NY Deferred Compensation Plan Change Form 2018 free printable template

Show details

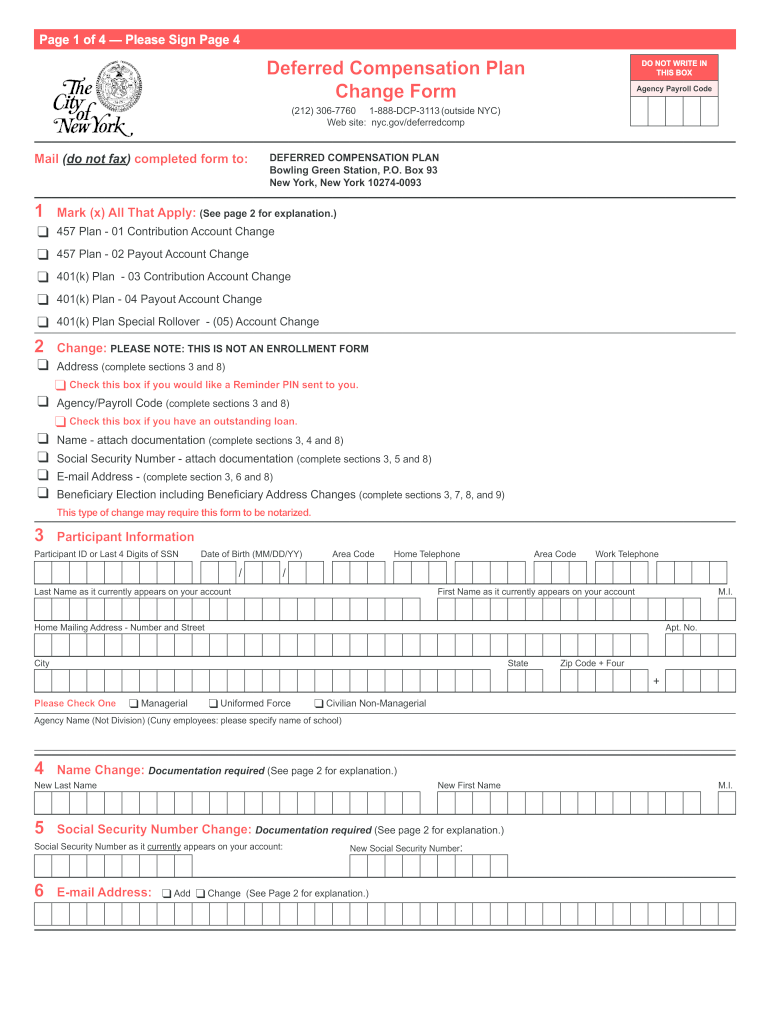

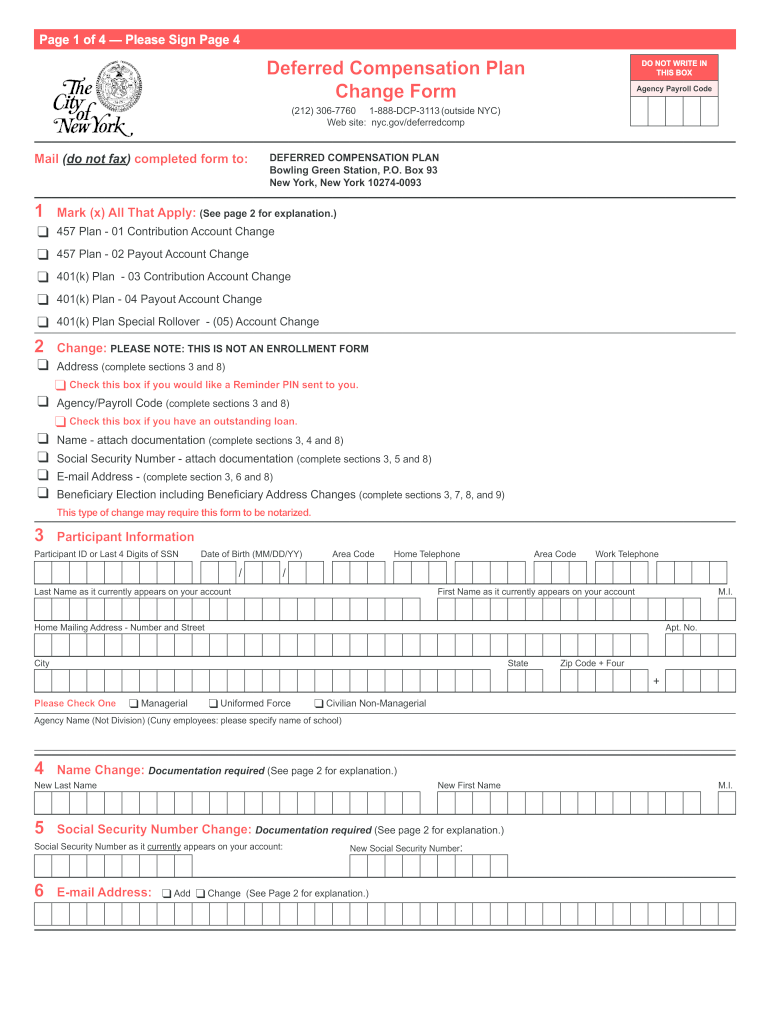

Page 1 of 4 Please Sign Page 4Deferred Compensation Plan Change Form DO NOT WRITE IN THIS BOX Agency Payroll Code(212) 3067760 1888DCP3113 (outside NYC) Website: nyc.gov/deferredcompMail (do not fax)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY Deferred Compensation Plan Change Form

