PRO Financial Rental Property Profit and free printable template

Show details

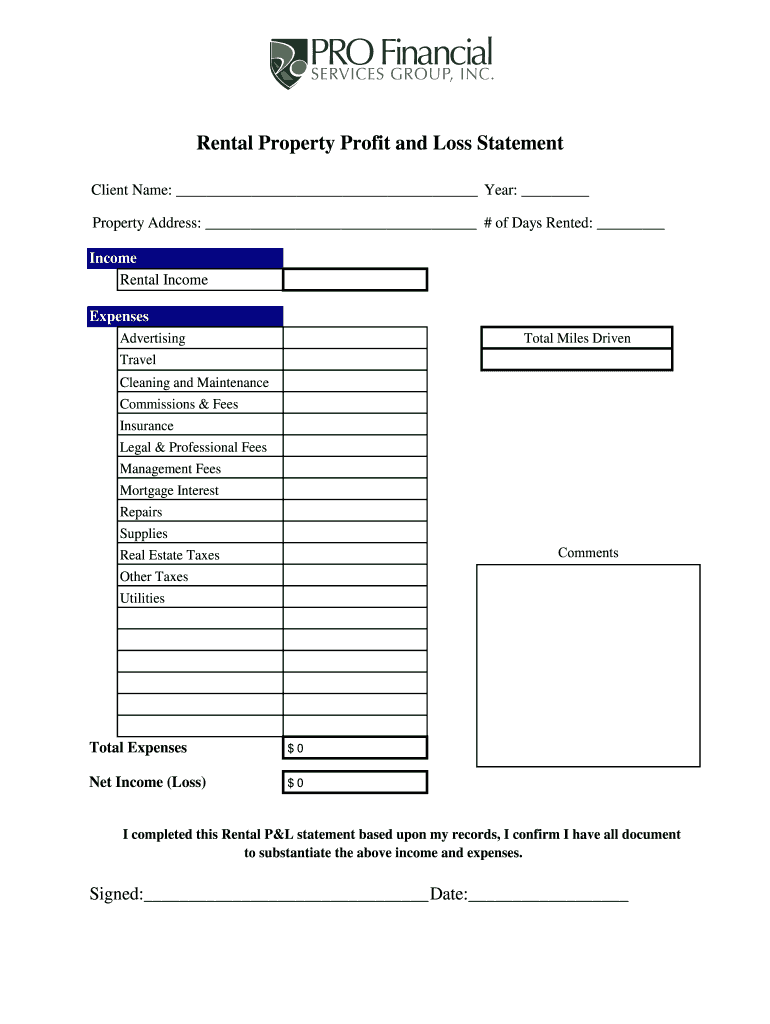

Rental Property Profit and Loss Statement Client Name: Year: Property Address: # of Days Rented: Income Rental Income Expenses AdvertisingTotal Miles DrivenTravel Cleaning and Maintenance Commissions

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign profit and loss for rental property form

Edit your property profit loss statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental property profit and loss statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental property profit and loss template excel online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rental profit and loss statement template form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental property profit and loss statement pdf form

How to fill out PRO Financial Rental Property Profit and Loss

01

Obtain the PRO Financial Rental Property Profit and Loss form.

02

Fill in the property address and your personal information at the top of the form.

03

List all rental income received for the property during the specified period.

04

Detail all operating expenses, including property management fees, maintenance, repairs, property taxes, and insurance.

05

Calculate the total income by summing up all rental income.

06

Calculate the total expenses by summing up all operating expenses.

07

Subtract the total expenses from the total income to determine net profit or loss.

08

Review the completed form for accuracy before submission.

Who needs PRO Financial Rental Property Profit and Loss?

01

Real estate investors managing rental properties.

02

Property managers maintaining financial records for multiple properties.

03

Accountants or tax professionals preparing tax filings for landlords.

04

Landlords seeking to analyze their property's financial performance.

Fill

rental property profit and loss statement template

: Try Risk Free

People Also Ask about rental property income statement

What is a financial statement for a property?

What is a real estate income statement? Also known as a profit and loss statement (P&L) or income expense statement, a real estate income statement lists all of the income and expenses associated with your property over a specified period of time.

Who pays tax on joint rental income?

Jointly-owned property. If a rental property is jointly-owned, the way in which the rental income is taxed will depend on the share of the property that each person owns.

What is rental income classified as in accounting?

If you rent real estate such as buildings, rooms or apartments, you normally report your rental income and expenses on Form 1040 or 1040-SR, Schedule E, Part I. List your total income, expenses, and depreciation for each rental property on the appropriate line of Schedule E.

What is Ontario tax form T776?

Form T776 will help you calculate your rental income and expenses for income tax purposes. Even though we accept other types of financial statements, we encourage you to use Form T776. To calculate your rental income or loss as well as your capital cost allowance (CCA), complete the areas of the form that apply to you.

How to prepare for T776?

0:30 3:56 How to complete the T776 tax form - Statement of Real Estate Rentals YouTube Start of suggested clip End of suggested clip Select the type of ownership. In our example it will be a sole proprietor. So we'll leave it as itMoreSelect the type of ownership. In our example it will be a sole proprietor. So we'll leave it as it is enter your information in the identification. Area make sure this is completely filled out you can

How do you calculate rent on an income statement?

To calculate straight-line rent, aggregate the total cost of all rent payments, and divide by the total contract term. The result is the amount to be charged to expense in each month of the contract.

What is rental income in financial statement?

A rental property income statement is a report that shows income and expenses by month, along with a running year-to-date total and year-end summary. Also known as a profit and loss statement (P&L), the income statement reports whether a rental property turns a profit or generates a loss.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit real estate income statement template from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including printable rental property profit and loss statement template. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete real estate profit and loss statement pdf online?

Easy online income statement for rental property completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit rental profit and loss statement on an Android device?

You can edit, sign, and distribute profit and loss statement example on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is PRO Financial Rental Property Profit and Loss?

PRO Financial Rental Property Profit and Loss is a financial document that summarizes the income and expenses associated with rental properties, allowing property owners to assess their profitability and financial performance.

Who is required to file PRO Financial Rental Property Profit and Loss?

Property owners who receive rental income from their properties are typically required to file PRO Financial Rental Property Profit and Loss to report their earnings and expenses for tax purposes.

How to fill out PRO Financial Rental Property Profit and Loss?

To fill out PRO Financial Rental Property Profit and Loss, gather all rental income and related expense documentation, categorize the income and expenses, and input the data into the relevant sections of the form, making sure to maintain accurate records.

What is the purpose of PRO Financial Rental Property Profit and Loss?

The purpose of PRO Financial Rental Property Profit and Loss is to provide a clear overview of a rental property's financial performance, helping owners make informed decisions regarding their investments and prepare for tax obligations.

What information must be reported on PRO Financial Rental Property Profit and Loss?

The information that must be reported includes total rental income, operating expenses, mortgage interest, depreciation, repairs, management fees, and any other relevant financial data related to the rental property.

Fill out your PRO Financial Rental Property Profit and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Property P L Template is not the form you're looking for?Search for another form here.

Keywords relevant to real estate profit and loss statement

Related to rental income statement template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.