CA EDD DE 1326CD 2014 free printable template

Show details

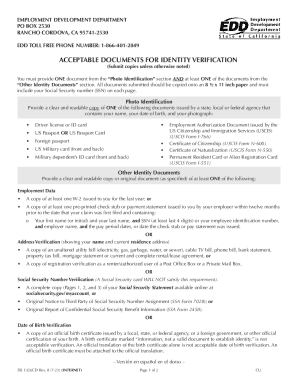

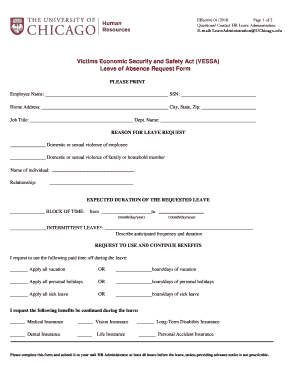

EMPLOYMENT DEVELOPMENT DEPARTMENT P.O. BOX 2530 RANCHO CORDOVA, CA 957412530 ACCEPTABLE DOCUMENTS FOR IDENTITY VERIFICATION (Submit copies unless otherwise noted)You must provide ONE document from

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA EDD DE 1326CD

Edit your CA EDD DE 1326CD form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA EDD DE 1326CD form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA EDD DE 1326CD online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA EDD DE 1326CD. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA EDD DE 1326CD Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA EDD DE 1326CD

How to fill out CA EDD DE 1326CD

01

Obtain the CA EDD DE 1326CD form from the official California EDD website or your local EDD office.

02

Fill out the applicant's personal information at the top of the form, including name, address, and contact details.

03

Indicate your Social Security number.

04

Complete the section that details your employment information, including your employer's name and address.

05

Provide specific information regarding the reason for the claim, ensuring to describe your circumstances clearly.

06

Review the form for accuracy and completeness to avoid delays in processing.

07

Sign and date the form where indicated.

08

Submit the completed form as instructed, either online or by mail.

Who needs CA EDD DE 1326CD?

01

Individuals who are applying for disability benefits due to illness or injury and require documentation to support their claim.

02

Employees who have lost wages and need to file a claim for state disability insurance.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you can't pay back EDD overpayment?

If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. This is called a benefit offset. For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments.

Will EDD not require refunds of overpayment?

“They can now rest assured that as long as they were truthful with the department, they will not be required to pay back any benefits even if they ultimately were found ineligible. “

How do I download my EDD form?

Disability Insurance – Forms and Publications Visit Online Forms and Publications. Select Keyword(s) or Form Number from the dropdown. Enter DE 2501 for an English form or DE 2501/S for a Spanish form. Select Search.

What happens if EDD can't verify identity?

If we do not receive your correct identification documents or a request for more time, or we are not able to verify your identity: You will not be eligible for benefits. You will receive a disqualification notice (Notice of Determination) in the mail. You will have to file an appeal to receive benefits for this claim.

Where can I get my EDD forms?

Ordering a form onlineto have it mailed to you. Getting the form from your licensed health professional or employer. Visiting an SDI Office. Calling 1-800-480-3287 and selecting DI Information option 3 to request a paper form by mail.

How long do you have to pay EDD overpayment?

You must pay your benefit overpayment in full within 60 days of the date on the Notice of Intent to Offset Your Federal Income Tax Return (DE 957) to avoid having your refund offset (reduced or withheld). Visit Benefit Overpayment Services to log in or make a payment.

Why EDD asked for identity verification?

The California Employment Development Department (California EDD) works with ID.me to create a highly secure identity verification process that ensures you—and only you—will be able to access your benefits.

What happens if I don't verify my identity with EDD?

Penalties. If we do not receive your correct identification documents or a request for more time, or we are not able to verify your identity: You will not be eligible for benefits. You will receive a disqualification notice (Notice of Determination) in the mail.

How do I prove my identity to EDD?

Acceptable Documents for Identity Verification State identification (ID) card. Driver license. US passport or passport card. US military card (front and back) Military dependent's ID card (front and back) Permanent Resident Card. Certificate of Citizenship. Certificate of Naturalization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA EDD DE 1326CD for eSignature?

When your CA EDD DE 1326CD is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in CA EDD DE 1326CD?

With pdfFiller, it's easy to make changes. Open your CA EDD DE 1326CD in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out CA EDD DE 1326CD on an Android device?

Complete CA EDD DE 1326CD and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is CA EDD DE 1326CD?

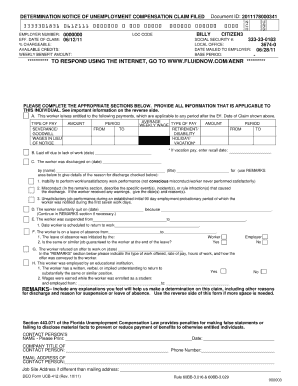

CA EDD DE 1326CD is a form used to report an employee's claim for disability insurance benefits under California's Employment Development Department (EDD).

Who is required to file CA EDD DE 1326CD?

Employers are required to file CA EDD DE 1326CD on behalf of employees who are applying for disability benefits.

How to fill out CA EDD DE 1326CD?

To fill out CA EDD DE 1326CD, provide the employee's personal information, the nature of the disability, the dates of the disability, and relevant employment details as specified in the form instructions.

What is the purpose of CA EDD DE 1326CD?

The purpose of CA EDD DE 1326CD is to provide necessary information to the EDD to assess an employee’s eligibility for disability benefits.

What information must be reported on CA EDD DE 1326CD?

The information that must be reported includes the employee's personal details, the date disability began, the nature of the illness or injury, and the last day worked, among other specifics.

Fill out your CA EDD DE 1326CD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA EDD DE 1326cd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.