Edit your NY Deferred Compensation Plan Change Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY Deferred Compensation Plan Change Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY Deferred Compensation Plan Change Form online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY Deferred Compensation Plan Change Form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY Deferred Compensation Plan Change Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY Deferred Compensation Plan Change Form

How to fill out NY Deferred Compensation Plan Change Form

01

Start by downloading the NY Deferred Compensation Plan Change Form from the official website.

02

Carefully read the instructions included with the form to understand the requirements.

03

Fill in your personal information such as your name, address, and employee identification number at the top of the form.

04

Indicate the type of change you are requesting (e.g., changes to your contribution amount, investment options, etc.) in the designated section.

05

Provide any additional information required based on the changes you are making.

06

Review all the information you have entered to ensure accuracy and completeness.

07

Sign and date the form at the bottom to validate your request.

08

Submit the completed form as instructed, either via mail or electronically, to the correct administrative office.

Who needs NY Deferred Compensation Plan Change Form?

01

Employees who are enrolled in the NY Deferred Compensation Plan and wish to make changes to their contributions or investment options.

02

Individuals looking to update personal information or beneficiaries associated with their Deferred Compensation Plan account.

Fill

form

: Try Risk Free

People Also Ask about

How do I withdraw from my 457 Plan?

Participants are eligible to withdraw funds from their 457(b) plan when separating from service (for any reason) or for an approved unforeseeable emergency. After separation from service, a participant may rollover their account into a traditional IRA or an existing qualified retirement plan.

Can I withdraw from my NYS deferred comp?

You may take up to 12 partial withdrawals annually. Each withdrawal must be at least $100. You may postpone payment of the remainder of your Plan account balance until age 72, request additional partial withdrawals as needed or establish periodic payments.

When can I cash out my deferred compensation?

Planning retirement distributions For example, the Internal Revenue Code (IRC) allows for 401(k) withdrawals to begin penalty-free after age 59½—but the IRC also requires that you start taking distributions at age 73. By contrast, there are no IRC age restrictions on distributions from a deferred compensation plan.

When can I withdraw from Nysdcp?

Is there a time when I must withdraw money from my Deferred Compensation Plan? If you have separated from service with New York State or a participating employer, you must begin receiving payments no later than April 1 following the close of the calendar year in which you turn age 72.

Can I withdraw money from my deferred compensation plan?

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

How do I withdraw money from Nysdcp?

You can log into your account to request an online distribution or you can call one of our Account Executives or HELPLINE Representatives to discuss which withdrawal option(s) work(s) best for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY Deferred Compensation Plan Change Form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NY Deferred Compensation Plan Change Form and other forms. Find the template you need and change it using powerful tools.

How do I edit NY Deferred Compensation Plan Change Form in Chrome?

Install the pdfFiller Google Chrome Extension to edit NY Deferred Compensation Plan Change Form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit NY Deferred Compensation Plan Change Form on an Android device?

You can make any changes to PDF files, such as NY Deferred Compensation Plan Change Form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NY Deferred Compensation Plan Change Form?

The NY Deferred Compensation Plan Change Form is a document used by participants in the New York State Deferred Compensation Plan to request changes to their account, such as adjusting contributions or updating personal information.

Who is required to file NY Deferred Compensation Plan Change Form?

Participants in the New York State Deferred Compensation Plan who wish to make changes to their contributions, investment selections, or personal information are required to file the NY Deferred Compensation Plan Change Form.

How to fill out NY Deferred Compensation Plan Change Form?

To fill out the NY Deferred Compensation Plan Change Form, participants must provide their personal information, specify the changes they wish to make, sign the form, and submit it according to the instructions provided by the plan.

What is the purpose of NY Deferred Compensation Plan Change Form?

The purpose of the NY Deferred Compensation Plan Change Form is to facilitate changes to a participant's deferred compensation account, ensuring that the plan accurately reflects their current contributions and investment preferences.

What information must be reported on NY Deferred Compensation Plan Change Form?

The information that must be reported on the NY Deferred Compensation Plan Change Form includes the participant's name, Social Security number, account number, details of the change being requested, and the participant's signature.

Fill out your NY Deferred Compensation Plan Change Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY Deferred Compensation Plan Change Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.