Get the free prince edward island tax centre fax number

Show details

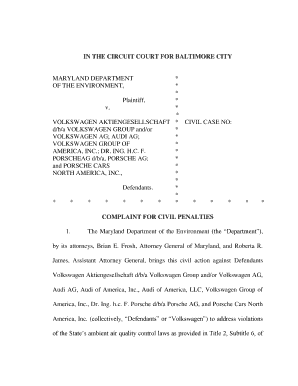

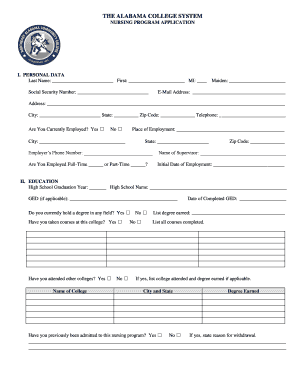

Clear DataHelpProtected B when completedExcise Tax Return Insured Business named this completed return to:Canada Revenue Agency Prince Edward Island Tax Center 275 Pope Road Summer side PE C1N 6E7Mailing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pei tax centre fax number form

Edit your prince edward island tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prince edward island tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing prince edward island tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit prince edward island tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out prince edward island tax

How to fill out Prince Edward Island tax:

01

Gather all necessary documents such as T4 slips, receipts, and expense records.

02

Calculate your income by adding up all your sources of income including employment, self-employment, rental income, etc.

03

Review available tax credits and deductions that you may be eligible for and gather any supporting documentation.

04

Use tax software or consult a tax professional to help prepare your tax return accurately.

05

Don't forget to include any additional schedules or forms that may be required based on your specific situation.

06

Double-check all the information you've entered to ensure accuracy.

07

File your tax return by the deadline by either submitting it electronically or mailing it to the appropriate tax office.

Who needs Prince Edward Island tax?

01

Residents of Prince Edward Island who have a taxable income are required to file a tax return.

02

Non-residents of Prince Edward Island who earned income within the province are also required to file a tax return.

03

People who have received income from property located in Prince Edward Island need to file a tax return as well.

Fill

form

: Try Risk Free

People Also Ask about

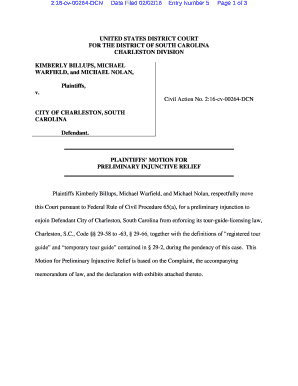

Where do I mail my tax return PEI?

Send your return to the following:For individuals served by tax services offices in:Canada Revenue Agency Tax Centre 105 - 275 Pope Road Summerside PE C1N 6E8Prince Edward Island, Belleville, Hamilton and Kitchener/Waterloo6 more rows

Where do I mail my PA state tax return?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

How do I write a letter to CRA?

Be specific and concise, and include any relevant dates or reference numbers. Provide supporting documents: If you are writing to the CRA to provide additional information or documentation, make sure to include copies of any relevant documents. It is important to keep the originals for your records.

Where do I mail my t1 adjustment?

Send the completed form to the Individual Client Services and Benefits Division of your tax centre as indicated on your notice of assessment. You can find the address on the back of this form. Take or send the completed form to your tax centre as indicated on your Notice of Assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify prince edward island tax without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your prince edward island tax into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I fill out prince edward island tax on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your prince edward island tax from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit prince edward island tax on an Android device?

You can make any changes to PDF files, like prince edward island tax, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is prince edward island tax?

Prince Edward Island tax refers to the provincial income tax collected by the government of Prince Edward Island, which applies to individuals and corporations who earn income within the province.

Who is required to file prince edward island tax?

Individuals and corporations residing or earning income in Prince Edward Island must file a Prince Edward Island tax return.

How to fill out prince edward island tax?

To fill out the Prince Edward Island tax return, taxpayers need to gather their income information, complete the applicable tax forms (T1 for individuals, T2 for corporations), and report their deductions, credits, and taxes owed according to provincial guidelines.

What is the purpose of prince edward island tax?

The purpose of Prince Edward Island tax is to generate revenue for the provincial government to fund public services and infrastructure, including healthcare, education, and transportation.

What information must be reported on prince edward island tax?

Taxpayers must report their total income, deductions, tax credits, and any taxes already paid to determine their final tax liability on the Prince Edward Island tax return.

Fill out your prince edward island tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Prince Edward Island Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.