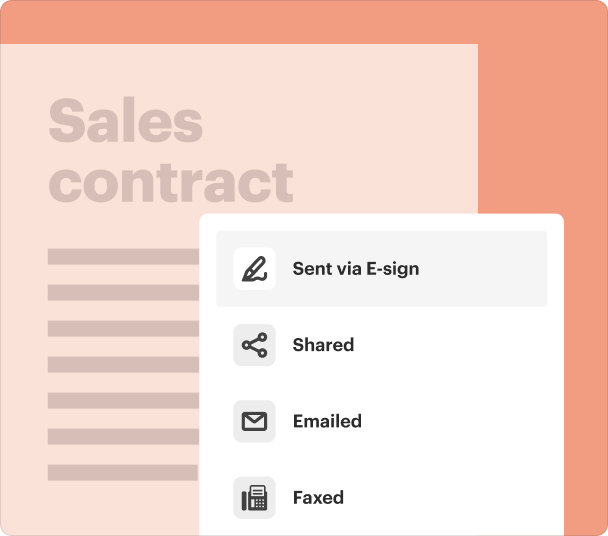

Edit and sign in one place

Create professional forms

Simplify data collection

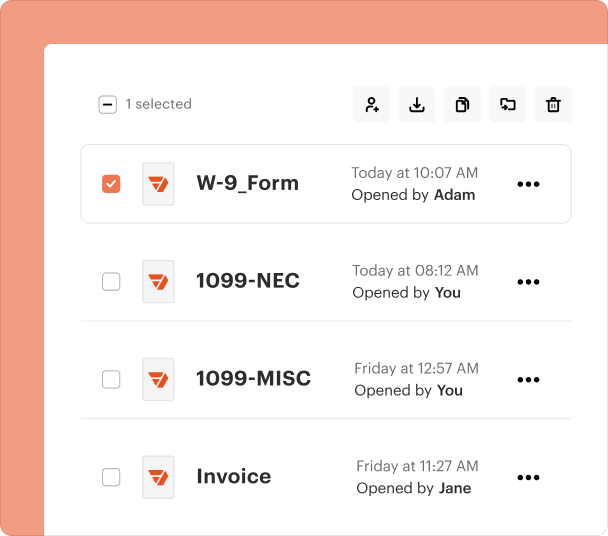

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to the Appraisal Gap Waiver Form

How does an appraisal gap waiver work?

An appraisal gap waiver form is a crucial document in real estate transactions. It allows the buyer to proceed with a property purchase even if the property's appraised value is lower than the offered purchase price. This ensures that both buyers and sellers can navigate competitive markets effectively, enabling smoother transactions.

What are appraisal gap waivers?

-

Appraisal gap waivers are clauses buyers can sign to cover the difference between the appraised value and the purchase price, ensuring sellers are more inclined to consider offers above the appraised value.

-

The appraisal process involves evaluating a property's value by a licensed appraiser. This assessment helps buyers and lenders understand how much a property is worth, impacting purchase decisions significantly.

When and why should you use an appraisal gap waiver?

-

Buyers might encounter appraisal gaps in competitive markets where bidding wars drive prices above market value, necessitating the use of waivers.

-

Signing a waiver can be a strategic move in hot real estate areas, allowing buyers to secure properties without being held back by appraisal inconsistencies.

What are the key components of the appraisal gap waiver form?

-

The form includes essential information such as buyer and seller details, which are crucial for legal identification in the transaction.

-

Understanding the differences between the contract price and the appraised value is vital for both the lender and the buyer.

-

The form outlines deadlines for notifying sellers after the appraisal is conducted, ensuring timely communication during the negotiation phase.

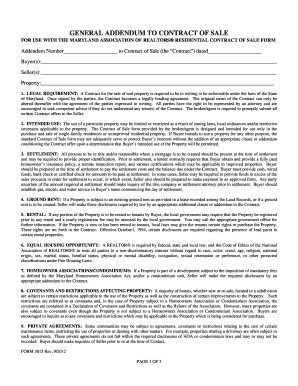

How to fill out the appraisal gap waiver form?

Filling out the appraisal gap waiver form accurately is vital for a successful transaction. Start by gathering required documents and information, including appraisal costs and appraiser selection. Ensure compliance with Maryland real estate laws by double-checking your work for accuracy.

-

Begin with basic information about the buyer and seller, then move to specific clauses related to the appraisal. Make certain all entries are clear and legible.

-

Highlight confirmation of appraisal costs and choose a qualified appraiser, as these details directly influence the transaction's success.

What to do after receiving low appraisal results?

-

If an appraisal comes in lower than expected, buyers can either renegotiate the purchase price or proceed with the original offer with additional funds.

-

Choosing to proceed despite a low appraisal can involve significant financial risk, as the buyer must cover the difference out-of-pocket.

-

Buyers can approach sellers for a price reduction based on the appraisal, which may lead to negotiations that can save them money.

What should you consider when signing an appraisal gap waiver?

-

Signing an appraisal gap clause can lead to higher financial burdens if the purchase price significantly exceeds appraisal value.

-

Consider that a buyer's willingness to sign a waiver may affect their negotiation leverage with sellers, especially in situations of low appraisals.

How can collaborative tools assist with filling out the waiver form?

-

With pdfFiller, users can easily edit and manage the appraisal gap waiver form digitally, streamlining the filling process.

-

pdfFiller offers collaboration capabilities for buyers and agents, ensuring clear communication and accurate submissions of real estate documentation.

What are the common mistakes to avoid with appraisal gap waiver forms?

-

Common mistakes include incomplete forms, missing essential information, or failing to clarify terms and conditions, which can derail the process.

-

Always double-check entries against supporting documents and consult real estate professionals when unsure about specific terms.

Frequently Asked Questions about appraisal contingency example form

What is an appraisal gap waiver?

An appraisal gap waiver is a form that allows buyers to proceed with their purchase even if the property's appraised value is lower than the purchase price. This tool is particularly useful in competitive real estate markets.

When should I consider using an appraisal gap waiver?

You should consider using an appraisal gap waiver when you are in a competitive real estate market or when you find a property that you are willing to pay a higher price for than its appraised value. This can provide an edge in negotiations.

What are the risks associated with signing the waiver?

One of the main risks is potentially overpaying for a property if the appraised value significantly falls short of the purchase price. This could lead to financial strain if the buyer must cover the difference.

How do I fill out the appraisal gap waiver form?

To fill out the appraisal gap waiver form, gather necessary details about the transaction, review each section carefully, and provide accurate information regarding appraisal costs and terms of the agreement.

Can I use pdfFiller to manage my appraisal gap waiver?

Yes! pdfFiller allows you to edit, sign, and collaborate on your appraisal gap waiver form digitally, making it easy to manage your documents anytime and anywhere.

pdfFiller scores top ratings on review platforms